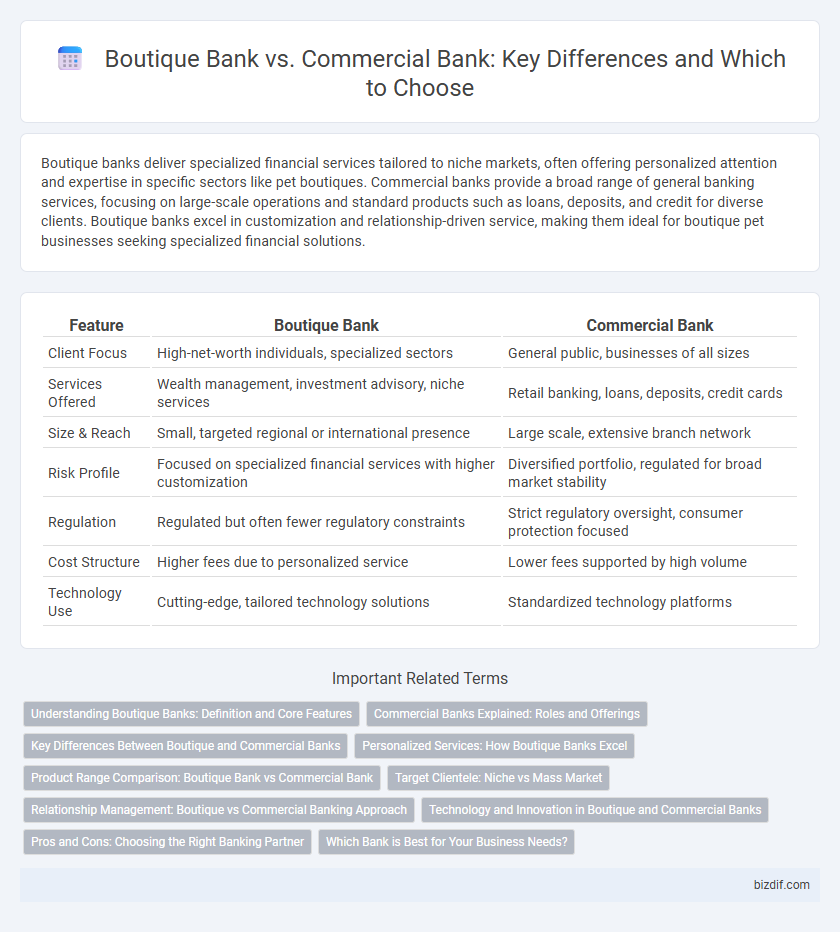

Boutique banks deliver specialized financial services tailored to niche markets, often offering personalized attention and expertise in specific sectors like pet boutiques. Commercial banks provide a broad range of general banking services, focusing on large-scale operations and standard products such as loans, deposits, and credit for diverse clients. Boutique banks excel in customization and relationship-driven service, making them ideal for boutique pet businesses seeking specialized financial solutions.

Table of Comparison

| Feature | Boutique Bank | Commercial Bank |

|---|---|---|

| Client Focus | High-net-worth individuals, specialized sectors | General public, businesses of all sizes |

| Services Offered | Wealth management, investment advisory, niche services | Retail banking, loans, deposits, credit cards |

| Size & Reach | Small, targeted regional or international presence | Large scale, extensive branch network |

| Risk Profile | Focused on specialized financial services with higher customization | Diversified portfolio, regulated for broad market stability |

| Regulation | Regulated but often fewer regulatory constraints | Strict regulatory oversight, consumer protection focused |

| Cost Structure | Higher fees due to personalized service | Lower fees supported by high volume |

| Technology Use | Cutting-edge, tailored technology solutions | Standardized technology platforms |

Understanding Boutique Banks: Definition and Core Features

Boutique banks specialize in providing highly personalized financial services such as mergers and acquisitions advisory, capital raising, and wealth management often targeting niche markets or high-net-worth individuals. These banks typically operate on a smaller scale compared to commercial banks, emphasizing bespoke solutions and deep industry expertise rather than broad retail banking offerings. Unlike commercial banks, which focus on deposit-taking and lending to a wide customer base, boutique banks prioritize specialized advisory roles and customized financial strategies.

Commercial Banks Explained: Roles and Offerings

Commercial banks provide a wide range of services including deposit accounts, loans, credit cards, and payment processing tailored to individuals and businesses. They play a crucial role in the economy by facilitating financial transactions, offering liquidity, and supporting business growth through various credit products. Unlike boutique banks, commercial banks cater to a broader market with standardized services and extensive branch networks.

Key Differences Between Boutique and Commercial Banks

Boutique banks specialize in personalized financial services, such as mergers and acquisitions advisory, private equity, and wealth management, catering mainly to high-net-worth individuals and niche markets. Commercial banks offer a broad range of standardized banking services, including deposit accounts, loans, and credit products, targeting the general public and businesses of all sizes. The primary differences lie in service customization, client focus, and the scope of financial products offered.

Personalized Services: How Boutique Banks Excel

Boutique banks excel in personalized services by offering tailored financial solutions and dedicated relationship management that commercial banks often lack due to their larger scale. Clients benefit from bespoke investment strategies, exclusive wealth management, and direct access to senior bankers who understand individual needs. This high-touch approach creates a more intimate banking experience, fostering trust and long-term client satisfaction.

Product Range Comparison: Boutique Bank vs Commercial Bank

Boutique banks specialize in tailored financial services, offering niche products such as bespoke investment advisory, private equity, and wealth management solutions specifically designed for high-net-worth individuals and specialized industries. Commercial banks provide a broad spectrum of standardized products including retail banking, business loans, credit cards, and deposit accounts aimed at mass-market customers and small to medium enterprises. The product range of boutique banks is narrower but highly customized, whereas commercial banks focus on volume and accessibility with extensive, generalized offerings.

Target Clientele: Niche vs Mass Market

Boutique banks target a niche clientele, such as high-net-worth individuals, startups, and specialized industries, offering personalized and tailored financial services. Commercial banks serve the mass market, providing standardized banking products to a broad customer base, including individuals, small businesses, and corporations. The focused client approach of boutique banks enables deeper relationships and customized solutions compared to the volume-driven model of commercial banks.

Relationship Management: Boutique vs Commercial Banking Approach

Boutique banks prioritize personalized relationship management, offering tailored financial solutions through dedicated relationship managers who often provide specialized industry expertise. In contrast, commercial banks utilize a more standardized approach with broader product offerings, relying on larger teams and automated systems to manage higher client volumes. This focused, customer-centric approach in boutique banking cultivates deeper client trust and long-term partnerships.

Technology and Innovation in Boutique and Commercial Banks

Boutique banks leverage cutting-edge technology and tailored digital platforms to offer personalized financial solutions, enhancing client experience through advanced analytics and AI-driven insights. Commercial banks invest heavily in large-scale IT infrastructure and automation to handle vast transaction volumes and provide standardized services efficiently across extensive networks. Innovation in boutique banks focuses on niche market customization and agility, whereas commercial banks prioritize scalability and robust cybersecurity measures to support diverse customer bases.

Pros and Cons: Choosing the Right Banking Partner

Boutique banks specialize in personalized financial services and niche markets, offering tailored solutions with high-touch client engagement but often lack the extensive resources and broad product range of commercial banks. Commercial banks provide comprehensive services, extensive branch networks, and stronger capital bases, yet their standardized offerings may result in less customized attention for individual clients. Selecting the right banking partner depends on prioritizing specialized expertise and bespoke services versus a wide array of accessible financial products and established infrastructure.

Which Bank is Best for Your Business Needs?

Boutique banks specialize in personalized financial services, focusing on tailored investment strategies and niche markets, making them ideal for businesses seeking customized banking solutions. Commercial banks offer a broad range of standard banking products such as loans, deposits, and credit facilities, suitable for companies needing comprehensive and accessible banking services. Choosing the best bank depends on your business size, complexity, and need for specialized advisory versus conventional banking products and widespread branch access.

Boutique Bank vs Commercial Bank Infographic

bizdif.com

bizdif.com