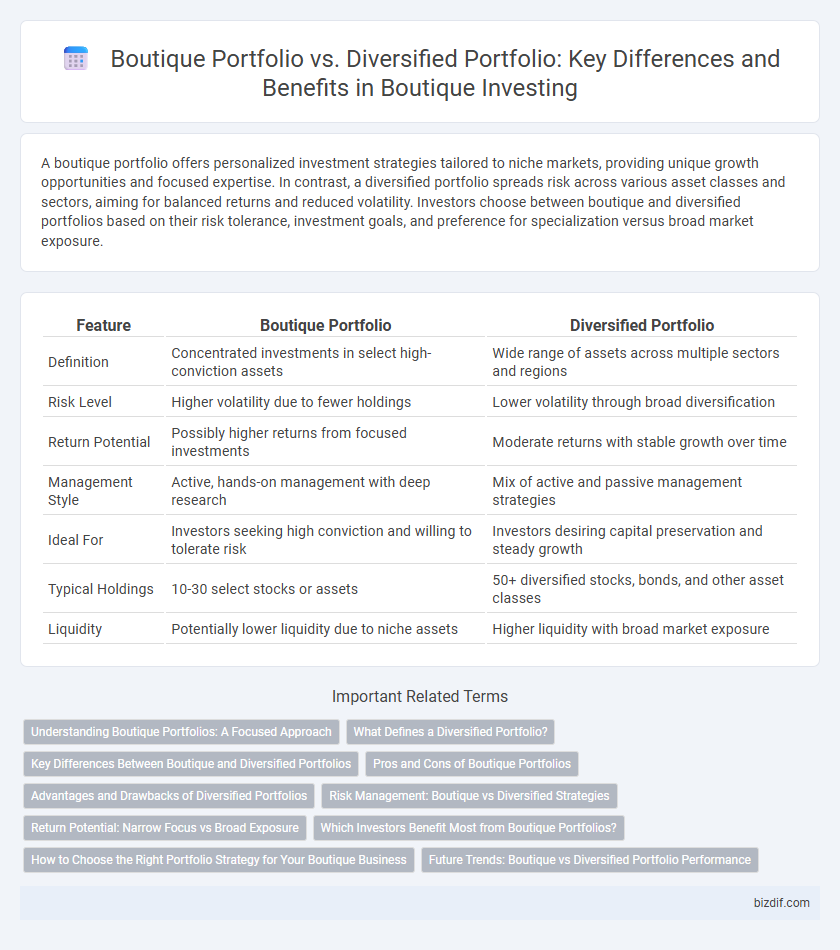

A boutique portfolio offers personalized investment strategies tailored to niche markets, providing unique growth opportunities and focused expertise. In contrast, a diversified portfolio spreads risk across various asset classes and sectors, aiming for balanced returns and reduced volatility. Investors choose between boutique and diversified portfolios based on their risk tolerance, investment goals, and preference for specialization versus broad market exposure.

Table of Comparison

| Feature | Boutique Portfolio | Diversified Portfolio |

|---|---|---|

| Definition | Concentrated investments in select high-conviction assets | Wide range of assets across multiple sectors and regions |

| Risk Level | Higher volatility due to fewer holdings | Lower volatility through broad diversification |

| Return Potential | Possibly higher returns from focused investments | Moderate returns with stable growth over time |

| Management Style | Active, hands-on management with deep research | Mix of active and passive management strategies |

| Ideal For | Investors seeking high conviction and willing to tolerate risk | Investors desiring capital preservation and steady growth |

| Typical Holdings | 10-30 select stocks or assets | 50+ diversified stocks, bonds, and other asset classes |

| Liquidity | Potentially lower liquidity due to niche assets | Higher liquidity with broad market exposure |

Understanding Boutique Portfolios: A Focused Approach

Boutique portfolios concentrate on specialized sectors or unique investment themes, allowing deeper expertise and tailored strategies that target specific market niches. Unlike diversified portfolios that spread risk across various asset classes to minimize volatility, boutique portfolios embrace concentrated holdings for potentially higher returns and distinctive risk profiles. Investors seeking personalized management and thematic focus often prefer boutique portfolios to align closely with specific goals and market insights.

What Defines a Diversified Portfolio?

A diversified portfolio consists of a wide range of asset classes, sectors, and geographic exposures to reduce risk and enhance stable returns. It spreads investments across stocks, bonds, real estate, and alternative assets to minimize the impact of any single market downturn. This contrasts with boutique portfolios, which often concentrate on specialized sectors or strategies, offering tailored but less diversified investment exposure.

Key Differences Between Boutique and Diversified Portfolios

Boutique portfolios concentrate on a limited number of carefully selected assets, emphasizing high-conviction investments tailored to specific market niches or client preferences, which can lead to higher potential returns and increased risk. Diversified portfolios spread investments across a broad range of asset classes, sectors, and geographies to mitigate risk and promote stable, long-term growth. The key differences lie in risk concentration, investment strategy, and customization, with boutique portfolios offering specialized expertise and focused exposure versus the broad risk management of diversified portfolios.

Pros and Cons of Boutique Portfolios

Boutique portfolios offer personalized investment strategies tailored to niche markets or specialized asset classes, providing potential for higher alpha and unique opportunities not available in diversified portfolios. However, they carry increased risk due to limited asset diversification and can suffer from liquidity constraints and higher fees. Investors seeking bespoke solutions and concentrated exposure may benefit, but must weigh the trade-off between targeted growth and volatility management.

Advantages and Drawbacks of Diversified Portfolios

Diversified portfolios spread investments across various asset classes and sectors, reducing unsystematic risk and enhancing stability during market volatility. This approach can limit potential high returns from niche markets or sectors that a boutique portfolio might capture. However, over-diversification may dilute gains and increase portfolio complexity, potentially leading to higher management costs and less personalized investment strategies.

Risk Management: Boutique vs Diversified Strategies

Boutique portfolios emphasize specialized asset selection and personalized risk management, leveraging concentrated investments to maximize returns while accepting higher volatility. Diversified portfolios spread risk across a wide range of asset classes and sectors, reducing the impact of any single investment's poor performance on the overall portfolio. Boutique strategies rely on deep expertise to identify high-conviction opportunities, whereas diversified approaches prioritize stability and broad market exposure to mitigate risk.

Return Potential: Narrow Focus vs Broad Exposure

A boutique portfolio typically targets specific sectors or niches, offering higher return potential through concentrated investments in high-growth opportunities. In contrast, a diversified portfolio spreads assets across various industries and geographies to reduce risk but may deliver moderate returns due to broader exposure. Investors seeking aggressive growth might prefer boutique portfolios, while those aiming for stable, steady returns often opt for diversified portfolios.

Which Investors Benefit Most from Boutique Portfolios?

Investors seeking a highly specialized, actively managed investment approach benefit most from boutique portfolios, as these portfolios offer tailored strategies emphasizing niche markets or unique asset classes. Boutique portfolios typically appeal to high-net-worth individuals and institutional clients who prioritize personalized service and differentiated investment opportunities over broad market exposure. Unlike diversified portfolios that spread risk across various sectors, boutique portfolios concentrate assets to potentially achieve higher alpha through expert management and focused insights.

How to Choose the Right Portfolio Strategy for Your Boutique Business

Choosing the right portfolio strategy for your boutique business depends on your risk tolerance, market expertise, and growth objectives. A boutique portfolio typically involves concentrated investments in niche markets or specialized products, maximizing potential returns through deep industry knowledge. In contrast, a diversified portfolio spreads investments across various sectors to reduce risk and stabilize income, making it suitable for boutiques seeking steady growth and risk mitigation.

Future Trends: Boutique vs Diversified Portfolio Performance

Boutique portfolios, with their specialized focus and expert-driven asset selection, often outperform diversified portfolios in niche markets by capitalizing on emerging trends and sector-specific opportunities. Future trends indicate that boutique portfolios will gain traction as investors seek higher alpha through concentrated, research-intensive strategies, contrasting with the broad-risk mitigation approach of diversified portfolios. Data shows that boutique funds tend to deliver superior returns during periods of market volatility, leveraging deep expertise and agility in dynamic sectors like technology and healthcare.

Boutique Portfolio vs Diversified Portfolio Infographic

bizdif.com

bizdif.com