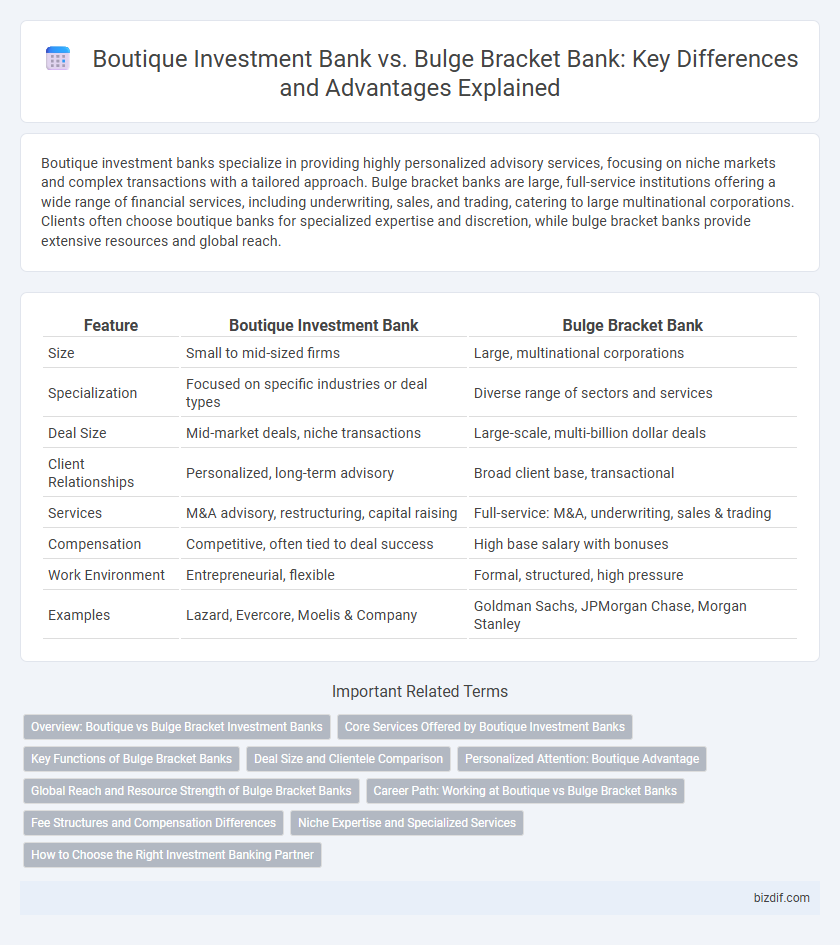

Boutique investment banks specialize in providing highly personalized advisory services, focusing on niche markets and complex transactions with a tailored approach. Bulge bracket banks are large, full-service institutions offering a wide range of financial services, including underwriting, sales, and trading, catering to large multinational corporations. Clients often choose boutique banks for specialized expertise and discretion, while bulge bracket banks provide extensive resources and global reach.

Table of Comparison

| Feature | Boutique Investment Bank | Bulge Bracket Bank |

|---|---|---|

| Size | Small to mid-sized firms | Large, multinational corporations |

| Specialization | Focused on specific industries or deal types | Diverse range of sectors and services |

| Deal Size | Mid-market deals, niche transactions | Large-scale, multi-billion dollar deals |

| Client Relationships | Personalized, long-term advisory | Broad client base, transactional |

| Services | M&A advisory, restructuring, capital raising | Full-service: M&A, underwriting, sales & trading |

| Compensation | Competitive, often tied to deal success | High base salary with bonuses |

| Work Environment | Entrepreneurial, flexible | Formal, structured, high pressure |

| Examples | Lazard, Evercore, Moelis & Company | Goldman Sachs, JPMorgan Chase, Morgan Stanley |

Overview: Boutique vs Bulge Bracket Investment Banks

Boutique investment banks specialize in niche markets, offering personalized advisory services in mergers and acquisitions, capital raising, and restructuring, usually with a lower headcount and less regulatory burden. Bulge bracket banks operate globally with extensive resources, providing a full suite of services including underwriting, sales and trading, and asset management, often serving large multinational clients. The primary distinction lies in scale, client focus, and service breadth, with boutique banks excelling in specialized, high-touch engagements and bulge bracket banks dominating large-scale, diversified financial operations.

Core Services Offered by Boutique Investment Banks

Boutique investment banks specialize in tailored advisory services, including mergers and acquisitions, capital raising, and restructuring, focusing on niche markets and personalized client relationships. These firms typically avoid large-scale underwriting and trading operations common in bulge bracket banks, allowing for more specialized expertise and agility. Their core services emphasize strategic advisory over volume-driven transactions, targeting middle-market companies and specific industry sectors.

Key Functions of Bulge Bracket Banks

Bulge bracket banks primarily focus on large-scale investment banking services such as mergers and acquisitions advisory, underwriting of equity and debt securities, and global market trading. They offer extensive capital raising capabilities and comprehensive risk management solutions across multiple sectors and regions. Their key functions include providing liquidity to markets, facilitating cross-border transactions, and delivering strategic financial advice for multinational corporations.

Deal Size and Clientele Comparison

Boutique investment banks typically focus on mid-market deal sizes ranging from $50 million to $500 million, catering to niche clientele such as startups, family-owned businesses, and specialized industries. In contrast, bulge bracket banks handle mega-deals often exceeding $1 billion and serve large multinational corporations, governments, and institutional investors. This difference in deal size and clientele impacts the scope of advisory services, with boutiques providing more personalized and sector-focused expertise.

Personalized Attention: Boutique Advantage

Boutique investment banks prioritize personalized attention by offering tailored financial solutions and direct senior-level engagement, unlike bulge bracket banks where clients often navigate large, complex teams. This boutique advantage allows for deeper client relationships and agile decision-making that better align with specific business goals. Personalized service and specialized expertise drive superior client satisfaction in boutique investment banking.

Global Reach and Resource Strength of Bulge Bracket Banks

Bulge bracket banks possess extensive global reach with operations spanning multiple continents, providing unparalleled market access and cross-border deal execution. Their vast resource strength includes substantial capital reserves, comprehensive research teams, and advanced technological infrastructure, enabling large-scale financing and complex transactions. In contrast, boutique investment banks typically focus on specialized advisory services within specific niches or regions, lacking the expansive network and capital depth of bulge bracket institutions.

Career Path: Working at Boutique vs Bulge Bracket Banks

Boutique investment banks offer a specialized career path with closer client interaction, faster exposure to deal-making, and a more entrepreneurial work environment compared to bulge bracket banks. Bulge bracket banks provide extensive training programs, global deal flow, and a structured progression but often involve more hierarchical roles and longer hours. Professionals seeking tailored experience and direct responsibility often choose boutiques, while those aiming for broad industry exposure and global networks prefer bulge bracket firms.

Fee Structures and Compensation Differences

Boutique investment banks typically have fee structures centered around advisory and transaction-based fees, offering more customized and flexible compensation packages that often include higher bonuses linked directly to deal performance. Bulge bracket banks employ fixed salary frameworks combined with significant bonuses tied to overall firm profitability and deal volume, creating a more standardized but potentially less agile pay system. These differences reflect boutiques' focus on specialized sector expertise versus bulge bracket firms' large-scale, diversified financial services.

Niche Expertise and Specialized Services

Boutique investment banks distinguish themselves through niche expertise and specialized services tailored to specific industries or transaction types, offering highly personalized advisory and strategic solutions. Unlike bulge bracket banks that provide broad, large-scale financial services across multiple sectors, boutique firms excel in handling complex, lower-volume deals with deep industry knowledge. This focus enables boutiques to deliver customized, high-touch client experiences and innovative financial products that larger banks may not specialize in.

How to Choose the Right Investment Banking Partner

Choosing the right investment banking partner hinges on understanding the distinct advantages of boutique investment banks and bulge bracket banks. Boutique investment banks offer specialized expertise, personalized service, and agility in niche markets, while bulge bracket banks provide extensive global reach, comprehensive financial products, and substantial capital resources. Evaluating your company's size, industry focus, deal complexity, and need for global versus tailored advisory services ensures alignment with the optimal banking partner for strategic growth and successful transactions.

Boutique Investment Bank vs Bulge Bracket Bank Infographic

bizdif.com

bizdif.com