Boutique private equity firms focus on specialized, niche investments with a hands-on approach, offering tailored strategies that align closely with the unique needs of boutique pet businesses. Mega fund private equity, however, manages larger capital pools, prioritizing scale and broad market reach, which may not provide the same level of personalized attention. For boutique pet companies seeking bespoke growth strategies and flexibility, boutique private equity often delivers more customized support and industry-specific expertise.

Table of Comparison

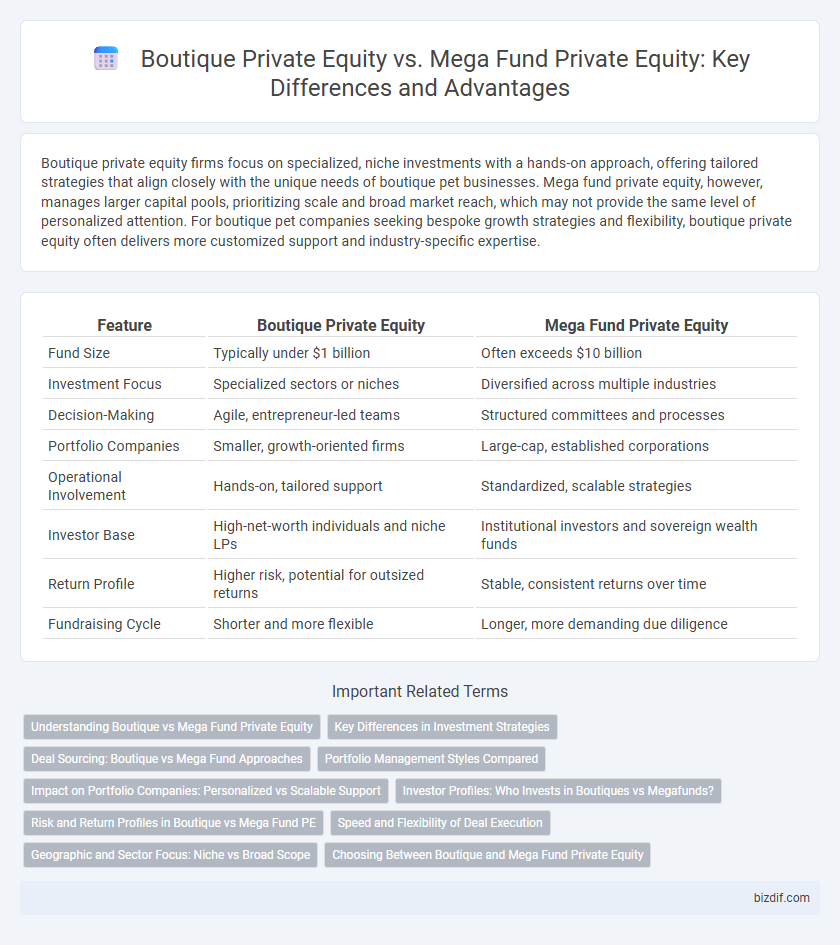

| Feature | Boutique Private Equity | Mega Fund Private Equity |

|---|---|---|

| Fund Size | Typically under $1 billion | Often exceeds $10 billion |

| Investment Focus | Specialized sectors or niches | Diversified across multiple industries |

| Decision-Making | Agile, entrepreneur-led teams | Structured committees and processes |

| Portfolio Companies | Smaller, growth-oriented firms | Large-cap, established corporations |

| Operational Involvement | Hands-on, tailored support | Standardized, scalable strategies |

| Investor Base | High-net-worth individuals and niche LPs | Institutional investors and sovereign wealth funds |

| Return Profile | Higher risk, potential for outsized returns | Stable, consistent returns over time |

| Fundraising Cycle | Shorter and more flexible | Longer, more demanding due diligence |

Understanding Boutique vs Mega Fund Private Equity

Boutique private equity firms typically manage smaller funds with a focus on specialized or niche markets, enabling tailored investment strategies and closer portfolio company involvement. Mega fund private equity firms oversee vast capital pools, investing in large-scale transactions with broader industry footprints and greater emphasis on operational efficiencies. Understanding the distinctions between boutique and mega fund private equity centers on fund size, investment approach, and target company profiles.

Key Differences in Investment Strategies

Boutique private equity firms typically focus on specialized sectors or niche markets, leveraging deep industry expertise and pursuing targeted, hands-on investment approaches. In contrast, mega fund private equity firms invest across a broad range of industries with diversified portfolios, emphasizing scale, operational efficiency, and large-volume deal execution. The boutique approach often involves lower deal sizes and more customized value creation strategies, whereas mega funds prioritize global reach and extensive capital deployment to drive returns.

Deal Sourcing: Boutique vs Mega Fund Approaches

Boutique private equity firms excel in deal sourcing through specialized industry networks and personalized relationships, enabling access to unique, lower-competition opportunities often missed by larger players. In contrast, mega fund private equity leverages extensive resources, global reach, and advanced data analytics to target high-value, large-scale deals often requiring significant capital deployment. The boutique approach emphasizes quality and niche expertise, while mega funds prioritize volume and scale in their deal sourcing strategies.

Portfolio Management Styles Compared

Boutique private equity firms typically emphasize hands-on portfolio management with a focus on operational improvements and long-term value creation, leveraging deep industry expertise and close collaboration with portfolio companies. Mega fund private equity firms often prioritize large-scale strategic initiatives, financial engineering, and economies of scale to drive portfolio company growth and exit strategies. The differing portfolio management styles impact deal sourcing, value creation timelines, and risk tolerance, with boutique firms favoring niche markets and mega funds targeting broader, high-capital opportunities.

Impact on Portfolio Companies: Personalized vs Scalable Support

Boutique private equity firms offer personalized support to portfolio companies, enabling tailored strategies and hands-on management that align closely with individual business needs. In contrast, mega fund private equity provides scalable support through extensive resources and standardized processes, facilitating rapid growth but potentially sacrificing customization. This difference significantly influences portfolio company development, with boutiques driving deep value creation and mega funds focusing on broader operational efficiencies.

Investor Profiles: Who Invests in Boutiques vs Megafunds?

Boutique private equity firms typically attract high-net-worth individuals, family offices, and specialized institutional investors seeking tailored investment strategies and personalized service. In contrast, megafunds primarily draw large institutional investors such as pension funds, sovereign wealth funds, and endowments requiring substantial capital deployment and broad market exposure. The investor profiles reflect differing risk tolerances, investment horizons, and demand for bespoke portfolio management versus scale and diversified asset allocation.

Risk and Return Profiles in Boutique vs Mega Fund PE

Boutique private equity firms typically exhibit higher risk and return profiles due to their focus on niche markets and hands-on management approach, allowing for more specialized deal sourcing and value creation. Mega fund private equity firms generally pursue larger, diversified investments with lower risk and more stable returns, benefiting from economies of scale and extensive capital resources. The contrasting strategies impact investment horizons, portfolio concentration, and performance volatility between boutique and mega fund private equity.

Speed and Flexibility of Deal Execution

Boutique private equity firms excel in speed and flexibility of deal execution due to their streamlined decision-making and specialized expertise, enabling quicker responses to market opportunities. Unlike mega fund private equity firms, which often involve complex hierarchical approval processes and extensive due diligence, boutiques can close deals faster and tailor terms more efficiently to meet specific investment goals. This agility allows boutique firms to capitalize on niche markets and customized investment strategies that larger funds might overlook or deem too cumbersome to pursue.

Geographic and Sector Focus: Niche vs Broad Scope

Boutique private equity firms concentrate on specific geographic regions and industry sectors, leveraging deep local expertise and specialized market knowledge to identify unique investment opportunities. In contrast, mega fund private equity firms operate across broad geographic areas, targeting diverse sectors and large-scale deals to maximize portfolio diversification and capital deployment. This difference in focus allows boutique firms to excel in niche markets, while mega funds dominate through scale and breadth.

Choosing Between Boutique and Mega Fund Private Equity

Boutique private equity firms offer personalized investment strategies and niche market expertise, often resulting in tailored value creation for portfolio companies. Mega fund private equity firms provide substantial capital resources and global networks, enabling large-scale deals and diversified risk management. Choosing between boutique and mega fund private equity depends on factors such as deal size, industry specialization, and the desired level of operational involvement.

Boutique private equity vs Mega fund private equity Infographic

bizdif.com

bizdif.com