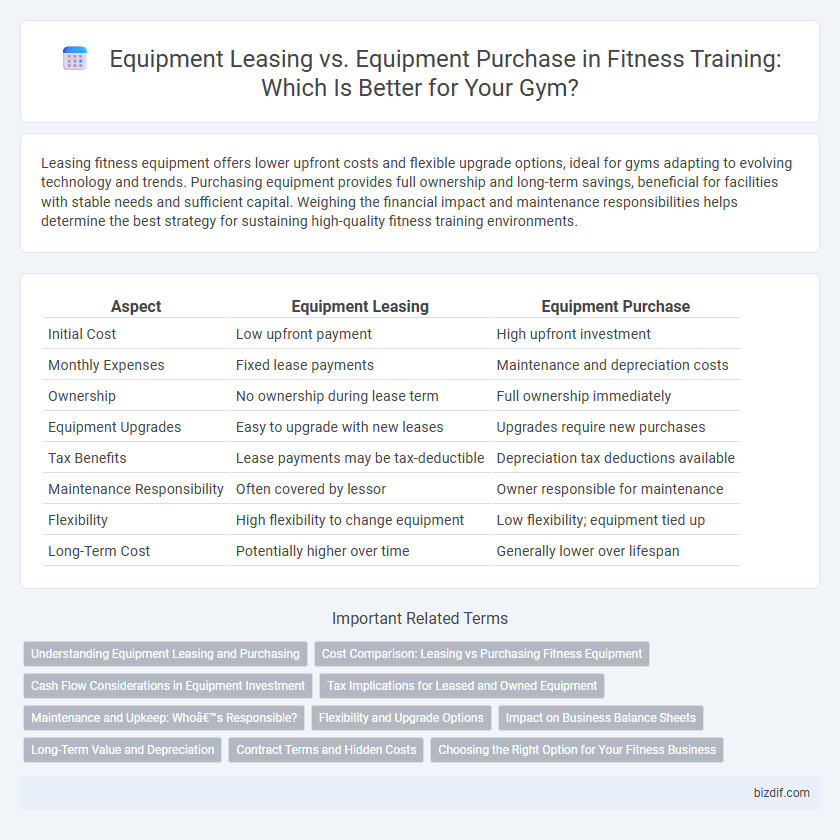

Leasing fitness equipment offers lower upfront costs and flexible upgrade options, ideal for gyms adapting to evolving technology and trends. Purchasing equipment provides full ownership and long-term savings, beneficial for facilities with stable needs and sufficient capital. Weighing the financial impact and maintenance responsibilities helps determine the best strategy for sustaining high-quality fitness training environments.

Table of Comparison

| Aspect | Equipment Leasing | Equipment Purchase |

|---|---|---|

| Initial Cost | Low upfront payment | High upfront investment |

| Monthly Expenses | Fixed lease payments | Maintenance and depreciation costs |

| Ownership | No ownership during lease term | Full ownership immediately |

| Equipment Upgrades | Easy to upgrade with new leases | Upgrades require new purchases |

| Tax Benefits | Lease payments may be tax-deductible | Depreciation tax deductions available |

| Maintenance Responsibility | Often covered by lessor | Owner responsible for maintenance |

| Flexibility | High flexibility to change equipment | Low flexibility; equipment tied up |

| Long-Term Cost | Potentially higher over time | Generally lower over lifespan |

Understanding Equipment Leasing and Purchasing

Equipment leasing for fitness training provides flexible access to high-quality machines without the upfront capital required for purchasing, making it ideal for gyms aiming to conserve cash flow. Purchasing equipment involves a significant initial investment but offers full ownership, potential tax benefits such as depreciation, and no ongoing lease payments, which can reduce long-term costs. Evaluating factors like budget constraints, maintenance responsibilities, and upgrade cycles is essential for fitness centers to decide between leasing or buying exercise equipment.

Cost Comparison: Leasing vs Purchasing Fitness Equipment

Leasing fitness equipment typically involves lower upfront costs, allowing gyms and trainers to access high-quality machines without significant capital investment. Purchasing fitness equipment requires a substantial initial outlay but can offer long-term savings by eliminating monthly lease payments and providing asset ownership. Over time, cost comparison reveals leasing can be more expensive due to ongoing fees, while purchasing is cost-effective for facilities committed to long-term use and maintenance control.

Cash Flow Considerations in Equipment Investment

Leasing fitness equipment preserves cash flow by minimizing upfront costs, allowing gyms to allocate funds toward marketing or personnel. Purchasing requires significant capital but offers long-term asset ownership and potential tax depreciation benefits. Careful cash flow analysis ensures that investment decisions align with business growth and operational budget constraints.

Tax Implications for Leased and Owned Equipment

Leasing fitness equipment often provides tax advantages by allowing full lease payments to be deducted as business expenses, reducing taxable income in the year of payment. Purchased equipment qualifies for depreciation deductions, including accelerated methods like Section 179 or bonus depreciation, spreading tax benefits over several years. Business owners must evaluate their cash flow and tax position to decide which method offers optimal tax savings for fitness training facilities.

Maintenance and Upkeep: Who’s Responsible?

In fitness training, equipment leasing typically shifts maintenance and upkeep responsibilities to the leasing company, ensuring regular servicing and repairs without additional costs to the gym owner. Purchasing fitness equipment places full responsibility for maintenance and repair on the buyer, requiring budget allocation for periodic inspections, part replacements, and potential downtime. Leasing reduces unexpected expenses and maintenance hassles, while ownership offers control but demands proactive equipment management.

Flexibility and Upgrade Options

Leasing fitness equipment offers greater flexibility by allowing gyms to upgrade to the latest models regularly without large upfront costs, ensuring access to cutting-edge technology and maintaining client appeal. Equipment purchase involves a significant initial investment, with limited options for upgrades unless additional purchases are made, which can reduce adaptability to evolving fitness trends. Leasing agreements often include maintenance and upgrade clauses, minimizing downtime and maximizing operational efficiency compared to ownership.

Impact on Business Balance Sheets

Leasing fitness equipment reduces immediate capital expenditure, preserving cash flow while recording lease liabilities as operating expenses on the balance sheet. Purchasing equipment results in asset capitalization, increasing fixed assets and depreciation expenses, which improves equity but ties up working capital. Businesses must evaluate their financial strategy, considering liquidity needs and balance sheet strength when deciding between equipment leasing and purchase.

Long-Term Value and Depreciation

Leasing fitness equipment often reduces upfront costs but may lead to higher long-term expenses due to cumulative lease payments and minimal asset ownership. Purchasing equipment entails greater initial investment but offers potential value retention and asset depreciation benefits that can be leveraged for tax advantages. Evaluating long-term value requires analyzing depreciation schedules, expected equipment lifespan, and cash flow implications to determine the most cost-effective approach for sustained fitness training operations.

Contract Terms and Hidden Costs

Leasing fitness equipment often involves shorter contract terms with flexible upgrade options but may include hidden costs such as maintenance fees and early termination penalties. Purchasing equipment requires a larger upfront investment with longer-term ownership benefits, yet buyers should consider potential hidden expenses like repair, storage, and depreciation. Carefully reviewing contract terms and total cost of ownership ensures fitness facilities optimize budget and operational efficiency.

Choosing the Right Option for Your Fitness Business

Choosing between equipment leasing and purchasing significantly impacts your fitness business's financial health and operational flexibility. Leasing offers lower upfront costs and easier upgrades, ideal for startups or businesses anticipating rapid growth, while purchasing provides long-term asset ownership and potential tax benefits, better suited for established gyms with stable cash flow. Evaluating cash flow, budget constraints, and business goals ensures the optimal decision aligns with your fitness center's sustainability and expansion plans.

Equipment Leasing vs Equipment Purchase Infographic

bizdif.com

bizdif.com