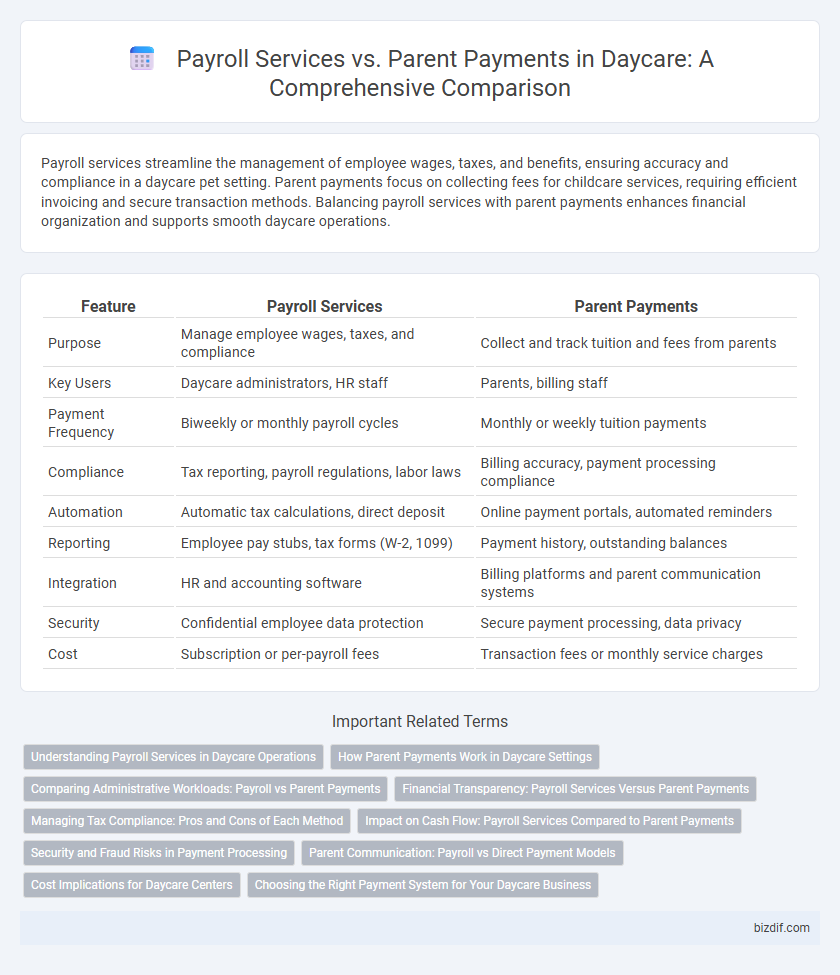

Payroll services streamline the management of employee wages, taxes, and benefits, ensuring accuracy and compliance in a daycare pet setting. Parent payments focus on collecting fees for childcare services, requiring efficient invoicing and secure transaction methods. Balancing payroll services with parent payments enhances financial organization and supports smooth daycare operations.

Table of Comparison

| Feature | Payroll Services | Parent Payments |

|---|---|---|

| Purpose | Manage employee wages, taxes, and compliance | Collect and track tuition and fees from parents |

| Key Users | Daycare administrators, HR staff | Parents, billing staff |

| Payment Frequency | Biweekly or monthly payroll cycles | Monthly or weekly tuition payments |

| Compliance | Tax reporting, payroll regulations, labor laws | Billing accuracy, payment processing compliance |

| Automation | Automatic tax calculations, direct deposit | Online payment portals, automated reminders |

| Reporting | Employee pay stubs, tax forms (W-2, 1099) | Payment history, outstanding balances |

| Integration | HR and accounting software | Billing platforms and parent communication systems |

| Security | Confidential employee data protection | Secure payment processing, data privacy |

| Cost | Subscription or per-payroll fees | Transaction fees or monthly service charges |

Understanding Payroll Services in Daycare Operations

Payroll services in daycare operations streamline employee salary management, tax withholdings, and compliance with labor laws, ensuring accurate and timely compensation for staff. These services reduce administrative burden by automating payroll calculations and reporting, allowing daycare providers to focus on quality care rather than financial management. Effective payroll management supports staff retention and operational efficiency, directly impacting the overall success of the daycare business.

How Parent Payments Work in Daycare Settings

Parent payments in daycare settings are typically processed through secure online portals or mobile apps, allowing families to make tuition and fee payments directly according to their schedule. Payment options often include credit/debit cards, bank transfers, or automatic withdrawals, providing flexibility and convenience for timely fee collection. This system enhances transparency by enabling parents to view invoices, track payment history, and receive automatic reminders, streamlining the overall financial administration in daycare centers.

Comparing Administrative Workloads: Payroll vs Parent Payments

Payroll services streamline childcare staff salary management by automating tax calculations, direct deposits, and compliance reporting, significantly reducing administrative hours. Parent payments require tracking individual accounts, processing varied payment methods, and managing invoicing, which often involves more manual oversight and reconciliation. Comparing these workloads, payroll services typically offer higher efficiency gains, while parent payments demand consistent, detailed attention to maintain accurate financial records.

Financial Transparency: Payroll Services Versus Parent Payments

Payroll services offer daycare centers detailed records of staff wages, taxes, and deductions, ensuring clear financial transparency for internal accounting. Parent payments provide direct revenue tracking, enabling accurate monitoring of tuition fees, discounts, and payment histories to maintain trust and clarity with families. Combining both systems enhances overall financial transparency by reconciling employee compensation with revenue streams.

Managing Tax Compliance: Pros and Cons of Each Method

Payroll services streamline tax compliance by automatically calculating withholdings, filing necessary forms, and ensuring adherence to federal and state regulations, reducing errors and audit risks. Parent payments require daycare providers to manually track income and taxes, increasing the chance of misreporting and non-compliance but offer more direct control over cash flow. Employing payroll services typically improves accuracy and legal compliance, while relying solely on parent payments demands rigorous accounting efforts to meet tax obligations.

Impact on Cash Flow: Payroll Services Compared to Parent Payments

Payroll services offer predictable and timely salary disbursements, stabilizing daycare centers' cash flow by ensuring employee payments are systematically managed. In contrast, parent payments can fluctuate due to delayed or inconsistent tuition fees, potentially causing cash flow gaps that disrupt operational expenses. Efficient payroll management mitigates the risk of cash shortages, while relying solely on parent payments requires robust collection strategies to maintain financial stability.

Security and Fraud Risks in Payment Processing

Payroll services in daycare centers employ advanced encryption and compliance protocols to safeguard sensitive employee financial data, significantly reducing the risk of fraud. Parent payment processing platforms also integrate secure authentication measures, yet they face higher exposure to fraud due to frequent transactions and varying payment methods. Implementing tokenization and multi-factor authentication enhances security, minimizing vulnerabilities in both payroll and parent payment systems.

Parent Communication: Payroll vs Direct Payment Models

Effective parent communication in daycare settings varies significantly between payroll services and direct payment models. Payroll services simplify billing by automating invoicing and payment tracking, reducing errors and enhancing transparency for parents through detailed statements and digital access. Direct payment models require proactive communication from daycare providers to clarify payment deadlines and methods, which fosters stronger parent engagement but demands consistent administrative effort.

Cost Implications for Daycare Centers

Payroll services for daycare centers involve fixed monthly fees and can streamline employee wage management, reducing administrative costs and errors. Parent payments, dependent on enrollment and attendance, provide variable revenue but may lead to cash flow inconsistencies impacting operational budgeting. Evaluating cost implications reveals that while payroll services optimize internal expenses, reliance on timely parent payments is crucial for maintaining financial stability in daycare operations.

Choosing the Right Payment System for Your Daycare Business

Selecting the right payment system for your daycare business involves comparing payroll services and parent payments to streamline financial management and enhance operational efficiency. Payroll services offer automated employee wage calculations, tax filings, and compliance tracking, reducing administrative burden and minimizing errors. Parent payment platforms provide flexible invoicing, multiple payment methods, and timely reminders, ensuring consistent cash flow and improving parent satisfaction.

Payroll Services vs Parent Payments Infographic

bizdif.com

bizdif.com