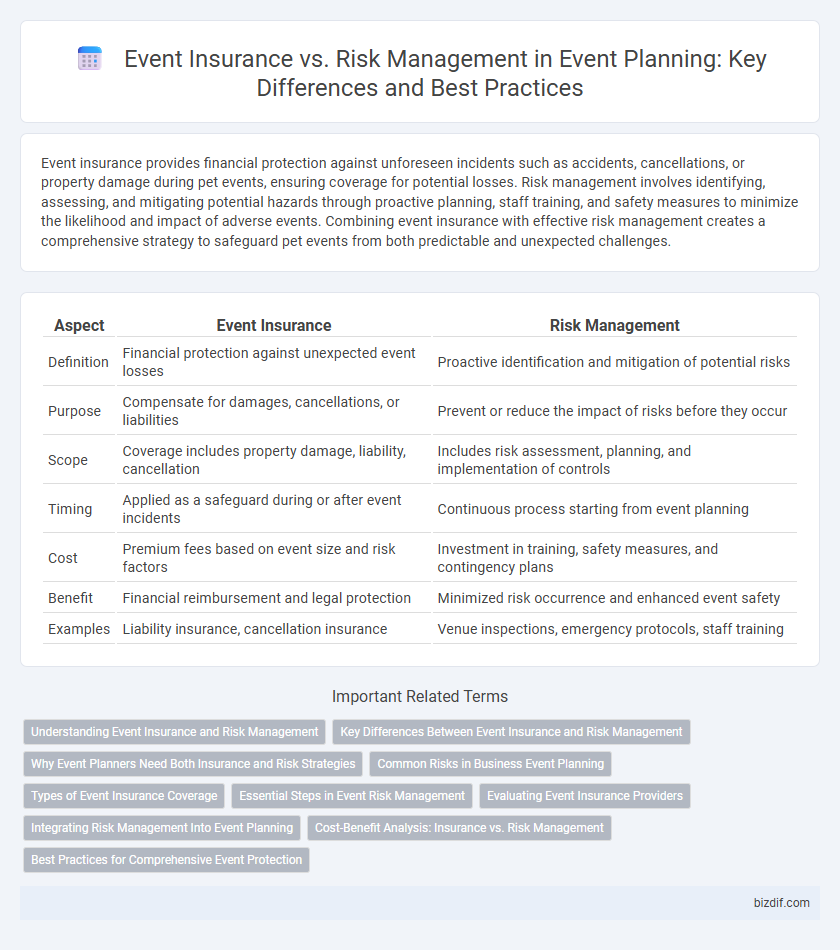

Event insurance provides financial protection against unforeseen incidents such as accidents, cancellations, or property damage during pet events, ensuring coverage for potential losses. Risk management involves identifying, assessing, and mitigating potential hazards through proactive planning, staff training, and safety measures to minimize the likelihood and impact of adverse events. Combining event insurance with effective risk management creates a comprehensive strategy to safeguard pet events from both predictable and unexpected challenges.

Table of Comparison

| Aspect | Event Insurance | Risk Management |

|---|---|---|

| Definition | Financial protection against unexpected event losses | Proactive identification and mitigation of potential risks |

| Purpose | Compensate for damages, cancellations, or liabilities | Prevent or reduce the impact of risks before they occur |

| Scope | Coverage includes property damage, liability, cancellation | Includes risk assessment, planning, and implementation of controls |

| Timing | Applied as a safeguard during or after event incidents | Continuous process starting from event planning |

| Cost | Premium fees based on event size and risk factors | Investment in training, safety measures, and contingency plans |

| Benefit | Financial reimbursement and legal protection | Minimized risk occurrence and enhanced event safety |

| Examples | Liability insurance, cancellation insurance | Venue inspections, emergency protocols, staff training |

Understanding Event Insurance and Risk Management

Event insurance provides financial protection against unforeseen incidents such as cancellations, accidents, or property damage during an event. Risk management involves identifying, assessing, and mitigating potential hazards to minimize the likelihood and impact of these incidents. Combining both strategies ensures comprehensive coverage and proactive safety measures for successful event execution.

Key Differences Between Event Insurance and Risk Management

Event insurance provides financial protection against unforeseen incidents such as cancellations, property damage, or liability claims, covering specific risks with policy limits and premiums. Risk management involves proactively identifying, assessing, and mitigating potential hazards throughout the event planning process to minimize the likelihood and impact of adverse outcomes. While event insurance transfers financial risk, risk management emphasizes prevention and control strategies to ensure a safe and successful event.

Why Event Planners Need Both Insurance and Risk Strategies

Event planners require both event insurance and comprehensive risk management strategies to safeguard against financial losses and unforeseen liabilities. Insurance provides essential coverage for accidents, cancellations, and damages, while risk management proactively identifies potential hazards, enabling planners to implement preventive measures. Combining these tools ensures a balanced approach to protecting clients, vendors, and attendees, minimizing disruptions and legal exposure.

Common Risks in Business Event Planning

Common risks in business event planning include liability issues, property damage, and cancellations due to unforeseen circumstances. Event insurance provides financial protection against these risks by covering potential losses, while risk management involves proactive strategies to identify, assess, and mitigate hazards before the event. Combining both approaches ensures comprehensive security by reducing exposure and securing compensation if incidents occur.

Types of Event Insurance Coverage

Event insurance coverage includes general liability, which protects against bodily injury and property damage claims, and cancellation insurance that reimburses financial losses if the event is postponed or canceled. Specialized policies cover equipment damage, liquor liability for events serving alcohol, and weather insurance to guard against adverse weather conditions disrupting outdoor events. Comprehensive risk management integrates these insurance types with strategies to minimize hazards, ensuring thorough protection for event organizers.

Essential Steps in Event Risk Management

Event risk management involves identifying potential hazards, assessing their impact, and implementing strategies to minimize risks throughout the event lifecycle. Essential steps include conducting thorough site inspections, developing comprehensive safety protocols, and ensuring clear communication channels among staff and vendors. While event insurance provides financial protection against unforeseen incidents, proactive risk management significantly reduces the likelihood of claims and enhances overall event safety.

Evaluating Event Insurance Providers

Evaluating event insurance providers requires thorough analysis of coverage options, including liability limits, cancellation policies, and property protection tailored to specific event types like weddings, concerts, or corporate gatherings. Comparing providers such as Hiscox, EventHelper, and Markel Insurance involves assessing their financial stability, claims process efficiency, and customer reviews to ensure comprehensive risk mitigation. Prioritizing insurers with customizable plans and prompt support maximizes protection against unforeseen incidents and regulatory compliance challenges in event planning.

Integrating Risk Management Into Event Planning

Integrating risk management into event planning involves identifying potential hazards, assessing their likelihood and impact, and implementing strategies to mitigate these risks throughout the event lifecycle. Event insurance complements risk management by providing financial protection against unforeseen incidents such as cancellations, property damage, or liability claims. A comprehensive approach combining proactive risk assessment with appropriate insurance coverage ensures event organizers can minimize losses and enhance overall event safety.

Cost-Benefit Analysis: Insurance vs. Risk Management

Event insurance provides financial protection against unforeseen liabilities and damages, often covering costs that risk management strategies alone cannot mitigate. Risk management focuses on identifying, assessing, and minimizing potential hazards through proactive planning, which can reduce incident frequency and severity, thereby lowering overall insurance premiums. Conducting a cost-benefit analysis involves comparing the upfront and ongoing expenses of insurance premiums with the investment in comprehensive risk management practices to determine the most economical balance between risk transfer and risk reduction.

Best Practices for Comprehensive Event Protection

Event insurance provides financial coverage for unforeseen incidents such as cancellations, property damage, or liability claims, ensuring financial stability. Risk management involves identifying, assessing, and mitigating potential hazards through detailed planning, safety protocols, and contingency plans. Combining thorough risk assessment with tailored insurance policies offers the most comprehensive protection for event organizers, minimizing both operational disruptions and financial losses.

Event insurance vs risk management Infographic

bizdif.com

bizdif.com