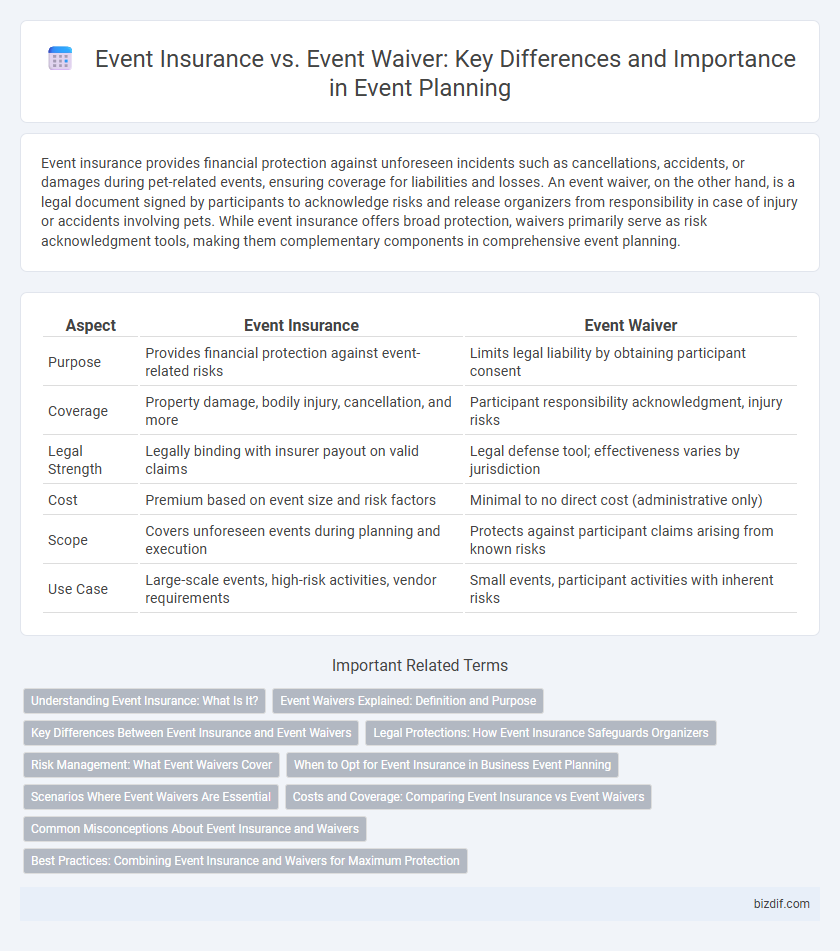

Event insurance provides financial protection against unforeseen incidents such as cancellations, accidents, or damages during pet-related events, ensuring coverage for liabilities and losses. An event waiver, on the other hand, is a legal document signed by participants to acknowledge risks and release organizers from responsibility in case of injury or accidents involving pets. While event insurance offers broad protection, waivers primarily serve as risk acknowledgment tools, making them complementary components in comprehensive event planning.

Table of Comparison

| Aspect | Event Insurance | Event Waiver |

|---|---|---|

| Purpose | Provides financial protection against event-related risks | Limits legal liability by obtaining participant consent |

| Coverage | Property damage, bodily injury, cancellation, and more | Participant responsibility acknowledgment, injury risks |

| Legal Strength | Legally binding with insurer payout on valid claims | Legal defense tool; effectiveness varies by jurisdiction |

| Cost | Premium based on event size and risk factors | Minimal to no direct cost (administrative only) |

| Scope | Covers unforeseen events during planning and execution | Protects against participant claims arising from known risks |

| Use Case | Large-scale events, high-risk activities, vendor requirements | Small events, participant activities with inherent risks |

Understanding Event Insurance: What Is It?

Event insurance provides financial protection against unforeseen incidents such as cancellations, property damage, or liability claims during an event. It covers costs related to accidents, injuries, or weather disruptions, ensuring the organizer is not personally liable for losses. Unlike event waivers, which require participants to relinquish legal claims, event insurance offers comprehensive risk management by transferring potential financial burdens to the insurer.

Event Waivers Explained: Definition and Purpose

Event waivers are legal documents signed by participants to release event organizers from liability for potential injuries or damages during the event. These waivers serve to protect organizers by ensuring that attendees acknowledge and accept the inherent risks involved. Unlike event insurance, which provides financial coverage, waivers primarily function as risk management tools to limit legal claims.

Key Differences Between Event Insurance and Event Waivers

Event insurance provides financial protection against unforeseen incidents such as property damage, cancellations, or injuries during the event, covering liabilities that may arise. Event waivers, on the other hand, are legal documents signed by participants to acknowledge risks and waive the organizer's liability for personal injury or damages. The key difference lies in event insurance transferring financial risk to the insurer, while waivers aim to limit the organizer's legal responsibility through participant consent.

Legal Protections: How Event Insurance Safeguards Organizers

Event insurance provides legal protection by covering liabilities such as property damage, bodily injury, and cancellation costs, safeguarding organizers against financial loss. Unlike event waivers, which attempt to limit participant claims but may not hold up in court, event insurance offers enforceable risk management and peace of mind. This coverage ensures that organizers can handle unforeseen incidents without facing legal or out-of-pocket expenses.

Risk Management: What Event Waivers Cover

Event waivers primarily cover participant assumptions of risk, protecting organizers from liability related to injuries or damages during the event. These legal documents specify the types of risks participants accept, limiting claims based on negligence or accidental harm. While waivers reduce exposure to lawsuits, they do not provide financial coverage for property damage or third-party claims, which event insurance typically addresses.

When to Opt for Event Insurance in Business Event Planning

Event insurance is essential for business event planning when there is a significant financial risk involving property damage, cancellation, or liability claims, ensuring comprehensive protection against unforeseen incidents. Opt for event insurance to safeguard large-scale conferences, trade shows, or corporate gatherings where attendee safety and contract obligations are critical. Unlike event waivers, which primarily limit individual liability, event insurance provides broader coverage that protects the organizer's financial interests and reputation.

Scenarios Where Event Waivers Are Essential

Event waivers are essential in scenarios where participants engage in physical activities or high-risk environments, such as sports tournaments, adventure races, or festivals with interactive attractions. These waivers legally protect organizers by having attendees acknowledge and assume potential risks, reducing liability for injuries or accidents. In contrast, event insurance covers broader financial risks but does not replace the need for waivers in situations requiring explicit participant consent to risk exposure.

Costs and Coverage: Comparing Event Insurance vs Event Waivers

Event insurance typically involves upfront costs but provides comprehensive coverage for liabilities, property damage, and cancellations, reducing financial risk substantially. Event waivers are low-cost tools that shift responsibility to participants but offer limited protection against third-party claims or unforeseen expenses. Comparing these options, event insurance ensures broader financial safety, whereas waivers primarily minimize direct participant liability without covering wider event risks.

Common Misconceptions About Event Insurance and Waivers

Many event organizers mistakenly believe that event waivers fully protect against liability, but waivers primarily limit claims related to participant negligence rather than covering third-party damages or property loss. Event insurance provides comprehensive protection, including liability, cancellation, and property damage, which waivers do not address. Understanding that insurance and waivers serve different legal and financial purposes is essential for effective risk management in event planning.

Best Practices: Combining Event Insurance and Waivers for Maximum Protection

Combining event insurance and waivers offers comprehensive risk management by addressing both financial liability and participant acknowledgment of hazards. Event insurance covers unforeseen incidents such as property damage or bodily injury, while waivers legally bind attendees to accept certain risks, reducing potential litigation. Best practices include clearly communicating waiver terms to participants and selecting insurance policies tailored to the event type and scope for maximum protection.

Event insurance vs Event waiver Infographic

bizdif.com

bizdif.com