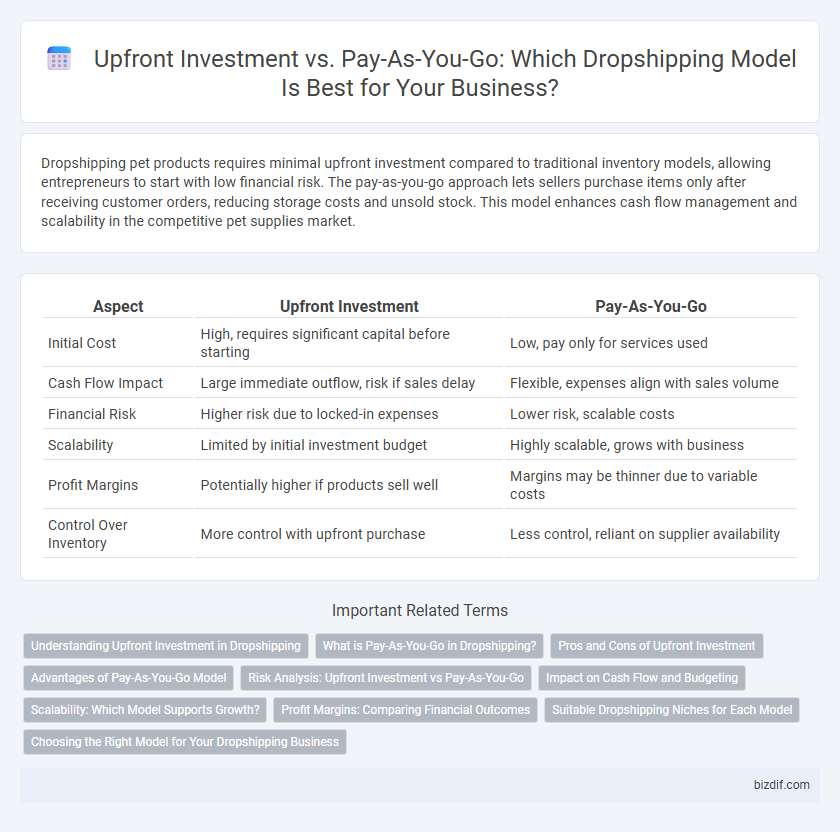

Dropshipping pet products requires minimal upfront investment compared to traditional inventory models, allowing entrepreneurs to start with low financial risk. The pay-as-you-go approach lets sellers purchase items only after receiving customer orders, reducing storage costs and unsold stock. This model enhances cash flow management and scalability in the competitive pet supplies market.

Table of Comparison

| Aspect | Upfront Investment | Pay-As-You-Go |

|---|---|---|

| Initial Cost | High, requires significant capital before starting | Low, pay only for services used |

| Cash Flow Impact | Large immediate outflow, risk if sales delay | Flexible, expenses align with sales volume |

| Financial Risk | Higher risk due to locked-in expenses | Lower risk, scalable costs |

| Scalability | Limited by initial investment budget | Highly scalable, grows with business |

| Profit Margins | Potentially higher if products sell well | Margins may be thinner due to variable costs |

| Control Over Inventory | More control with upfront purchase | Less control, reliant on supplier availability |

Understanding Upfront Investment in Dropshipping

Upfront investment in dropshipping primarily involves costs such as purchasing initial inventory, website development, and marketing expenses to establish a brand presence. Unlike pay-as-you-go models, upfront investments require capital before generating sales, affecting cash flow and risk management. Understanding these costs helps entrepreneurs strategize budget allocation and forecast break-even points more accurately.

What is Pay-As-You-Go in Dropshipping?

Pay-as-you-go in dropshipping refers to a payment model where sellers incur costs only when a sale is made, eliminating the need for upfront inventory investment. This approach minimizes financial risk by allowing dropshippers to purchase products from suppliers after customers place orders. It offers flexibility and scalability, enabling entrepreneurs to test products and markets without significant initial capital.

Pros and Cons of Upfront Investment

Upfront investment in dropshipping offers control over inventory quality and potential cost savings through bulk purchasing but requires significant initial capital and carries the risk of unsold stock. This approach enables better brand customization and faster shipping times due to in-house stock management, boosting customer satisfaction. However, the financial commitment can strain cash flow and limit flexibility compared to pay-as-you-go models that reduce upfront costs.

Advantages of Pay-As-You-Go Model

The pay-as-you-go model in dropshipping eliminates the need for significant upfront investment, reducing financial risk and allowing entrepreneurs to start with minimal capital. This approach offers greater scalability, as costs directly align with sales volume, enabling flexible budget management. It supports cash flow optimization by only incurring expenses when orders are placed, improving overall business sustainability.

Risk Analysis: Upfront Investment vs Pay-As-You-Go

Upfront investment in dropshipping typically involves purchasing inventory and setting up infrastructure, leading to higher financial risk but potentially greater control over margins. In contrast, the pay-as-you-go model minimizes initial costs by only paying for products after a sale, reducing financial exposure and cash flow pressure. Evaluating these approaches requires balancing risk tolerance with scalability goals to optimize profit potential in a dynamic market.

Impact on Cash Flow and Budgeting

Upfront investment in dropshipping requires allocating capital for inventory and platform costs, which can strain cash flow but provides predictable budgeting. Pay-as-you-go models minimize initial expenses and improve cash flow flexibility by paying only for fulfilled orders but may result in variable monthly costs, complicating budget forecasts. Evaluating cash flow impact and budgeting preferences is essential for selecting the optimal financial approach in dropshipping operations.

Scalability: Which Model Supports Growth?

Upfront investment in dropshipping involves higher initial costs for inventory and platform setup, which can create barriers to rapid scaling but offers greater control over product quality and branding. Pay-as-you-go models enable scalable growth by minimizing financial risk and allowing merchants to test markets with low upfront costs, though they may face higher per-unit expenses and limited customization. Choosing the optimal model depends on the entrepreneur's budget flexibility, risk tolerance, and long-term growth strategy in the dropshipping business.

Profit Margins: Comparing Financial Outcomes

Dropshipping requires minimal upfront investment compared to traditional retail, reducing initial financial risk and allowing faster market entry. Pay-as-you-go models align expenses directly with sales volume, optimizing cash flow and minimizing inventory holding costs. Higher profit margins often result from managing operational costs dynamically, making pay-as-you-go preferable for scalable dropshipping businesses.

Suitable Dropshipping Niches for Each Model

Low upfront investment suits niches like fashion accessories and digital products, appealing to entrepreneurs seeking minimal initial costs. Pay-as-you-go models fit high-ticket items such as electronics or home appliances, enabling gradual cash flow management aligned with customer orders. Choosing the right financing approach depends on niche profit margins, order frequency, and inventory risk tolerance.

Choosing the Right Model for Your Dropshipping Business

Selecting the ideal payment model for your dropshipping business hinges on balancing upfront investment against pay-as-you-go costs to maximize profitability and cash flow. Upfront investment often includes website setup, inventory samples, and marketing expenses, which can create a strong foundation but require significant capital. Pay-as-you-go models minimize initial risks by aligning costs with sales volume, making them suitable for entrepreneurs seeking flexibility and scalability.

Upfront investment vs pay-as-you-go Infographic

bizdif.com

bizdif.com