Premises liability protection covers accidents and injuries that occur on your property, specifically protecting pet owners from claims related to their animals' actions within the home or yard. General liability protection offers broader coverage for various business-related incidents, including bodily injury or property damage caused by your services to clients or third parties. For a childproofing service focused on pets, premises liability is crucial for safeguarding the property where the pet resides, while general liability ensures overall protection against claims arising during service delivery.

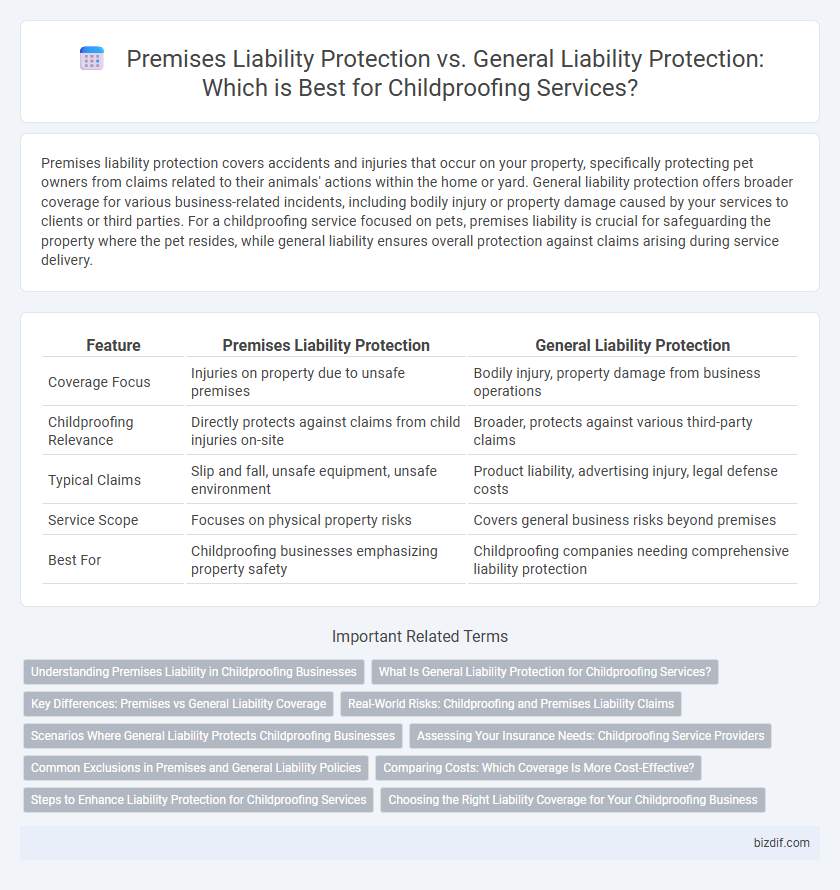

Table of Comparison

| Feature | Premises Liability Protection | General Liability Protection |

|---|---|---|

| Coverage Focus | Injuries on property due to unsafe premises | Bodily injury, property damage from business operations |

| Childproofing Relevance | Directly protects against claims from child injuries on-site | Broader, protects against various third-party claims |

| Typical Claims | Slip and fall, unsafe equipment, unsafe environment | Product liability, advertising injury, legal defense costs |

| Service Scope | Focuses on physical property risks | Covers general business risks beyond premises |

| Best For | Childproofing businesses emphasizing property safety | Childproofing companies needing comprehensive liability protection |

Understanding Premises Liability in Childproofing Businesses

Premises liability protection in childproofing businesses focuses on safeguarding against claims arising from injuries or accidents that occur on the client's property due to defective or unsafe conditions related to childproofing installations. This type of coverage is crucial as it addresses the specific risks of hazards left unaddressed or improperly installed safety measures, directly impacting the child's safety. General liability protection, while broader, covers other business risks but may not fully address the unique premises-related claims critical to childproofing service providers.

What Is General Liability Protection for Childproofing Services?

General liability protection for childproofing services covers claims related to bodily injury, property damage, and personal injury caused by accidents during the childproofing process. This insurance safeguards businesses from lawsuits arising when a client or third party experiences harm or damage due to negligence or errors made by the service provider. It is essential for childproofing companies to maintain general liability coverage to mitigate financial risks and ensure legal compliance while performing installations or safety assessments in clients' homes.

Key Differences: Premises vs General Liability Coverage

Premises liability protection specifically covers injuries or damages that occur on a property due to unsafe conditions, directly protecting property owners from claims related to slips, falls, or hazardous environments. General liability protection offers broader coverage, including bodily injury, property damage, and personal injury claims not necessarily tied to property conditions, extending protection to business operations overall. Understanding these key differences helps childproofing service providers ensure targeted coverage against risks associated with both their physical premises and general business activities.

Real-World Risks: Childproofing and Premises Liability Claims

Real-world risks in childproofing often lead to premises liability claims if hazards cause injuries, making premises liability protection crucial for businesses offering these services. Premises liability protection specifically covers accidents related to unsafe conditions on the property, such as improperly installed safety devices or overlooked hazards. General liability protection offers broader coverage but may not address the unique risks of childproofing, emphasizing the need for tailored premises liability insurance to mitigate financial exposure.

Scenarios Where General Liability Protects Childproofing Businesses

General liability protection covers childproofing businesses against claims of bodily injury or property damage caused by their operations, such as a client tripping over tools left on-site or accidental damage during installation. It offers financial coverage for legal fees, medical expenses, and settlements if a child or adult is injured while the childproofing service is being performed. Unlike premises liability protection, which protects property owners for accidents occurring on their property, general liability protection specifically safeguards the business owner in scenarios related to their professional activities and products.

Assessing Your Insurance Needs: Childproofing Service Providers

Childproofing service providers must carefully assess premises liability protection to cover injuries related to hazardous conditions in clients' homes, ensuring specific risks are mitigated. General liability protection offers broader coverage for bodily injury, property damage, and legal defense costs arising from routine business operations beyond premises-related incidents. Tailoring insurance coverage by evaluating potential hazards and client interactions helps optimize financial security and compliance for childproofing businesses.

Common Exclusions in Premises and General Liability Policies

Premises liability protection typically excludes damages arising from professional services, intentional harm, and pollution, while general liability protection often excludes claims related to employee injuries covered under workers' compensation and contractual liabilities. Both policies commonly exclude losses from war, nuclear hazards, and asbestos exposure. Understanding these common exclusions helps ensure comprehensive childproofing service coverage and minimizes risk exposure.

Comparing Costs: Which Coverage Is More Cost-Effective?

General liability protection typically offers broader coverage at a lower premium, making it more cost-effective for businesses seeking basic protection against common liabilities. Premises liability protection, while more specialized for accidents occurring on-site, often comes with higher costs due to targeted risk management coverage. Evaluating specific business risks, claim history, and coverage limits is essential to determine which option provides the best value in childproofing service contexts.

Steps to Enhance Liability Protection for Childproofing Services

Premises liability protection specifically covers injuries that occur on a childproofing service provider's property, addressing hazards related to safety installations and equipment. General liability protection offers broader coverage for third-party bodily injury, property damage, and advertising claims beyond the physical premises. To enhance liability protection, childproofing services should regularly inspect and maintain installed safety devices, document all safety measures taken, and secure comprehensive insurance policies that combine both premises and general liability coverage.

Choosing the Right Liability Coverage for Your Childproofing Business

Choosing the right liability coverage for your childproofing business involves understanding the distinctions between premises liability protection and general liability protection. Premises liability coverage specifically protects against injuries or accidents occurring on the property where childproofing services are performed, while general liability coverage offers broader protection against claims related to bodily injury, property damage, and advertising mistakes. Prioritizing comprehensive general liability insurance combined with premises liability ensures maximum financial security and legal protection tailored to the unique risks of a childproofing business.

Premises liability protection vs General liability protection Infographic

bizdif.com

bizdif.com