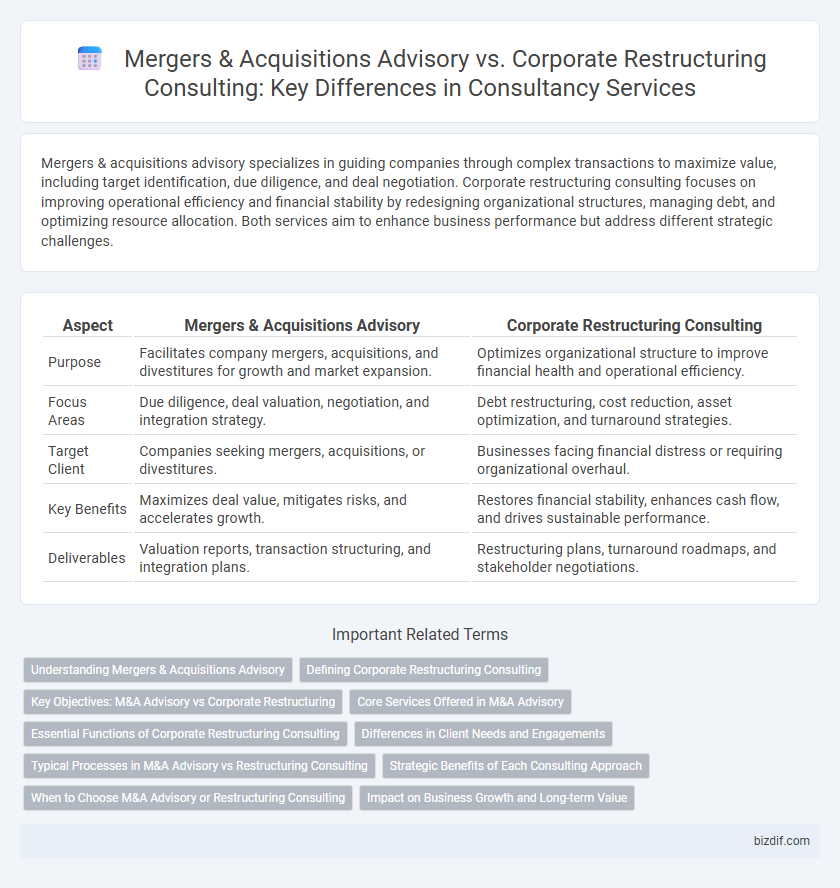

Mergers & acquisitions advisory specializes in guiding companies through complex transactions to maximize value, including target identification, due diligence, and deal negotiation. Corporate restructuring consulting focuses on improving operational efficiency and financial stability by redesigning organizational structures, managing debt, and optimizing resource allocation. Both services aim to enhance business performance but address different strategic challenges.

Table of Comparison

| Aspect | Mergers & Acquisitions Advisory | Corporate Restructuring Consulting |

|---|---|---|

| Purpose | Facilitates company mergers, acquisitions, and divestitures for growth and market expansion. | Optimizes organizational structure to improve financial health and operational efficiency. |

| Focus Areas | Due diligence, deal valuation, negotiation, and integration strategy. | Debt restructuring, cost reduction, asset optimization, and turnaround strategies. |

| Target Client | Companies seeking mergers, acquisitions, or divestitures. | Businesses facing financial distress or requiring organizational overhaul. |

| Key Benefits | Maximizes deal value, mitigates risks, and accelerates growth. | Restores financial stability, enhances cash flow, and drives sustainable performance. |

| Deliverables | Valuation reports, transaction structuring, and integration plans. | Restructuring plans, turnaround roadmaps, and stakeholder negotiations. |

Understanding Mergers & Acquisitions Advisory

Mergers & Acquisitions (M&A) advisory focuses on guiding companies through the complex process of buying, selling, or merging businesses to maximize value and strategic growth. This consultancy provides expertise in deal structuring, valuation, due diligence, negotiation, and regulatory compliance, ensuring transactions align with clients' financial and operational goals. Unlike corporate restructuring consulting, which centers on reorganizing company operations to improve efficiency or avoid insolvency, M&A advisory is specifically oriented toward facilitating successful ownership transitions and creating synergies between merging entities.

Defining Corporate Restructuring Consulting

Corporate restructuring consulting involves analyzing and realigning a company's operational structure, financial framework, and organizational strategies to enhance efficiency and profitability. This service targets distressed businesses or those undergoing significant change, enabling improved cash flow management, debt restructuring, and strategic repositioning in the market. Unlike mergers and acquisitions advisory, which centers on deal negotiation and integration, corporate restructuring consulting focuses on internal transformation to stabilize and revitalize corporate health.

Key Objectives: M&A Advisory vs Corporate Restructuring

Mergers & acquisitions advisory focuses on identifying, evaluating, and executing deals to maximize shareholder value through strategic growth and market expansion. Corporate restructuring consulting aims to improve organizational efficiency and financial stability by realigning business operations, optimizing cost structures, and managing debt. Both services prioritize enhancing company value but differ in timing, with M&A targeting expansion and restructuring addressing financial distress or operational challenges.

Core Services Offered in M&A Advisory

Mergers & acquisitions advisory primarily focuses on deal origination, due diligence, valuation, negotiation support, and post-merger integration to maximize transaction value and shareholder returns. Corporate restructuring consulting centers on financial reorganization, turnaround strategies, debt restructuring, and operational improvements to enhance corporate stability and performance. Core services in M&A advisory include target identification, transaction structuring, synergy analysis, and financing arrangements tailored to optimize merger success.

Essential Functions of Corporate Restructuring Consulting

Corporate restructuring consulting focuses on optimizing organizational structure, improving operational efficiency, and managing financial distress to enhance business viability. Experts assess asset allocation, debt management, and workforce realignment to stabilize and revitalize struggling companies. These essential functions directly support sustained growth and long-term competitiveness beyond the transaction-focused scope of mergers and acquisitions advisory.

Differences in Client Needs and Engagements

Mergers & acquisitions advisory primarily addresses client needs related to deal origination, valuation, negotiation, and post-merger integration, focusing on maximizing transaction value and strategic fit. Corporate restructuring consulting centers on improving financial stability, operational efficiency, and organizational redesign during distress or strategic shifts, often involving turnaround plans and creditor negotiations. Engagements in M&A are typically deal-driven and time-bound, while restructuring engagements require longer-term collaboration with an emphasis on crisis management and sustainable recovery.

Typical Processes in M&A Advisory vs Restructuring Consulting

Mergers & acquisitions advisory involves typical processes such as target identification, due diligence, valuation analysis, negotiation support, and deal structuring to facilitate seamless business combinations. Corporate restructuring consulting focuses on analyzing financial distress, developing turnaround strategies, renegotiating debt agreements, and optimizing organizational structures to restore company viability. These distinct processes require specialized expertise tailored to achieving either successful integration or financial recovery goals.

Strategic Benefits of Each Consulting Approach

Mergers & acquisitions advisory provides strategic benefits such as maximizing shareholder value through deal structuring, identifying synergistic opportunities, and facilitating market expansion or diversification. Corporate restructuring consulting focuses on improving operational efficiency, optimizing financial performance, and stabilizing troubled businesses to restore profitability and enhance long-term sustainability. Both approaches drive strategic growth but differ in focus: M&A advisory accelerates expansion, while restructuring ensures organizational resilience.

When to Choose M&A Advisory or Restructuring Consulting

Mergers & acquisitions advisory is ideal for companies seeking growth through strategic mergers, acquisitions, or divestitures to enhance market position and shareholder value. Corporate restructuring consulting is best suited for organizations facing financial distress or operational inefficiencies requiring asset reallocation, debt restructuring, or turnaround strategies. Choosing between M&A advisory and restructuring consulting depends on a company's current financial health, strategic objectives, and urgency of operational improvement.

Impact on Business Growth and Long-term Value

Mergers & acquisitions advisory directly accelerates business growth by identifying strategic acquisition targets and facilitating seamless deal execution, resulting in market expansion and increased revenue streams. Corporate restructuring consulting enhances long-term value by optimizing operational efficiency, reducing costs, and realigning organizational structures to improve sustainability and competitiveness. Both services are critical for maximizing shareholder value but address growth and value creation from different strategic angles.

Mergers & acquisitions advisory vs Corporate restructuring consulting Infographic

bizdif.com

bizdif.com