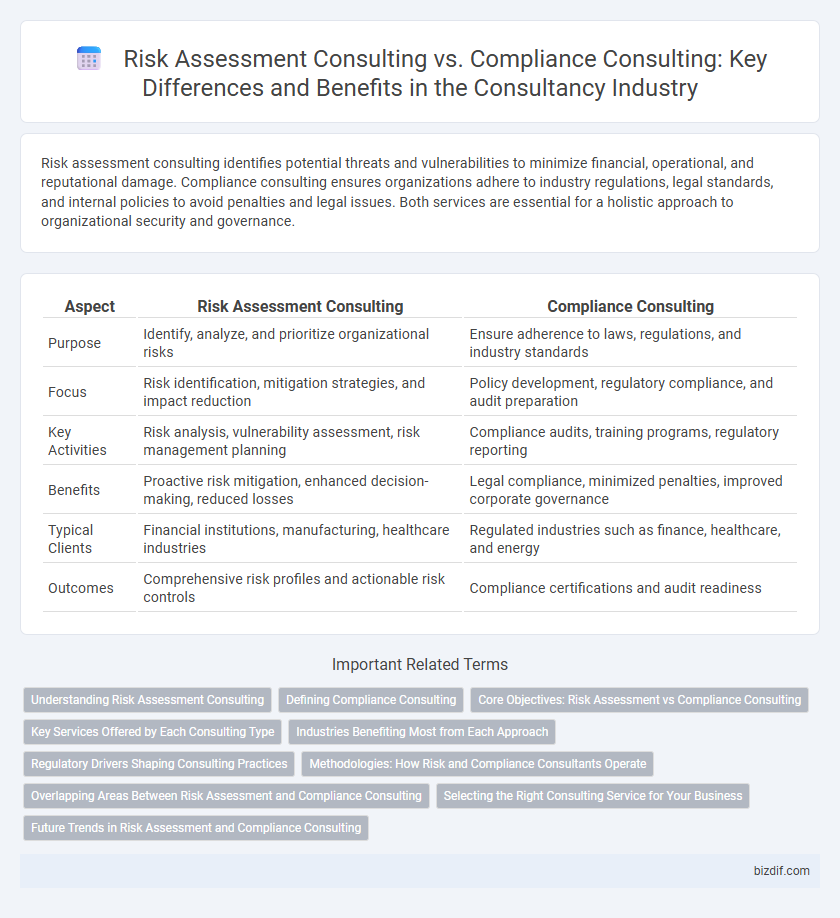

Risk assessment consulting identifies potential threats and vulnerabilities to minimize financial, operational, and reputational damage. Compliance consulting ensures organizations adhere to industry regulations, legal standards, and internal policies to avoid penalties and legal issues. Both services are essential for a holistic approach to organizational security and governance.

Table of Comparison

| Aspect | Risk Assessment Consulting | Compliance Consulting |

|---|---|---|

| Purpose | Identify, analyze, and prioritize organizational risks | Ensure adherence to laws, regulations, and industry standards |

| Focus | Risk identification, mitigation strategies, and impact reduction | Policy development, regulatory compliance, and audit preparation |

| Key Activities | Risk analysis, vulnerability assessment, risk management planning | Compliance audits, training programs, regulatory reporting |

| Benefits | Proactive risk mitigation, enhanced decision-making, reduced losses | Legal compliance, minimized penalties, improved corporate governance |

| Typical Clients | Financial institutions, manufacturing, healthcare industries | Regulated industries such as finance, healthcare, and energy |

| Outcomes | Comprehensive risk profiles and actionable risk controls | Compliance certifications and audit readiness |

Understanding Risk Assessment Consulting

Risk Assessment Consulting specializes in identifying, analyzing, and prioritizing potential risks that could impact an organization's operations, financial stability, and reputation. It involves quantitative and qualitative methodologies to evaluate threats such as cybersecurity breaches, market volatility, and regulatory changes, enabling proactive mitigation strategies. This consulting service supports decision-making by providing detailed risk profiles and scenario analyses tailored to industry-specific challenges.

Defining Compliance Consulting

Compliance consulting specializes in evaluating and ensuring that organizations adhere to industry regulations, legal standards, and internal policies to prevent legal penalties and reputational damage. It involves developing and implementing compliance programs, conducting audits, and providing training to align business operations with regulatory requirements. This form of consulting differs from risk assessment consulting, which primarily focuses on identifying, analyzing, and mitigating potential risks across various business processes.

Core Objectives: Risk Assessment vs Compliance Consulting

Risk assessment consulting primarily focuses on identifying, analyzing, and mitigating potential risks to an organization's operations, assets, and reputation, ensuring proactive management of threats. Compliance consulting concentrates on ensuring that a company adheres to relevant laws, regulations, and industry standards to avoid legal penalties and maintain operational integrity. Both services aim to protect the organization but differ in scope, with risk assessment targeting internal vulnerabilities and compliance consulting addressing external regulatory requirements.

Key Services Offered by Each Consulting Type

Risk assessment consulting specializes in identifying, analyzing, and mitigating potential threats to an organization's assets and operations through thorough risk evaluations and scenario planning. Compliance consulting focuses on guiding businesses to adhere to relevant laws, regulations, and industry standards by developing policies, conducting audits, and offering training programs. Both consulting types deliver tailored strategies to strengthen organizational resilience and ensure regulatory alignment.

Industries Benefiting Most from Each Approach

Risk Assessment Consulting primarily benefits industries with high operational hazards such as oil and gas, construction, and manufacturing, where identifying and mitigating potential risks is crucial to preventing accidents and financial losses. Compliance Consulting is essential for heavily regulated sectors including healthcare, finance, and pharmaceuticals, ensuring companies meet legal standards and avoid costly penalties. Both consulting approaches drive industry-specific strategies to enhance safety, regulatory adherence, and overall business resilience.

Regulatory Drivers Shaping Consulting Practices

Regulatory drivers such as GDPR, HIPAA, and SOX significantly shape risk assessment consulting by emphasizing the identification and mitigation of data breaches and operational vulnerabilities. Compliance consulting is driven by industry-specific regulations like PCI DSS, FDA guidelines, and AML laws, focusing on ensuring organizational adherence and avoiding legal penalties. Both consulting practices integrate regulatory mandates to enhance governance frameworks and support sustainable business operations.

Methodologies: How Risk and Compliance Consultants Operate

Risk assessment consulting employs quantitative and qualitative methodologies such as risk identification, analysis, and mitigation strategies to prioritize threats based on their potential impact and likelihood. Compliance consulting focuses on ensuring adherence to regulatory frameworks by conducting compliance audits, gap analyses, and developing policies to meet legal requirements. Both consulting types utilize data-driven evaluations but differentiate in their approach: risk consultants proactively forecast potential issues, while compliance consultants verify conformity with established standards.

Overlapping Areas Between Risk Assessment and Compliance Consulting

Risk assessment consulting and compliance consulting both prioritize identifying potential threats and ensuring adherence to legal and regulatory requirements, making their overlapping areas crucial for comprehensive organizational security. Both fields involve analyzing internal controls, evaluating operational risks, and advising on mitigation strategies to prevent violations and minimize financial or reputational damage. This synergy enhances proactive risk management by aligning compliance frameworks with the organization's risk tolerance and regulatory landscape.

Selecting the Right Consulting Service for Your Business

Risk assessment consulting specializes in identifying, analyzing, and mitigating potential threats that could impact your business operations and financial stability. Compliance consulting ensures your company adheres to industry regulations, legal standards, and internal policies to avoid penalties and reputational damage. Selecting the right consulting service depends on whether your primary goal is to proactively manage uncertainties or to maintain regulatory conformity, aligning with your business priorities and risk tolerance.

Future Trends in Risk Assessment and Compliance Consulting

Future trends in risk assessment consulting emphasize the integration of artificial intelligence and machine learning to predict and mitigate emerging threats with greater accuracy. Compliance consulting is increasingly adopting blockchain technology and real-time data analytics to ensure regulatory adherence across global markets. Both sectors are moving towards automated, continuous monitoring tools that enhance proactive risk management and adaptive compliance frameworks.

Risk Assessment Consulting vs Compliance Consulting Infographic

bizdif.com

bizdif.com