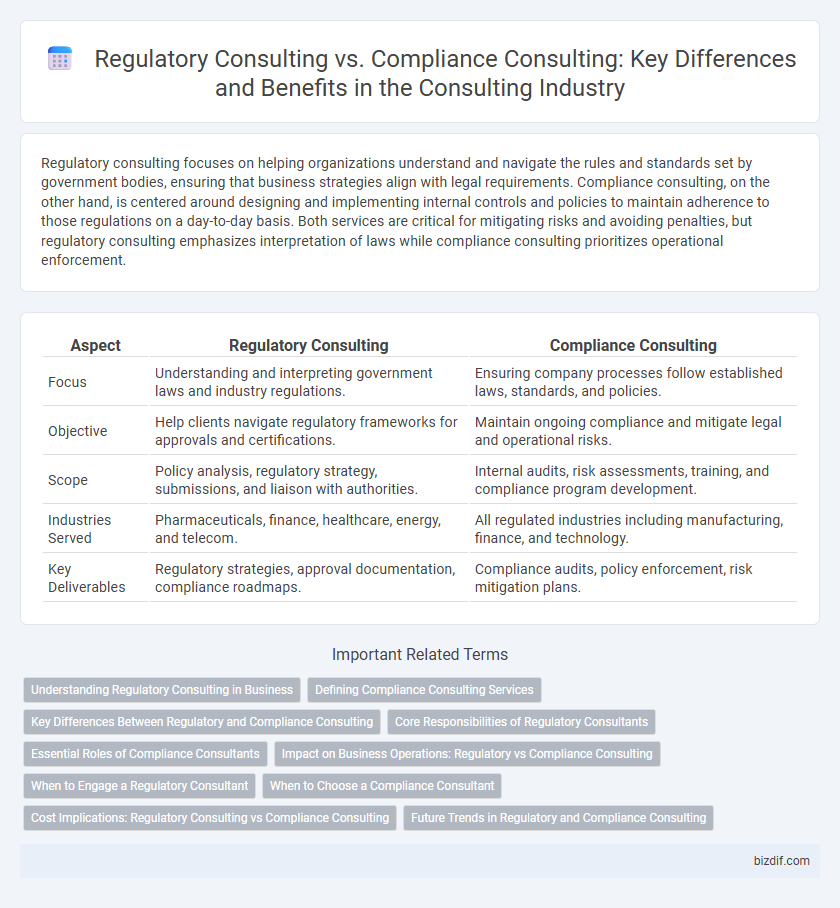

Regulatory consulting focuses on helping organizations understand and navigate the rules and standards set by government bodies, ensuring that business strategies align with legal requirements. Compliance consulting, on the other hand, is centered around designing and implementing internal controls and policies to maintain adherence to those regulations on a day-to-day basis. Both services are critical for mitigating risks and avoiding penalties, but regulatory consulting emphasizes interpretation of laws while compliance consulting prioritizes operational enforcement.

Table of Comparison

| Aspect | Regulatory Consulting | Compliance Consulting |

|---|---|---|

| Focus | Understanding and interpreting government laws and industry regulations. | Ensuring company processes follow established laws, standards, and policies. |

| Objective | Help clients navigate regulatory frameworks for approvals and certifications. | Maintain ongoing compliance and mitigate legal and operational risks. |

| Scope | Policy analysis, regulatory strategy, submissions, and liaison with authorities. | Internal audits, risk assessments, training, and compliance program development. |

| Industries Served | Pharmaceuticals, finance, healthcare, energy, and telecom. | All regulated industries including manufacturing, finance, and technology. |

| Key Deliverables | Regulatory strategies, approval documentation, compliance roadmaps. | Compliance audits, policy enforcement, risk mitigation plans. |

Understanding Regulatory Consulting in Business

Regulatory consulting in business involves providing expert guidance on navigating complex legal frameworks and industry-specific regulations to ensure organizational adherence and risk mitigation. It focuses on interpreting evolving laws, obtaining necessary approvals, and implementing standards to align business operations with regulatory requirements. Deep knowledge of sector-specific legislation and proactive management of regulatory changes distinguishes regulatory consulting from compliance consulting, which typically centers on internal adherence processes and audits.

Defining Compliance Consulting Services

Compliance consulting services focus on ensuring organizations adhere to applicable laws, regulations, and industry standards through risk assessments, policy development, and internal audits. These services help businesses implement effective compliance programs, reduce legal risks, and maintain regulatory certifications across sectors such as finance, healthcare, and manufacturing. Expertise includes monitoring evolving regulatory requirements, training staff, and facilitating reporting processes to regulatory bodies.

Key Differences Between Regulatory and Compliance Consulting

Regulatory consulting centers on interpreting and implementing industry-specific laws and standards imposed by governmental bodies, ensuring organizations meet legal requirements. Compliance consulting emphasizes establishing internal policies, risk management frameworks, and employee training programs to maintain adherence to these regulations consistently. The key difference lies in regulatory consulting's focus on external mandates, while compliance consulting prioritizes internal processes to sustain ongoing conformity.

Core Responsibilities of Regulatory Consultants

Regulatory consultants primarily guide organizations through complex government regulations, ensuring product approvals, licensing, and market entry align with legal standards. They conduct thorough regulatory risk assessments and develop strategic plans to navigate evolving laws across industries such as pharmaceuticals, finance, and manufacturing. Their core responsibility includes interpreting regulatory requirements and facilitating communication between clients and regulatory agencies to secure timely approvals and maintain compliance.

Essential Roles of Compliance Consultants

Compliance consultants play a critical role in helping organizations adhere to industry-specific regulations and avoid legal penalties by developing and implementing robust compliance frameworks. Their expertise includes risk assessment, internal audits, and continuous monitoring to ensure that company policies align with evolving regulatory standards. By providing tailored training and guidance, compliance consultants enhance organizational awareness and foster a culture of ethical behavior and accountability.

Impact on Business Operations: Regulatory vs Compliance Consulting

Regulatory consulting primarily focuses on helping businesses navigate and adhere to laws and regulations imposed by government agencies, minimizing legal risks and avoiding penalties. Compliance consulting ensures that internal processes, policies, and controls align with these regulations, promoting operational efficiency and reducing errors. Both types of consulting are crucial for maintaining business continuity, but regulatory consulting drives strategic alignment with evolving legal standards, while compliance consulting optimizes day-to-day adherence and risk management.

When to Engage a Regulatory Consultant

Engage a regulatory consultant when navigating complex legal frameworks, securing approvals, or interpreting evolving industry regulations to ensure accurate compliance strategies from the outset. Regulatory consultants provide specialized expertise in understanding governmental policies, product registrations, licensing requirements, and risk assessments, which is essential during product development or market entry phases. Their involvement minimizes enforcement risks and accelerates regulatory submissions, making them critical before compliance audits or regulatory reviews.

When to Choose a Compliance Consultant

Choosing a compliance consultant is essential when organizations face evolving regulatory requirements that demand strict adherence to laws and industry standards. Compliance consultants specialize in implementing policies, conducting audits, and mitigating risks to ensure ongoing conformity with specific regulations. Employing their expertise helps prevent costly penalties, enhances operational integrity, and supports sustainable business growth in highly regulated environments.

Cost Implications: Regulatory Consulting vs Compliance Consulting

Regulatory consulting often involves higher upfront costs due to the complexity of interpreting evolving laws and securing necessary approvals, which can demand specialized expertise and prolonged engagement. Compliance consulting typically incurs ongoing expenses centered on maintaining adherence to established regulations through audits, staff training, and continuous monitoring systems. Organizations must weigh the initial investment of regulatory consulting against the long-term operational costs associated with compliance consulting to optimize budget allocation effectively.

Future Trends in Regulatory and Compliance Consulting

Regulatory consulting is evolving with advancements in AI-driven risk assessment tools and blockchain technology for enhanced transparency, while compliance consulting increasingly integrates automation and real-time monitoring systems to ensure adherence to dynamic regulations. Future trends highlight the growing importance of data analytics and predictive modeling to anticipate regulatory changes and optimize compliance strategies. Firms adopting these innovations will lead in providing proactive, technology-enabled solutions tailored to complex regulatory landscapes across industries.

Regulatory Consulting vs Compliance Consulting Infographic

bizdif.com

bizdif.com