Boutique finance firms specialize in tailored financial advisory services for niche markets and high-net-worth clients, offering personalized attention and expertise that larger institutions may lack. Commercial finance typically focuses on broader lending solutions for businesses, including loans, asset financing, and cash flow management, prioritizing volume and standardized processes. Understanding the distinct approaches of boutique finance versus commercial finance helps businesses select the right partner based on their unique financial needs and growth objectives.

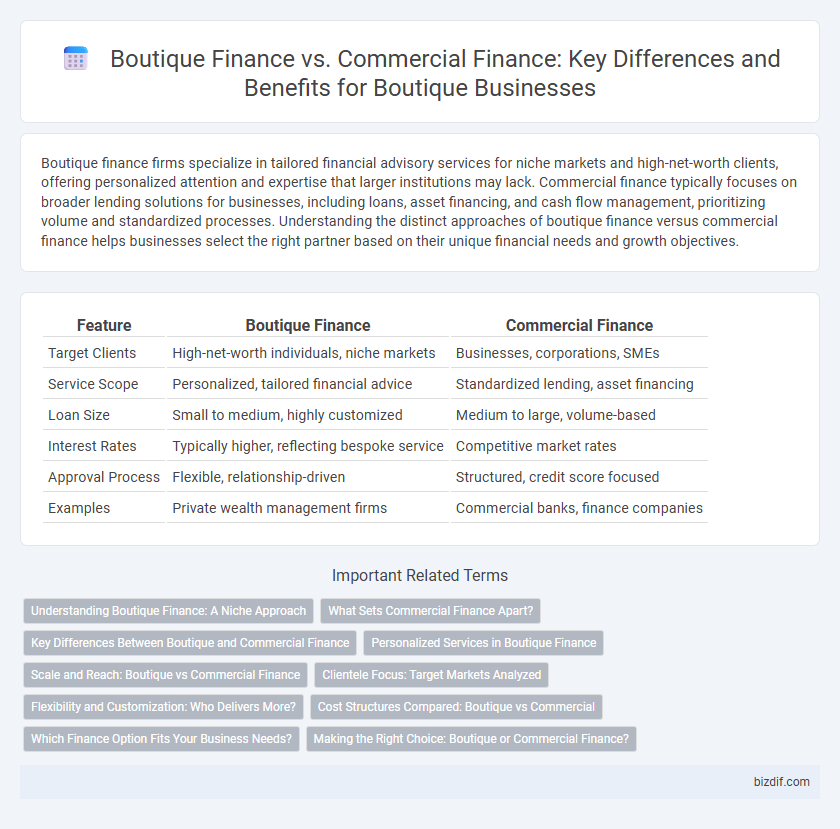

Table of Comparison

| Feature | Boutique Finance | Commercial Finance |

|---|---|---|

| Target Clients | High-net-worth individuals, niche markets | Businesses, corporations, SMEs |

| Service Scope | Personalized, tailored financial advice | Standardized lending, asset financing |

| Loan Size | Small to medium, highly customized | Medium to large, volume-based |

| Interest Rates | Typically higher, reflecting bespoke service | Competitive market rates |

| Approval Process | Flexible, relationship-driven | Structured, credit score focused |

| Examples | Private wealth management firms | Commercial banks, finance companies |

Understanding Boutique Finance: A Niche Approach

Boutique finance firms specialize in tailored financial services that prioritize personalized client relationships and niche market expertise. Unlike commercial finance institutions that offer standardized products to a broad audience, boutique finance delivers bespoke solutions often focusing on specific industries or complex transactions. This niche approach enables deeper strategic insights and customized financial advice that caters to unique business needs and growth opportunities.

What Sets Commercial Finance Apart?

Commercial finance is distinguished by its focus on funding larger-scale business operations, offering tailored loan structures that accommodate higher credit limits and extended repayment terms compared to boutique finance. It typically involves complex financial products such as lines of credit, equipment financing, and commercial real estate loans designed to support business growth and operational stability. The scale, risk assessment rigor, and regulatory compliance in commercial finance uniquely position it to meet the diverse needs of medium to large enterprises.

Key Differences Between Boutique and Commercial Finance

Boutique finance firms specialize in tailored financial services, offering personalized solutions and niche market expertise often overlooked by larger institutions. Commercial finance entities focus on high-volume transactions, standardized products, and servicing large corporate clients with broad credit needs. Key differences include service customization, client relationship depth, and flexibility in deal structuring, with boutique finance emphasizing bespoke advisory and commercial finance prioritizing scale and efficiency.

Personalized Services in Boutique Finance

Boutique finance firms excel in delivering highly personalized services, tailoring financial solutions to the unique needs of each client rather than offering standardized packages commonly found in commercial finance. Their specialized approach ensures close collaboration, in-depth understanding of client goals, and flexibility in structuring deals to optimize outcomes. This contrasts with the broader, volume-driven model of commercial finance, where personalization is often limited by scale.

Scale and Reach: Boutique vs Commercial Finance

Boutique finance firms specialize in tailored, high-touch services with focused expertise, often serving niche markets and smaller-scale transactions, resulting in limited geographic reach but deeper client relationships. Commercial finance institutions operate at a larger scale, managing extensive portfolios and offering broad financial products across multiple regions, providing wide-reaching accessibility but less personalized service. The scale and reach of boutique finance prioritize customized solutions, while commercial finance emphasizes volume and regional or global presence.

Clientele Focus: Target Markets Analyzed

Boutique finance firms primarily target high-net-worth individuals, startups, and niche industries requiring personalized financial solutions, while commercial finance institutions cater to larger corporations and mass market segments with standardized products. Boutique firms emphasize deep market expertise and tailored services for specific clienteles such as tech innovators or luxury brands, contrasting with the broader, volume-driven approach of commercial finance. This focused target market strategy allows boutique finance companies to offer specialized advisory and flexible funding options closely aligned with unique client needs.

Flexibility and Customization: Who Delivers More?

Boutique finance firms excel in flexibility and customization by offering tailored financial solutions that adapt to unique client needs, unlike commercial finance institutions that often rely on standardized products and rigid terms. Their niche focus allows boutique providers to design personalized strategies, addressing complex or non-traditional financing requirements with agility. As a result, businesses seeking bespoke financial services often find greater responsiveness and innovation within boutique finance compared to the more conventional approach of commercial finance.

Cost Structures Compared: Boutique vs Commercial

Boutique finance firms typically operate with leaner cost structures, focusing on specialized advisory services and charging higher fees for personalized attention. Commercial finance institutions incur larger overhead costs due to extensive operational frameworks and a broader client base, which allows them to offer more competitive rates. The boutique model emphasizes quality and customization, whereas commercial finance prioritizes scale and cost efficiency.

Which Finance Option Fits Your Business Needs?

Boutique finance offers personalized, flexible solutions tailored to niche markets and specialized business models, ideal for startups and small enterprises seeking customized funding. Commercial finance provides standardized, large-scale funding options suitable for established companies requiring substantial capital for expansion and operations. Assessing your business size, growth stage, and financial goals helps determine whether boutique or commercial finance better fits your unique business needs.

Making the Right Choice: Boutique or Commercial Finance?

Choosing between boutique finance and commercial finance depends on business size, financing needs, and relationship preferences. Boutique finance offers personalized services and customized solutions ideal for startups and niche markets, while commercial finance provides standardized products with broader access to capital suited for larger businesses. Understanding specific funding requirements and long-term goals ensures the right choice that maximizes financial efficiency and growth potential.

Boutique Finance vs Commercial Finance Infographic

bizdif.com

bizdif.com