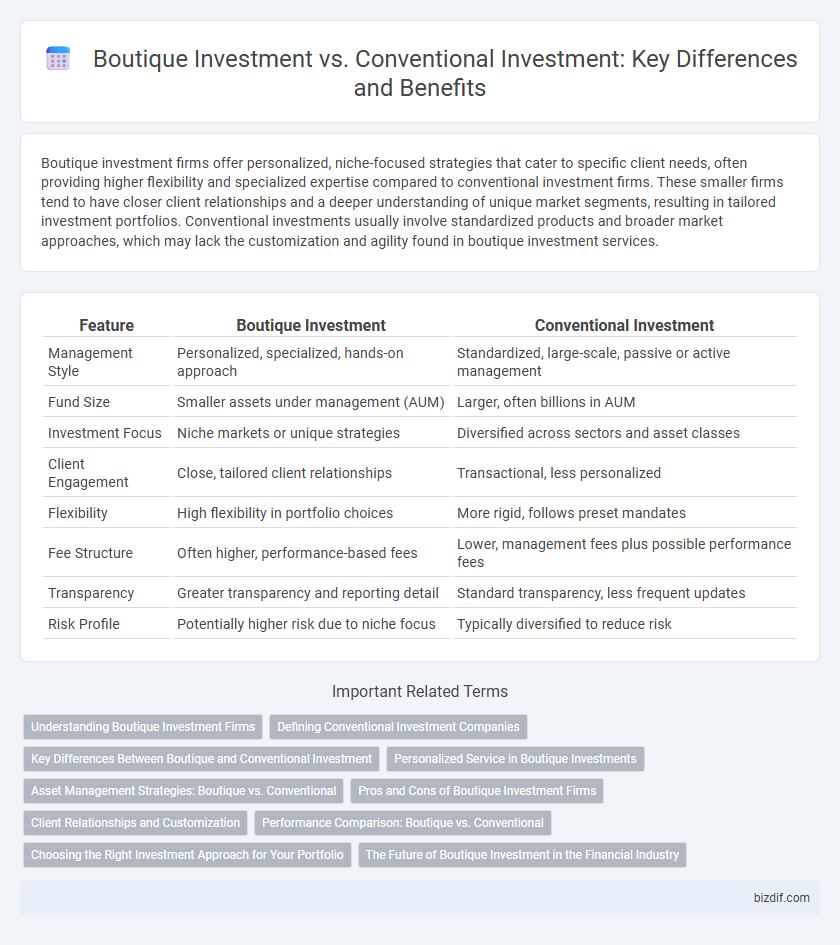

Boutique investment firms offer personalized, niche-focused strategies that cater to specific client needs, often providing higher flexibility and specialized expertise compared to conventional investment firms. These smaller firms tend to have closer client relationships and a deeper understanding of unique market segments, resulting in tailored investment portfolios. Conventional investments usually involve standardized products and broader market approaches, which may lack the customization and agility found in boutique investment services.

Table of Comparison

| Feature | Boutique Investment | Conventional Investment |

|---|---|---|

| Management Style | Personalized, specialized, hands-on approach | Standardized, large-scale, passive or active management |

| Fund Size | Smaller assets under management (AUM) | Larger, often billions in AUM |

| Investment Focus | Niche markets or unique strategies | Diversified across sectors and asset classes |

| Client Engagement | Close, tailored client relationships | Transactional, less personalized |

| Flexibility | High flexibility in portfolio choices | More rigid, follows preset mandates |

| Fee Structure | Often higher, performance-based fees | Lower, management fees plus possible performance fees |

| Transparency | Greater transparency and reporting detail | Standard transparency, less frequent updates |

| Risk Profile | Potentially higher risk due to niche focus | Typically diversified to reduce risk |

Understanding Boutique Investment Firms

Boutique investment firms specialize in tailored financial services, offering personalized portfolio management that contrasts with the standardized approaches of conventional investment firms. These firms emphasize deep expertise in niche markets and prioritize client relationships over asset volume, enabling more agile and customized investment strategies. Investors benefit from boutique firms' focused knowledge and flexibility, often gaining access to unique opportunities not typically available through larger, traditional firms.

Defining Conventional Investment Companies

Conventional investment companies are large, established firms that manage diversified portfolios with standardized strategies, often prioritizing scale and broad market exposure. These companies rely on traditional asset classes such as stocks, bonds, and mutual funds, emphasizing liquidity and risk management through established financial models. Their structured approach contrasts with boutique investment firms, which typically offer specialized, customized services targeting niche markets or unique asset opportunities.

Key Differences Between Boutique and Conventional Investment

Boutique investment firms specialize in personalized asset management with a focus on niche markets and tailored strategies, contrasting with conventional investment firms that typically manage larger portfolios with standardized investment products. Boutique firms often provide more customized client service and agile decision-making, while conventional investments emphasize broad diversification and scale advantages. The key differences lie in the level of client engagement, investment approach, and portfolio customization.

Personalized Service in Boutique Investments

Boutique investments offer highly personalized service tailored to individual client needs, contrasting with the standardized approach typical of conventional investments. Clients benefit from direct access to senior management and customized strategies that reflect specific financial goals and risk tolerance. This personalized service enhances portfolio agility and aligns investment decisions closely with personal values and market insights.

Asset Management Strategies: Boutique vs. Conventional

Boutique investment firms emphasize personalized asset management strategies tailored to niche markets and specialized client needs, often enabling more agile decision-making and customized portfolio construction. Conventional investment firms typically offer standardized strategies focused on broader market exposure and scale, prioritizing diversification and risk management across large asset pools. Boutique approaches leverage deep sector expertise and concentrated holdings, while conventional approaches benefit from extensive resources and established processes for managing diverse asset classes.

Pros and Cons of Boutique Investment Firms

Boutique investment firms offer personalized, specialized services with a deep understanding of niche markets, enabling tailored investment strategies that often outperform generic portfolios. They provide greater transparency and closer client relationships, but may lack the extensive resources and diversified offerings of conventional investment firms. While boutique firms excel in agility and customization, their limited scale can result in higher fees and potential risks associated with less diversified asset management.

Client Relationships and Customization

Boutique investment firms prioritize deep client relationships by offering personalized services and tailored investment strategies that align with individual financial goals and risk tolerance. Unlike conventional investment firms, which often follow standardized approaches and manage large client portfolios with less customization, boutique firms provide bespoke solutions that adapt to evolving market conditions and client needs. This client-centric focus enhances trust, transparency, and long-term collaboration, distinguishing boutique investments in delivering value through specialized expertise and customized asset management.

Performance Comparison: Boutique vs. Conventional

Boutique investment firms often deliver higher performance compared to conventional investment firms due to their specialized strategies and focused asset management. These firms typically manage smaller portfolios, allowing for more agile decision-making and tailored investment approaches that can outperform broader market indices. Data shows boutique investments frequently achieve superior risk-adjusted returns, driven by deep sector expertise and personalized client service.

Choosing the Right Investment Approach for Your Portfolio

Boutique investment firms offer specialized expertise and personalized strategies that cater to niche markets, often providing higher potential returns through focused asset selection compared to conventional investment firms with broader, standardized portfolios. Investors seeking tailored portfolio management and unique opportunities may benefit from boutique firms' agility and sector-specific knowledge, enhancing diversification and risk-adjusted performance. Evaluating your investment goals, risk tolerance, and preference for customized service is crucial when choosing between boutique and conventional investment approaches to optimize portfolio growth and resilience.

The Future of Boutique Investment in the Financial Industry

Boutique investment firms leverage specialized expertise and personalized client services to deliver tailored financial strategies that often outperform conventional investment approaches reliant on standardized asset allocation. The future of boutique investment in the financial industry is characterized by increased demand for niche market knowledge, agile decision-making, and innovative technology integration, enabling these firms to respond rapidly to market changes. As regulatory environments evolve and investors seek diversification beyond traditional sectors, boutique investments are positioned to capture significant growth by emphasizing customization, transparency, and sustainable investment practices.

Boutique Investment vs Conventional Investment Infographic

bizdif.com

bizdif.com