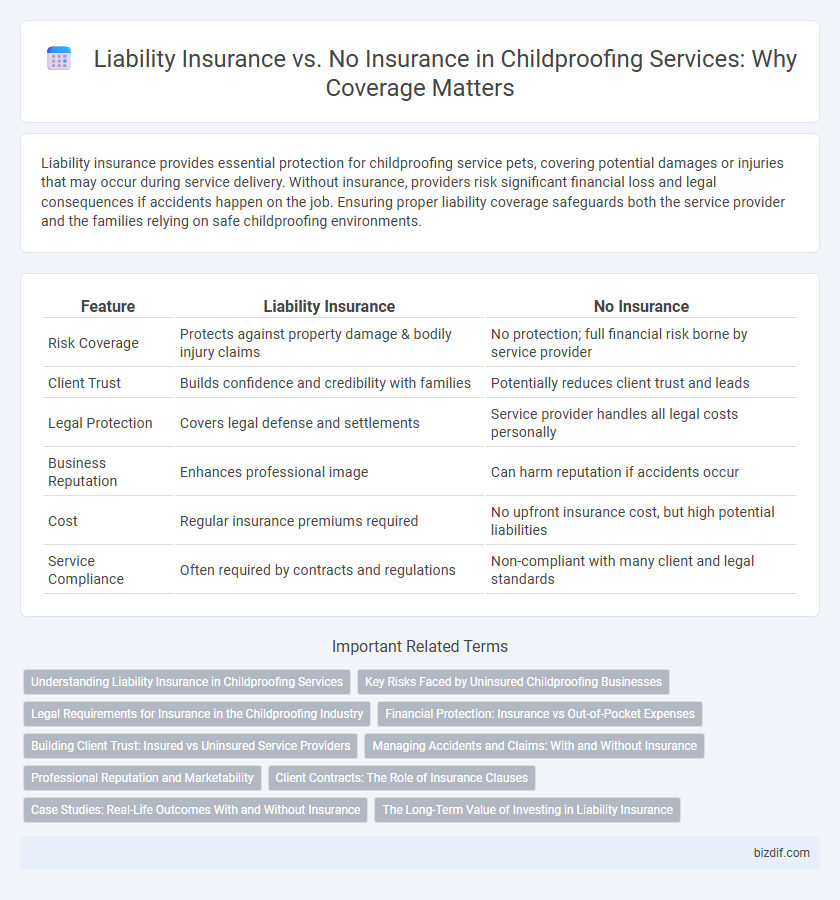

Liability insurance provides essential protection for childproofing service pets, covering potential damages or injuries that may occur during service delivery. Without insurance, providers risk significant financial loss and legal consequences if accidents happen on the job. Ensuring proper liability coverage safeguards both the service provider and the families relying on safe childproofing environments.

Table of Comparison

| Feature | Liability Insurance | No Insurance |

|---|---|---|

| Risk Coverage | Protects against property damage & bodily injury claims | No protection; full financial risk borne by service provider |

| Client Trust | Builds confidence and credibility with families | Potentially reduces client trust and leads |

| Legal Protection | Covers legal defense and settlements | Service provider handles all legal costs personally |

| Business Reputation | Enhances professional image | Can harm reputation if accidents occur |

| Cost | Regular insurance premiums required | No upfront insurance cost, but high potential liabilities |

| Service Compliance | Often required by contracts and regulations | Non-compliant with many client and legal standards |

Understanding Liability Insurance in Childproofing Services

Liability insurance in childproofing services protects businesses from financial losses resulting from accidents or damages during installations, ensuring peace of mind for both service providers and clients. Without liability insurance, providers risk bearing costly legal fees and compensation claims out-of-pocket, potentially jeopardizing business sustainability. Understanding the scope of coverage, including property damage, bodily injury, and legal defense costs, is essential for families seeking reliable and secure childproofing services.

Key Risks Faced by Uninsured Childproofing Businesses

Uninsured childproofing businesses face significant liability risks, including financial devastation from lawsuits linked to injuries caused by improper installations or product failures. Without liability insurance, these businesses must cover legal fees, settlements, and medical expenses out of pocket, risking bankruptcy or closure. The absence of coverage also undermines client trust and can result in the loss of contracts, as consumers increasingly demand proof of professional liability protection.

Legal Requirements for Insurance in the Childproofing Industry

Childproofing service providers must adhere to legal requirements mandating liability insurance to protect against potential claims of injury or property damage during installations. Operating without liability insurance exposes businesses to significant financial risks and legal penalties, as many states and contracts require proof of coverage before service approval. Ensuring compliance with insurance regulations not only safeguards clients and employees but also enhances credibility and trust in the highly regulated childproofing industry.

Financial Protection: Insurance vs Out-of-Pocket Expenses

Childproofing services with liability insurance provide essential financial protection by covering costs related to property damage or injuries, preventing significant out-of-pocket expenses for clients and service providers. Without insurance, clients may face unexpected high costs if accidents occur during childproofing, increasing financial risk. Liability insurance ensures peace of mind by mitigating potential lawsuits and minimizing economic burden associated with damages or claims.

Building Client Trust: Insured vs Uninsured Service Providers

Liability insurance significantly enhances client trust by demonstrating a service provider's commitment to safety and accountability in childproofing services. Insured providers offer reassurance that damages or accidents during installations are financially covered, reducing risks for clients. Uninsured providers may pose potential financial and legal risks, making it crucial for parents to verify coverage before hiring to ensure protection for their family and home.

Managing Accidents and Claims: With and Without Insurance

Liability insurance provides essential financial protection for childproofing services by covering costs related to accidents and claims, minimizing out-of-pocket expenses for damages or injuries. Without insurance, the service provider assumes full financial risk, potentially leading to significant personal liability and costly legal fees. Managing claims becomes more complex and financially burdensome without insurance, increasing vulnerability to lawsuits and reputational harm.

Professional Reputation and Marketability

Liability insurance significantly enhances a childproofing service's professional reputation by demonstrating reliability and commitment to safety, which attracts cautious parents and caregivers. Without insurance, the business risks losing trust and faces potential financial setbacks from accidents, undermining marketability and client confidence. Insured childproofing providers are often preferred by clients and can more easily secure partnerships and certifications, boosting long-term market growth.

Client Contracts: The Role of Insurance Clauses

Including liability insurance clauses in client contracts is essential for childproofing services to clearly define responsibility and mitigate financial risks associated with accidents or damages. Contracts specifying insurance coverage protect both the service provider and clients by ensuring compensation mechanisms are in place if incidents occur during childproofing installations. Without such clauses, providers face increased vulnerability to legal disputes and uninsured claims, potentially leading to significant losses and reputational harm.

Case Studies: Real-Life Outcomes With and Without Insurance

Case studies reveal that childproofing services with liability insurance mitigate financial risks from accidents or damages, ensuring compensation and legal protection for providers and clients. Services lacking insurance have faced significant legal claims and out-of-pocket expenses, often resulting in business closure or financial hardship. Data shows insured companies maintain trust and credibility, contributing to sustained growth in the childproofing industry.

The Long-Term Value of Investing in Liability Insurance

Investing in liability insurance for childproofing services ensures protection against costly legal claims and potential damages, safeguarding the business's financial stability. Without insurance, companies risk substantial out-of-pocket expenses that could jeopardize long-term operations and reputation. Liability insurance provides peace of mind and demonstrates professionalism, making it a critical asset for sustained growth and client trust.

Liability Insurance vs No Insurance Infographic

bizdif.com

bizdif.com