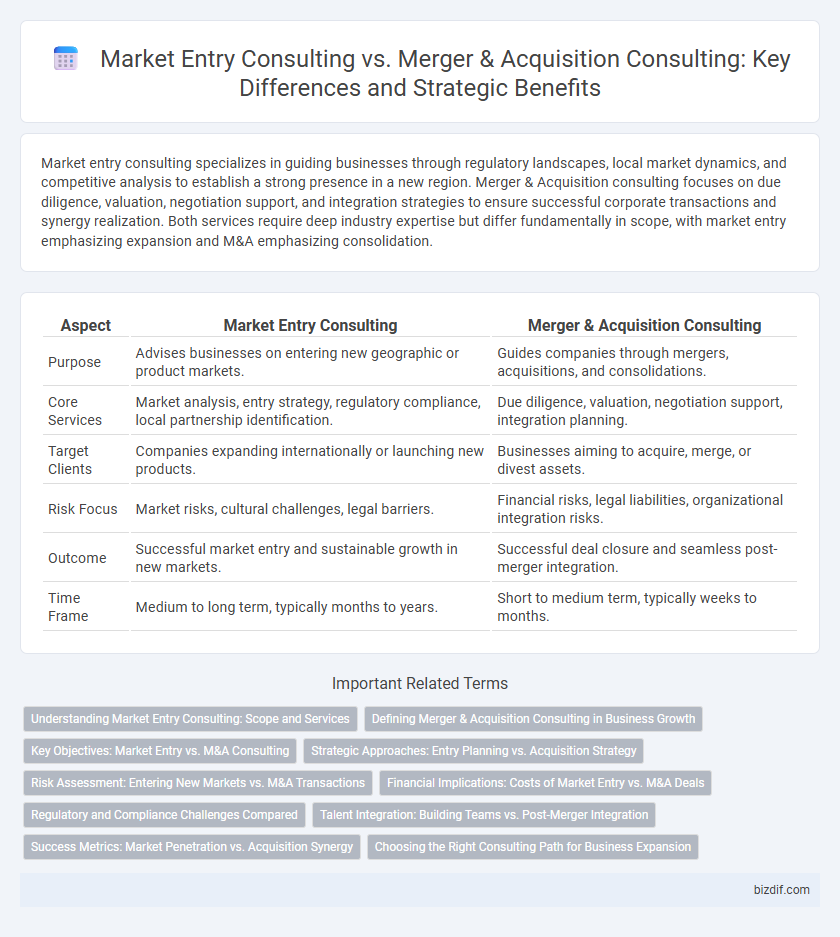

Market entry consulting specializes in guiding businesses through regulatory landscapes, local market dynamics, and competitive analysis to establish a strong presence in a new region. Merger & Acquisition consulting focuses on due diligence, valuation, negotiation support, and integration strategies to ensure successful corporate transactions and synergy realization. Both services require deep industry expertise but differ fundamentally in scope, with market entry emphasizing expansion and M&A emphasizing consolidation.

Table of Comparison

| Aspect | Market Entry Consulting | Merger & Acquisition Consulting |

|---|---|---|

| Purpose | Advises businesses on entering new geographic or product markets. | Guides companies through mergers, acquisitions, and consolidations. |

| Core Services | Market analysis, entry strategy, regulatory compliance, local partnership identification. | Due diligence, valuation, negotiation support, integration planning. |

| Target Clients | Companies expanding internationally or launching new products. | Businesses aiming to acquire, merge, or divest assets. |

| Risk Focus | Market risks, cultural challenges, legal barriers. | Financial risks, legal liabilities, organizational integration risks. |

| Outcome | Successful market entry and sustainable growth in new markets. | Successful deal closure and seamless post-merger integration. |

| Time Frame | Medium to long term, typically months to years. | Short to medium term, typically weeks to months. |

Understanding Market Entry Consulting: Scope and Services

Market entry consulting involves comprehensive analysis of target markets, including consumer behavior, regulatory environments, and competitive landscapes to develop tailored strategies for successful business expansion. Services encompass market research, localization strategies, partnership identification, and risk assessment to ensure clients efficiently navigate new markets. Unlike merger and acquisition consulting, which focuses on transaction execution and integration, market entry consulting prioritizes strategic planning and operational setup for sustainable growth.

Defining Merger & Acquisition Consulting in Business Growth

Merger & Acquisition consulting focuses on guiding businesses through strategic transactions involving the buying, selling, or combining of companies to accelerate growth and enhance competitive advantage. This consulting service includes due diligence, valuation analysis, negotiation support, and integration planning to ensure seamless transitions and maximize shareholder value. Unlike market entry consulting, which emphasizes launching into new markets, M&A consulting drives business expansion through corporate restructuring and asset consolidation.

Key Objectives: Market Entry vs. M&A Consulting

Market entry consulting primarily focuses on identifying viable market opportunities, assessing local competitive landscapes, regulatory compliance, and developing tailored entry strategies to ensure successful expansion. Merger & Acquisition consulting centers on due diligence, valuation, deal structuring, and integration planning to maximize transaction value and operational synergy. Both consulting types aim to mitigate risks and optimize growth but target distinct business phases--initial market penetration versus corporate consolidation.

Strategic Approaches: Entry Planning vs. Acquisition Strategy

Market entry consulting focuses on comprehensive entry planning, including market analysis, competitor assessment, and localization strategies to ensure a smooth and sustainable market penetration. Merger & Acquisition consulting prioritizes acquisition strategy by identifying suitable targets, conducting due diligence, and facilitating negotiations to optimize value creation and integration. Both approaches require tailored strategic frameworks but differ in execution focus: one builds presence organically, while the other accelerates growth through ownership transfer.

Risk Assessment: Entering New Markets vs. M&A Transactions

Market entry consulting prioritizes comprehensive risk assessment of local regulatory environments, cultural barriers, and competitive landscapes to ensure successful market integration. Merger & Acquisition consulting emphasizes evaluating financial liabilities, operational synergies, and legal compliance risks inherent in complex transactional structures. Both consulting types require tailored risk mitigation strategies to safeguard investment and maximize strategic value.

Financial Implications: Costs of Market Entry vs. M&A Deals

Market entry consulting typically involves lower upfront costs compared to merger and acquisition (M&A) consulting, which requires comprehensive financial due diligence, valuation, and integration expenses. Market entry costs often include market research, regulatory compliance, and initial operational setup, whereas M&A deals incur significant fees related to legal services, deal structuring, and post-merger integration efforts. Financial implications of M&A consulting also encompass potential risks of asset overvaluation and unforeseen liabilities, often making it a more capital-intensive strategy than market entry consulting.

Regulatory and Compliance Challenges Compared

Market entry consulting emphasizes navigating regulatory approvals, local licensing, and compliance with foreign investment laws to ensure smooth establishment in new markets. Merger & Acquisition consulting focuses on thorough due diligence of regulatory risks, antitrust laws, and integration of compliance frameworks to prevent post-transaction legal challenges. Both services require expertise in industry-specific regulations but differ in timing and scope of addressing compliance issues during expansion or consolidation phases.

Talent Integration: Building Teams vs. Post-Merger Integration

Market entry consulting emphasizes talent integration by focusing on building cohesive, high-performing teams tailored to new market environments, ensuring alignment with local business cultures and strategic goals. In contrast, merger and acquisition consulting prioritizes post-merger integration, addressing challenges such as cultural clashes, retention of key personnel, and harmonizing workflows to achieve seamless organizational synergy. Effective talent integration in both consulting approaches drives operational success and long-term value creation in complex business transformations.

Success Metrics: Market Penetration vs. Acquisition Synergy

Market entry consulting success is primarily measured by market penetration rates, reflecting the effectiveness of strategies to capture new customer segments and establish a competitive presence. Merger & Acquisition consulting success hinges on acquisition synergy realization, including operational integration, cost savings, and enhanced revenue streams post-transaction. Both consulting types require tailored KPIs to evaluate strategic outcomes aligned with client growth objectives.

Choosing the Right Consulting Path for Business Expansion

Market entry consulting guides businesses through local regulations, market analysis, and entry strategies to establish a strong foothold in new regions, emphasizing risk assessment and cultural adaptation. Merger and Acquisition consulting focuses on valuation, due diligence, negotiation, and integration processes to facilitate strategic growth through company transactions. Selecting the right consulting path depends on corporate objectives, resource availability, and desired speed of market penetration or expansion.

Market entry consulting vs Merger & Acquisition consulting Infographic

bizdif.com

bizdif.com