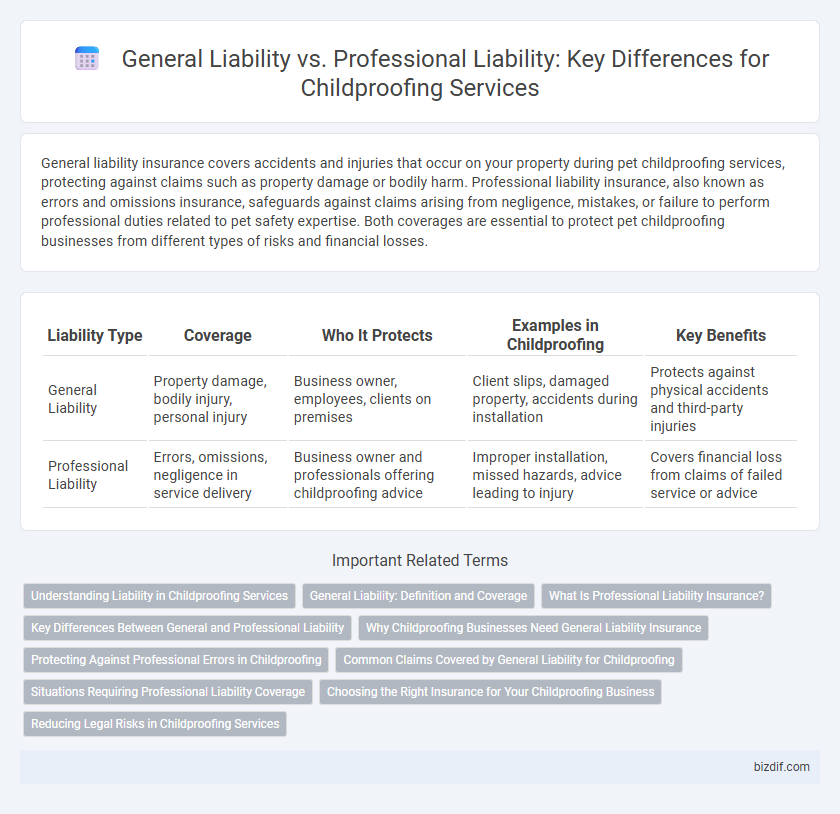

General liability insurance covers accidents and injuries that occur on your property during pet childproofing services, protecting against claims such as property damage or bodily harm. Professional liability insurance, also known as errors and omissions insurance, safeguards against claims arising from negligence, mistakes, or failure to perform professional duties related to pet safety expertise. Both coverages are essential to protect pet childproofing businesses from different types of risks and financial losses.

Table of Comparison

| Liability Type | Coverage | Who It Protects | Examples in Childproofing | Key Benefits |

|---|---|---|---|---|

| General Liability | Property damage, bodily injury, personal injury | Business owner, employees, clients on premises | Client slips, damaged property, accidents during installation | Protects against physical accidents and third-party injuries |

| Professional Liability | Errors, omissions, negligence in service delivery | Business owner and professionals offering childproofing advice | Improper installation, missed hazards, advice leading to injury | Covers financial loss from claims of failed service or advice |

Understanding Liability in Childproofing Services

General liability insurance covers property damage or bodily injury claims arising from accidents during childproofing installations, protecting against third-party lawsuits. Professional liability insurance addresses claims related to errors, omissions, or negligence in the advice, design, or execution of childproofing services. Understanding the distinction ensures comprehensive protection for childproofing professionals against both physical damages and service-related liabilities.

General Liability: Definition and Coverage

General liability insurance provides essential coverage for childproofing businesses by protecting against third-party claims of bodily injury, property damage, and personal injury occurring during service operations. This insurance safeguards childproofing professionals from financial losses related to accidents, such as a client or visitor sustaining injury while technicians are installing safety devices. Unlike professional liability insurance, which covers errors in advice or professional services, general liability focuses on physical incidents and legal liabilities arising from business premises and operations.

What Is Professional Liability Insurance?

Professional liability insurance, also known as errors and omissions insurance, protects childproofing service providers against claims of negligence, mistakes, or failure to perform professional duties. Unlike general liability insurance that covers bodily injury or property damage, professional liability focuses on financial losses clients may incur due to substandard advice, design flaws, or improper installation of childproofing products. This insurance is crucial for childproofing experts to safeguard against lawsuits arising from alleged professional errors or omissions during service delivery.

Key Differences Between General and Professional Liability

General liability insurance covers physical injuries and property damage occurring on your business premises during childproofing services, protecting against accidents like slips or damage to a client's home. Professional liability insurance, also known as errors and omissions insurance, safeguards against claims of negligence or inadequate work related to childproofing advice or installation errors. Understanding these key differences helps childproofing businesses ensure comprehensive protection by addressing both physical risks and professional service mistakes.

Why Childproofing Businesses Need General Liability Insurance

Childproofing businesses need general liability insurance because it protects against bodily injury and property damage claims that can arise during on-site services. This insurance covers accidents such as a child getting injured by improperly installed safety equipment or damage caused to a client's home. Unlike professional liability insurance, which addresses errors in professional advice or services, general liability insurance provides essential coverage for physical incidents common in childproofing jobs.

Protecting Against Professional Errors in Childproofing

General liability insurance covers bodily injury or property damage during childproofing, while professional liability insurance specifically protects against claims arising from professional errors or negligence in the childproofing process. Professional liability is crucial for childproofing specialists to safeguard against lawsuits related to improper installation or failure to identify hazards. Securing professional liability ensures coverage for errors that directly impact a child's safety within the protected environment.

Common Claims Covered by General Liability for Childproofing

General liability insurance for childproofing services typically covers claims related to property damage, bodily injury, and accidents occurring on the job site or client's home. Common claims include accidental damage to clients' property, slips and falls caused by childproofing installations, and injuries resulting from improper use or malfunction of safety equipment. This coverage protects service providers from financial losses due to third-party lawsuits unrelated to professional errors or negligence.

Situations Requiring Professional Liability Coverage

Situations requiring professional liability coverage in childproofing services include claims arising from negligence in the advice, design, or installation of safety devices that result in injury or property damage. Unlike general liability, which covers bodily injury and property damage from accidents on-site, professional liability covers errors or omissions in the specialized guidance provided by childproofing experts. This coverage is essential when a client alleges that improper recommendations or installation caused harm, ensuring protection against legal claims tied to the professional aspects of childproofing work.

Choosing the Right Insurance for Your Childproofing Business

General liability insurance protects your childproofing business against claims of property damage or bodily injury during services, while professional liability insurance covers errors, omissions, or negligence related to your professional advice or installation. Selecting the right insurance requires assessing risks specific to childproofing tasks, such as accidental damage versus faulty recommendations. Prioritize both policies to ensure comprehensive coverage and safeguard your business from potential financial losses.

Reducing Legal Risks in Childproofing Services

General liability insurance covers bodily injury and property damage claims that may occur during childproofing installations, reducing exposure to accidents onsite. Professional liability insurance protects against claims of errors or negligence in the childproofing design or advice provided, safeguarding the business from lawsuits related to inadequate safety measures. Combining both insurances provides comprehensive protection, minimizing legal risks inherent in childproofing services.

General liability vs Professional liability Infographic

bizdif.com

bizdif.com