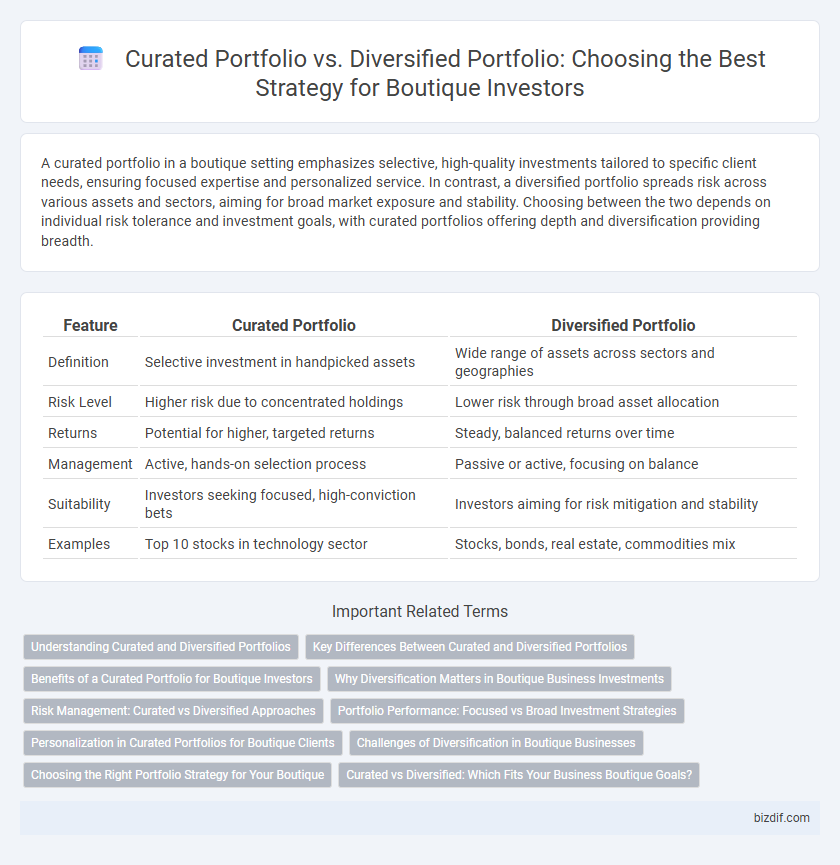

A curated portfolio in a boutique setting emphasizes selective, high-quality investments tailored to specific client needs, ensuring focused expertise and personalized service. In contrast, a diversified portfolio spreads risk across various assets and sectors, aiming for broad market exposure and stability. Choosing between the two depends on individual risk tolerance and investment goals, with curated portfolios offering depth and diversification providing breadth.

Table of Comparison

| Feature | Curated Portfolio | Diversified Portfolio |

|---|---|---|

| Definition | Selective investment in handpicked assets | Wide range of assets across sectors and geographies |

| Risk Level | Higher risk due to concentrated holdings | Lower risk through broad asset allocation |

| Returns | Potential for higher, targeted returns | Steady, balanced returns over time |

| Management | Active, hands-on selection process | Passive or active, focusing on balance |

| Suitability | Investors seeking focused, high-conviction bets | Investors aiming for risk mitigation and stability |

| Examples | Top 10 stocks in technology sector | Stocks, bonds, real estate, commodities mix |

Understanding Curated and Diversified Portfolios

A curated portfolio is meticulously selected, focusing on high-conviction investments that reflect specific themes or expertise, often managed by boutique firms to deliver tailored risk-return profiles. A diversified portfolio spreads investments across various asset classes, sectors, or geographies to minimize risk and enhance stability, leveraging broad market exposure. Understanding the distinction helps investors align their strategy with personal goals, balancing targeted insights against risk mitigation.

Key Differences Between Curated and Diversified Portfolios

Curated portfolios emphasize selective investments based on rigorous research and thematic coherence, often concentrating on high-conviction assets within niche markets. Diversified portfolios aim to mitigate risk by spreading investments across various asset classes, sectors, and geographies to achieve broad market exposure. The key difference lies in risk concentration: curated portfolios prioritize depth and potential high returns through focused positions, whereas diversified portfolios prioritize risk reduction through asset dispersion.

Benefits of a Curated Portfolio for Boutique Investors

A curated portfolio offers boutique investors the advantage of personalized investment selections tailored to their unique risk tolerance and financial goals, enhancing portfolio alignment with individual preferences. This focused approach allows for deeper analysis and expert-driven asset choices, often leading to higher conviction and potentially superior risk-adjusted returns. By concentrating on fewer, high-conviction holdings, boutique investors can avoid dilution and closely monitor performance, ensuring agility in response to market changes.

Why Diversification Matters in Boutique Business Investments

Diversification in boutique business investments reduces risk by spreading capital across multiple sectors and asset types, preventing overexposure to any single market fluctuation. A diversified portfolio enhances the potential for stable returns by balancing high-risk, high-reward ventures with more conservative assets. Strategic diversification ensures resilience in changing economic conditions, safeguarding long-term growth in boutique investment portfolios.

Risk Management: Curated vs Diversified Approaches

A curated portfolio concentrates on carefully selected assets to maximize targeted risk-return profiles, allowing focused risk management through expert analysis and thematic coherence. Diversified portfolios spread investments across various asset classes, sectors, and geographies to minimize exposure to any single risk factor, enhancing overall stability through risk dispersion. Effective risk management in boutique investment settings often involves balancing the precision of curated strategies with the risk mitigation inherent in diversified allocations.

Portfolio Performance: Focused vs Broad Investment Strategies

A curated portfolio typically delivers higher returns by concentrating on carefully selected, high-conviction assets, enhancing portfolio performance through targeted exposure. In contrast, a diversified portfolio reduces risk by spreading investments across various sectors and asset classes, often resulting in steadier but potentially lower overall returns. Boutique firms excel at curated portfolios, leveraging specialized expertise to outperform broader market benchmarks with focused investment strategies.

Personalization in Curated Portfolios for Boutique Clients

Curated portfolios prioritize personalization by tailoring investment selections to the unique goals, risk tolerance, and preferences of boutique clients, enhancing alignment with their financial aspirations. Unlike diversified portfolios that spread risk broadly across many assets, curated portfolios focus on a selective range of high-conviction investments to deliver targeted growth and engagement. This approach leverages in-depth client insights and boutique expertise, resulting in a deeply customized asset allocation not achievable through generic diversification.

Challenges of Diversification in Boutique Businesses

Boutique businesses often face challenges in diversification due to limited resources and market reach, which restrict their ability to spread risk across a wide range of investments. Curated portfolios emphasize deep expertise and tailored selections, but this focus can lead to concentration risk and vulnerability to specific sector downturns. Balancing a diversified portfolio while maintaining the boutique's specialized value proposition requires strategic allocation and rigorous market analysis.

Choosing the Right Portfolio Strategy for Your Boutique

Choosing the right portfolio strategy for your boutique hinges on balancing curated and diversified approaches to align with specific business goals and risk tolerance. A curated portfolio emphasizes select, high-conviction investments, allowing for deeper expertise and potentially higher returns, while a diversified portfolio spreads risk across various asset classes and sectors to enhance stability. Evaluating market conditions, client preferences, and boutique specialization ensures the optimal blend, enhancing long-term portfolio resilience and growth potential.

Curated vs Diversified: Which Fits Your Business Boutique Goals?

A curated portfolio offers boutique businesses tailored investment selections aligned with their unique brand identity and niche market, enhancing brand coherence and customer loyalty. In contrast, a diversified portfolio spreads risk across various asset classes, providing stability but potentially diluting the boutique's distinct market positioning. Choosing between curated and diversified portfolios depends on whether your boutique prioritizes specialized market impact or broad financial security.

Curated Portfolio vs Diversified Portfolio Infographic

bizdif.com

bizdif.com