Cash payments offer immediate and tangible transactions for daycare services but can pose risks such as loss or theft and complicate record-keeping. Electronic payments provide secure, traceable, and convenient options for both parents and daycare centers, enhancing financial management and reducing the likelihood of errors. Choosing between cash and electronic methods depends on factors like accessibility, preference, and the importance of streamlined accounting.

Table of Comparison

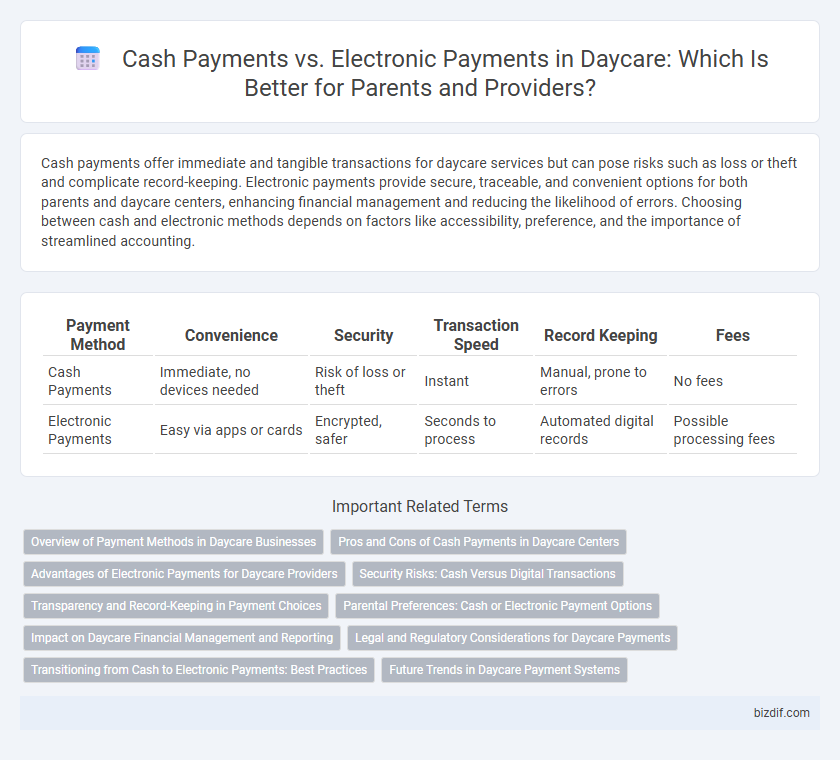

| Payment Method | Convenience | Security | Transaction Speed | Record Keeping | Fees |

|---|---|---|---|---|---|

| Cash Payments | Immediate, no devices needed | Risk of loss or theft | Instant | Manual, prone to errors | No fees |

| Electronic Payments | Easy via apps or cards | Encrypted, safer | Seconds to process | Automated digital records | Possible processing fees |

Overview of Payment Methods in Daycare Businesses

Daycare businesses commonly accept both cash payments and electronic payments, each offering distinct advantages. Cash payments provide immediate liquidity and simplicity for in-person transactions, while electronic payments enable secure, traceable, and convenient processing through credit cards, bank transfers, and mobile payment platforms. Integrating multiple payment methods enhances operational efficiency, reduces administrative errors, and improves parent satisfaction in daycare services.

Pros and Cons of Cash Payments in Daycare Centers

Cash payments in daycare centers offer immediate transaction confirmation and do not require technological infrastructure, benefiting families without access to electronic banking. However, cash handling poses risks such as theft, mismanagement, and increased administrative workload for staff, reducing operational efficiency. The lack of digital records complicates financial tracking and reporting, potentially impacting transparency and audit processes.

Advantages of Electronic Payments for Daycare Providers

Electronic payments streamline billing processes for daycare providers by reducing manual errors and accelerating payment collection, leading to improved cash flow management. These transactions offer enhanced security features that minimize risks of theft or loss compared to cash handling. Integration with accounting software allows daycare centers to efficiently track revenue and generate financial reports, optimizing operational efficiency.

Security Risks: Cash Versus Digital Transactions

Cash payments at daycare centers carry heightened security risks including theft, loss, and counterfeit currency acceptance, which can result in financial discrepancies. Electronic payments leverage encryption and secure authentication protocols, significantly reducing the likelihood of fraud and unauthorized access to funds. Digital transactions also offer traceability and audit trails, improving transparency and accountability in financial management compared to cash handling.

Transparency and Record-Keeping in Payment Choices

Cash payments in daycare settings often lack detailed documentation, making it challenging to maintain transparent financial records and track payment histories accurately. Electronic payments provide automated receipts and digital records, enhancing transparency and simplifying bookkeeping for daycare providers. Utilizing electronic payment systems minimizes errors and supports compliance with regulatory requirements through accessible, verifiable transaction data.

Parental Preferences: Cash or Electronic Payment Options

Parental preferences for daycare payments reveal a growing inclination toward electronic payment options due to their convenience, safety, and record-keeping advantages. Cash payments, while still favored by some for immediate transactions and simplicity, are declining as more parents opt for digital methods such as credit cards, bank transfers, and mobile payment apps. Daycare centers offering flexible electronic payment solutions often see higher satisfaction and timely fee submissions from parents.

Impact on Daycare Financial Management and Reporting

Cash payments in daycare settings create challenges for financial management and reporting due to the increased risk of errors, misplacement, and difficulties in tracking daily transactions. Electronic payments streamline record-keeping by providing automated, accurate, and real-time transaction data that improve transparency and simplify reconciliation processes. The integration of electronic payment systems enhances financial reporting accuracy, reduces administrative workload, and supports compliance with regulatory requirements in daycare operations.

Legal and Regulatory Considerations for Daycare Payments

Daycare providers must comply with legal regulations such as record-keeping and tax reporting when accepting cash payments, ensuring all transactions are properly documented to avoid penalties. Electronic payments offer enhanced transparency and traceability, simplifying compliance with anti-money laundering laws and financial audits mandated by federal and state authorities. Payment platforms must adhere to data protection laws like the Payment Card Industry Data Security Standard (PCI DSS) to secure sensitive client information during electronic transactions.

Transitioning from Cash to Electronic Payments: Best Practices

Transitioning from cash to electronic payments in daycare centers enhances transaction security and streamlines record-keeping by reducing manual errors. Implementing user-friendly digital payment platforms and providing clear communication to parents about the benefits and procedures can increase adoption rates. Training staff on managing electronic systems ensures smooth daily operations and maintains financial transparency.

Future Trends in Daycare Payment Systems

Future trends in daycare payment systems indicate a shift towards electronic payments, driven by increased adoption of mobile wallets, contactless cards, and online portals that enhance convenience and security for parents. Cash payments are expected to decline as digital platforms offer real-time transaction tracking, automated billing, and integration with daycare management software. Embracing electronic payment solutions supports operational efficiency, reduces errors, and aligns with growing preferences for seamless, paperless financial interactions in childcare services.

Cash payments vs electronic payments Infographic

bizdif.com

bizdif.com