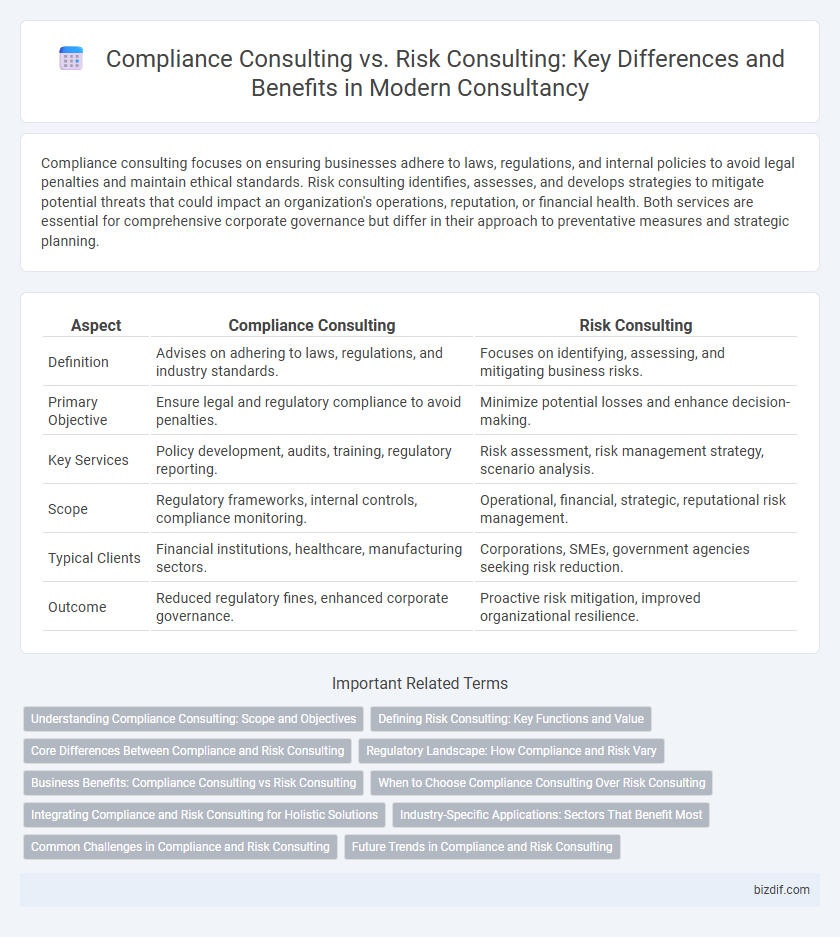

Compliance consulting focuses on ensuring businesses adhere to laws, regulations, and internal policies to avoid legal penalties and maintain ethical standards. Risk consulting identifies, assesses, and develops strategies to mitigate potential threats that could impact an organization's operations, reputation, or financial health. Both services are essential for comprehensive corporate governance but differ in their approach to preventative measures and strategic planning.

Table of Comparison

| Aspect | Compliance Consulting | Risk Consulting |

|---|---|---|

| Definition | Advises on adhering to laws, regulations, and industry standards. | Focuses on identifying, assessing, and mitigating business risks. |

| Primary Objective | Ensure legal and regulatory compliance to avoid penalties. | Minimize potential losses and enhance decision-making. |

| Key Services | Policy development, audits, training, regulatory reporting. | Risk assessment, risk management strategy, scenario analysis. |

| Scope | Regulatory frameworks, internal controls, compliance monitoring. | Operational, financial, strategic, reputational risk management. |

| Typical Clients | Financial institutions, healthcare, manufacturing sectors. | Corporations, SMEs, government agencies seeking risk reduction. |

| Outcome | Reduced regulatory fines, enhanced corporate governance. | Proactive risk mitigation, improved organizational resilience. |

Understanding Compliance Consulting: Scope and Objectives

Compliance consulting focuses on helping organizations adhere to legal regulations, industry standards, and internal policies to avoid penalties and maintain operational integrity. It involves assessing current practices, identifying gaps, and implementing controls to ensure full regulatory compliance across sectors such as finance, healthcare, and manufacturing. The main objectives include minimizing legal risks, enhancing corporate governance, and fostering a culture of accountability within the organization.

Defining Risk Consulting: Key Functions and Value

Risk consulting focuses on identifying, assessing, and mitigating potential threats that could impact an organization's assets and operations. Key functions include risk analysis, regulatory compliance evaluation, and the development of risk management strategies to minimize financial and reputational damage. This consulting area delivers value by enabling businesses to proactively address vulnerabilities and enhance decision-making processes through data-driven risk insights.

Core Differences Between Compliance and Risk Consulting

Compliance consulting focuses on ensuring organizations adhere to laws, regulations, and internal policies to avoid legal penalties and reputational damage. Risk consulting centers on identifying, assessing, and mitigating potential threats that could impact business objectives, including financial, operational, and strategic risks. While compliance consulting emphasizes adherence to external and internal standards, risk consulting prioritizes proactive risk management and strategic decision-making.

Regulatory Landscape: How Compliance and Risk Vary

Compliance consulting focuses on ensuring organizations adhere to specific regulatory requirements, emphasizing frameworks such as GDPR, HIPAA, and SOX to avoid legal penalties. Risk consulting assesses potential threats to business operations, including financial, operational, and reputational risks, by analyzing internal controls and external threats. The regulatory landscape impacts compliance consulting directly through detailed mandates, whereas risk consulting addresses broader uncertainties that might affect regulatory adherence indirectly.

Business Benefits: Compliance Consulting vs Risk Consulting

Compliance consulting ensures businesses adhere to legal regulations and industry standards, minimizing the risk of fines and legal penalties. Risk consulting proactively identifies and mitigates potential threats, enhancing decision-making and safeguarding assets. Both services drive operational resilience and protect organizational reputation through targeted expertise.

When to Choose Compliance Consulting Over Risk Consulting

Choose compliance consulting when your primary concern is adhering to legal regulations, industry standards, and internal policies to avoid penalties and ensure operational legitimacy. This type of consulting is essential for organizations facing frequent audits, regulatory changes, or requiring frameworks for governance and reporting. Risk consulting is more suitable for identifying, assessing, and mitigating broader business risks, but compliance consulting specifically addresses the demand for maintaining strict adherence to compliance obligations.

Integrating Compliance and Risk Consulting for Holistic Solutions

Integrating compliance and risk consulting creates a holistic approach that enhances organizational resilience by aligning regulatory adherence with proactive risk management strategies. This fusion enables businesses to identify potential risks early, ensure continuous compliance, and optimize operational processes to mitigate financial, legal, and reputational impacts. Leveraging combined expertise in both compliance frameworks and risk assessment tools delivers comprehensive solutions tailored to evolving industry standards and dynamic regulatory environments.

Industry-Specific Applications: Sectors That Benefit Most

Compliance consulting is essential for heavily regulated industries such as finance, healthcare, and energy, where adherence to legal standards and regulatory frameworks is critical. Risk consulting predominantly benefits sectors like manufacturing, construction, and technology by identifying operational vulnerabilities and minimizing potential disruptions. Both consulting types enhance sector-specific strategies, ensuring sustainable growth and regulatory alignment.

Common Challenges in Compliance and Risk Consulting

Common challenges in compliance and risk consulting include navigating complex regulatory environments and managing evolving industry standards. Ensuring accurate risk assessments while maintaining adherence to compliance frameworks requires integrating multidisciplinary expertise. Furthermore, clients often struggle with balancing operational efficiency and stringent regulatory requirements, necessitating tailored strategic solutions from consultants.

Future Trends in Compliance and Risk Consulting

Future trends in compliance consulting emphasize the integration of artificial intelligence and machine learning to enhance regulatory monitoring and automate reporting processes, ensuring proactive adherence to evolving laws. Risk consulting is increasingly focused on cybersecurity risk management and resilience planning, addressing the growing threats from digital transformation and geopolitical uncertainties. Both domains are adopting advanced data analytics and predictive modeling to anticipate regulatory changes and mitigate potential risks more effectively.

Compliance Consulting vs Risk Consulting Infographic

bizdif.com

bizdif.com