Event budgeting establishes a fixed financial plan by allocating specific amounts to various components such as venue, catering, and entertainment, ensuring expenses stay within a predetermined limit. Cost forecasting analyzes potential future expenses and revenue trends based on current data and market conditions, allowing planners to anticipate financial needs and adjust strategies proactively. Combining event budgeting with cost forecasting enhances financial control and improves decision-making accuracy throughout the event planning process.

Table of Comparison

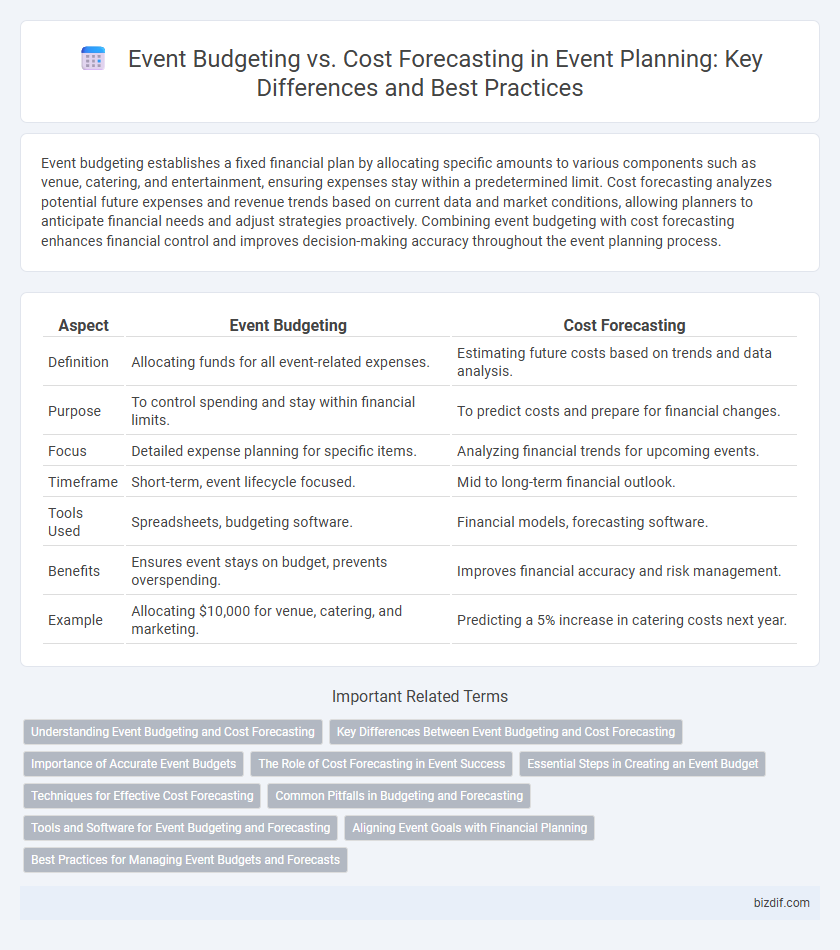

| Aspect | Event Budgeting | Cost Forecasting |

|---|---|---|

| Definition | Allocating funds for all event-related expenses. | Estimating future costs based on trends and data analysis. |

| Purpose | To control spending and stay within financial limits. | To predict costs and prepare for financial changes. |

| Focus | Detailed expense planning for specific items. | Analyzing financial trends for upcoming events. |

| Timeframe | Short-term, event lifecycle focused. | Mid to long-term financial outlook. |

| Tools Used | Spreadsheets, budgeting software. | Financial models, forecasting software. |

| Benefits | Ensures event stays on budget, prevents overspending. | Improves financial accuracy and risk management. |

| Example | Allocating $10,000 for venue, catering, and marketing. | Predicting a 5% increase in catering costs next year. |

Understanding Event Budgeting and Cost Forecasting

Event budgeting involves allocating specific financial resources to various components of an event, ensuring that expenses do not exceed the planned budget, while cost forecasting predicts future expenditures based on current data and market trends to manage financial risks effectively. Understanding the distinction enables event planners to create realistic budgets, monitor spending, and adjust forecasts promptly to accommodate changes or unforeseen costs. Employing tools like historical cost data, vendor quotes, and contingency planning enhances accuracy in budgeting and forecasting for successful event execution.

Key Differences Between Event Budgeting and Cost Forecasting

Event budgeting involves establishing a detailed financial plan that allocates funds across various event components, ensuring expenses do not exceed the set limits. Cost forecasting predicts potential future expenses based on current data and trends, enabling proactive adjustments to minimize financial risks. The key difference lies in budgeting setting fixed spending limits, while forecasting offers dynamic predictions to guide decision-making throughout the event lifecycle.

Importance of Accurate Event Budgets

Accurate event budgets are essential for effective cost control and resource allocation, enabling planners to anticipate expenses and avoid unexpected financial shortfalls. Precise budgeting supports better decision-making by providing a clear financial framework, ensuring all event elements--from venue and catering to marketing--are realistically funded. Reliable cost forecasting relies on these budgets to project future expenditures and optimize overall event profitability.

The Role of Cost Forecasting in Event Success

Cost forecasting plays a crucial role in event success by providing accurate predictions of future expenses, enabling planners to allocate resources effectively and avoid budget overruns. Unlike static event budgeting, which outlines fixed expenditures, cost forecasting continuously updates estimates based on real-time data and market trends, improving financial decision-making. This proactive approach helps ensure event objectives are met while maintaining financial control and maximizing return on investment.

Essential Steps in Creating an Event Budget

Effective event budgeting requires identifying all potential expenses, including venue, catering, entertainment, and marketing costs, to ensure comprehensive financial planning. Estimating realistic costs based on vendor quotes and historical data helps create a detailed budget framework that aligns with event goals. Tracking actual expenditures against the forecasted budget throughout the planning process enables timely adjustments and prevents overspending.

Techniques for Effective Cost Forecasting

Effective cost forecasting in event planning utilizes techniques such as historical data analysis, vendor quotes aggregation, and contingency allowance calculations to predict expenses accurately. Leveraging forecasting software and spreadsheets enables planners to model various budget scenarios and adjust allocations proactively. Implementing regular budget reviews and real-time expense tracking ensures alignment with financial objectives and minimizes unforeseen overruns.

Common Pitfalls in Budgeting and Forecasting

Event budgeting often suffers from underestimating hidden costs such as venue fees, permits, and contingency expenses, leading to inaccurate financial planning. Cost forecasting commonly overlooks market fluctuations and vendor price changes, resulting in budget overruns. Failure to incorporate realistic revenue projections and unexpected expenditures creates significant gaps between budgeted and actual event costs.

Tools and Software for Event Budgeting and Forecasting

Event budgeting relies on tools like Excel, specialized software such as Cvent and Eventbrite, and budget templates designed to track expenses and allocate funds efficiently. Cost forecasting employs advanced platforms like Float and Adaptive Insights, which leverage predictive analytics to estimate future expenditures and adjust budgets dynamically. Integrating these software solutions enhances accuracy and streamlines financial management throughout the event planning process.

Aligning Event Goals with Financial Planning

Event budgeting involves setting a detailed financial plan that allocates resources according to specific event goals, ensuring expenditures align with the intended outcomes. Cost forecasting predicts potential expenses and revenue inflows based on market trends and historical data to avoid overspending and maximize ROI. Aligning event goals with financial planning improves resource management, enhances decision-making accuracy, and supports achieving strategic objectives within budget constraints.

Best Practices for Managing Event Budgets and Forecasts

Effective event budgeting requires detailed tracking of all anticipated expenses, including venue, catering, and marketing costs, to establish a realistic financial plan. Best practices involve regularly updating cost forecasts based on vendor quotes and historical data, allowing for timely adjustments to avoid overspending. Utilizing software tools for budget management enhances accuracy, transparency, and facilitates seamless communication across event teams.

Event budgeting vs cost forecasting Infographic

bizdif.com

bizdif.com