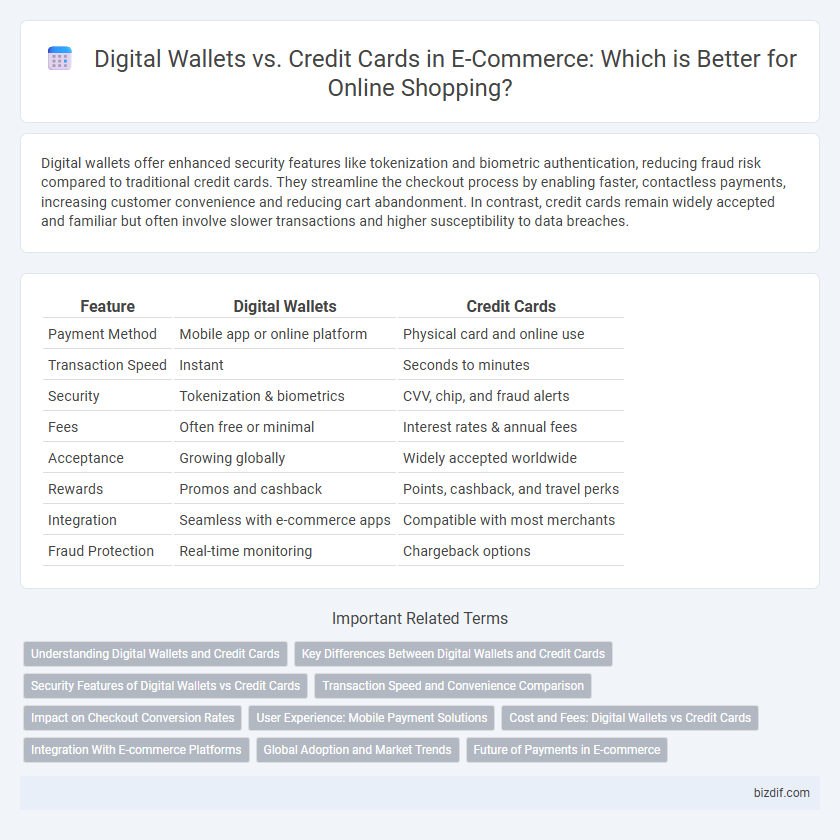

Digital wallets offer enhanced security features like tokenization and biometric authentication, reducing fraud risk compared to traditional credit cards. They streamline the checkout process by enabling faster, contactless payments, increasing customer convenience and reducing cart abandonment. In contrast, credit cards remain widely accepted and familiar but often involve slower transactions and higher susceptibility to data breaches.

Table of Comparison

| Feature | Digital Wallets | Credit Cards |

|---|---|---|

| Payment Method | Mobile app or online platform | Physical card and online use |

| Transaction Speed | Instant | Seconds to minutes |

| Security | Tokenization & biometrics | CVV, chip, and fraud alerts |

| Fees | Often free or minimal | Interest rates & annual fees |

| Acceptance | Growing globally | Widely accepted worldwide |

| Rewards | Promos and cashback | Points, cashback, and travel perks |

| Integration | Seamless with e-commerce apps | Compatible with most merchants |

| Fraud Protection | Real-time monitoring | Chargeback options |

Understanding Digital Wallets and Credit Cards

Digital wallets store payment information securely on smartphones, enabling fast, contactless transactions through technologies like NFC or QR codes. Credit cards, issued by banks or financial institutions, allow consumers to borrow funds up to a credit limit for purchases, with benefits such as rewards programs and fraud protection. Understanding the security features, user convenience, and acceptance networks of both payment methods helps consumers choose the optimal option for their e-commerce transactions.

Key Differences Between Digital Wallets and Credit Cards

Digital wallets store multiple payment methods securely on a mobile device, enabling contactless transactions and faster checkouts, while credit cards are physical cards linked directly to a bank account or credit line. Digital wallets offer enhanced security features such as tokenization and biometric authentication, reducing fraud risks compared to traditional credit cards. Unlike credit cards that require swiping or physical insertion, digital wallets facilitate seamless online and in-store payments through QR codes or NFC technology.

Security Features of Digital Wallets vs Credit Cards

Digital wallets employ advanced encryption, tokenization, and biometric authentication to provide enhanced security compared to traditional credit cards, which rely primarily on static CVV codes and magnetic stripes vulnerable to skimming. Features like two-factor authentication and real-time transaction alerts in digital wallets help prevent unauthorized access and fraud more effectively. Unlike credit cards, digital wallets reduce exposure of sensitive card details by using virtual card numbers during transactions, minimizing the risk of data breaches.

Transaction Speed and Convenience Comparison

Digital wallets process payments instantly through near-field communication (NFC) or QR codes, significantly reducing checkout time compared to traditional credit card transactions that often require manual entry and PIN verification. The convenience of stored multiple payment methods and biometric authentication in digital wallets enhances user experience by enabling faster, contactless payments. Credit cards, while widely accepted, typically involve slower transactional steps and pose higher risks of card skimming or physical theft.

Impact on Checkout Conversion Rates

Digital wallets dramatically increase checkout conversion rates by streamlining payment processes and reducing friction through one-tap payments and secure tokenization. Credit cards, while widely accepted, often involve manual entry of details, leading to cart abandonment due to longer transaction times and security concerns. Studies indicate that integrating digital wallets can boost conversion rates by up to 30%, making them a crucial tool for e-commerce platforms aiming to enhance user experience and sales.

User Experience: Mobile Payment Solutions

Digital wallets offer streamlined mobile payment solutions with faster transaction speeds and enhanced security features like biometric authentication, improving overall user experience. Credit cards, while widely accepted, often require manual input and physical swiping, leading to slower and less convenient payments on mobile platforms. Integration of digital wallets in e-commerce apps significantly reduces checkout friction and increases conversion rates by simplifying the payment process.

Cost and Fees: Digital Wallets vs Credit Cards

Digital wallets typically offer lower transaction fees than credit cards, reducing costs for both merchants and consumers. Credit cards often impose higher interchange fees and additional charges, increasing overall expense during purchases. Choosing digital wallets can result in more cost-efficient payment processing and savings on fees compared to traditional credit card usage.

Integration With E-commerce Platforms

Digital wallets like Apple Pay, Google Pay, and PayPal offer seamless integration with major e-commerce platforms such as Shopify, WooCommerce, and Magento, enabling faster checkout experiences and reduced cart abandonment rates. Credit cards remain widely accepted but require more manual data entry, which can slow down the purchase process and increase friction for mobile users. E-commerce businesses leveraging digital wallets benefit from enhanced security features like tokenization and biometric authentication, improving customer trust and conversion rates.

Global Adoption and Market Trends

Digital wallets have surged globally, with a compound annual growth rate (CAGR) exceeding 17%, driven by mobile penetration and demand for contactless payments. Credit cards remain dominant in North America and Europe, yet markets in Asia-Pacific exhibit stronger preferences for digital wallets due to convenience and enhanced security features. Market trends indicate a shift towards integrated payment ecosystems, where digital wallets leverage blockchain and AI technologies to outperform traditional credit card usage.

Future of Payments in E-commerce

Digital wallets are revolutionizing e-commerce by offering faster, more secure, and contactless payment methods compared to traditional credit cards, enhancing customer experience and reducing fraud risks. Emerging technologies like biometric authentication and blockchain integration are further driving the adoption of digital wallets in online transactions. The future of payments in e-commerce will increasingly prioritize seamless mobile integration and personalized, data-driven payment solutions, positioning digital wallets as the dominant choice over credit cards.

Digital Wallets vs Credit Cards Infographic

bizdif.com

bizdif.com