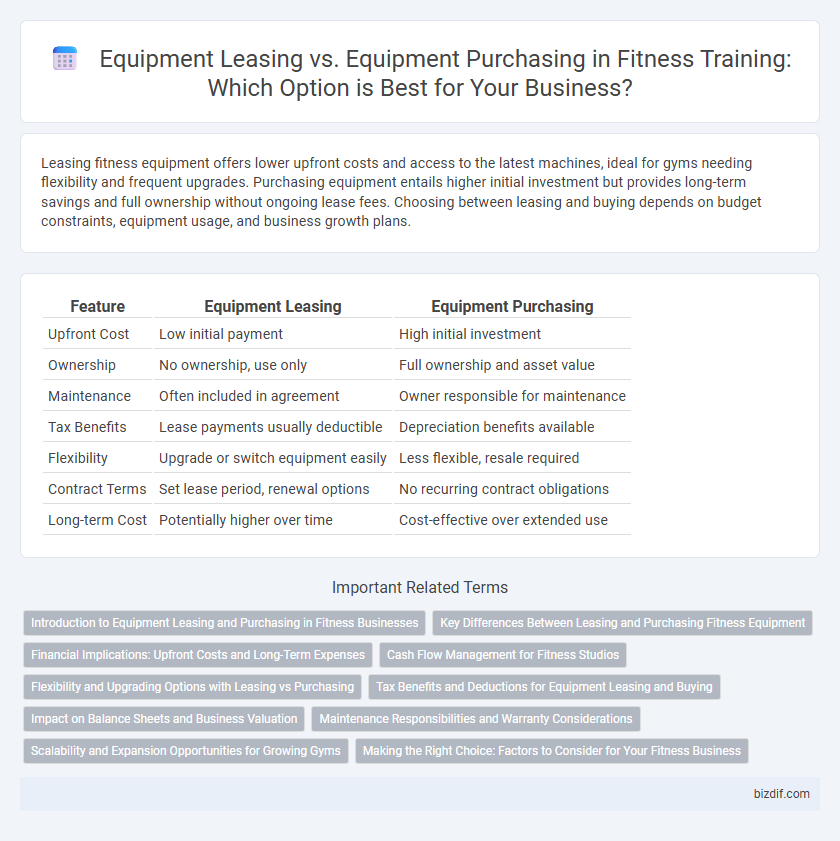

Leasing fitness equipment offers lower upfront costs and access to the latest machines, ideal for gyms needing flexibility and frequent upgrades. Purchasing equipment entails higher initial investment but provides long-term savings and full ownership without ongoing lease fees. Choosing between leasing and buying depends on budget constraints, equipment usage, and business growth plans.

Table of Comparison

| Feature | Equipment Leasing | Equipment Purchasing |

|---|---|---|

| Upfront Cost | Low initial payment | High initial investment |

| Ownership | No ownership, use only | Full ownership and asset value |

| Maintenance | Often included in agreement | Owner responsible for maintenance |

| Tax Benefits | Lease payments usually deductible | Depreciation benefits available |

| Flexibility | Upgrade or switch equipment easily | Less flexible, resale required |

| Contract Terms | Set lease period, renewal options | No recurring contract obligations |

| Long-term Cost | Potentially higher over time | Cost-effective over extended use |

Introduction to Equipment Leasing and Purchasing in Fitness Businesses

Fitness businesses face a critical decision between equipment leasing and purchasing, impacting capital allocation and operational flexibility. Leasing offers lower upfront costs and regular upgrades to the latest fitness machines, which helps maintain state-of-the-art facilities without heavy investment. Purchasing, however, builds long-term asset ownership and may reduce overall expenses, benefiting businesses with stable cash flow and commitment to specific equipment.

Key Differences Between Leasing and Purchasing Fitness Equipment

Leasing fitness equipment offers lower upfront costs and flexible upgrade options, while purchasing requires a significant initial investment but provides full ownership and long-term cost savings. Leasing contracts typically include maintenance services, reducing unexpected repair expenses, whereas purchasing places the responsibility of upkeep solely on the owner. Businesses aiming for cash flow management often prefer leasing, whereas gyms planning permanent installations tend to invest in purchasing equipment.

Financial Implications: Upfront Costs and Long-Term Expenses

Leasing fitness equipment reduces upfront costs by spreading payments over time, making it accessible for businesses with limited capital. Purchasing requires significant initial investment but may lower long-term expenses by eliminating recurring lease payments and increasing asset equity. Assessing cash flow, tax benefits, and depreciation impacts is crucial for optimal financial planning in fitness equipment acquisition.

Cash Flow Management for Fitness Studios

Leasing fitness equipment preserves cash flow by minimizing upfront expenses, allowing fitness studios to allocate funds toward marketing and operational costs. Purchasing equipment requires significant capital investment, potentially straining cash flow but offers long-term savings without recurring lease payments. Carefully managing cash flow through leasing can enhance financial flexibility and support steady business growth in fitness studios.

Flexibility and Upgrading Options with Leasing vs Purchasing

Leasing fitness equipment offers superior flexibility by allowing gyms to upgrade to the latest models regularly without large upfront costs, ensuring access to cutting-edge technology. Purchasing equipment typically involves higher initial investments and limits upgrades to when the equipment is fully depreciated or replaced, reducing adaptability to new fitness trends. Leasing contracts often include maintenance and upgrade options, making it easier for fitness facilities to stay current and efficient compared to outright purchases.

Tax Benefits and Deductions for Equipment Leasing and Buying

Equipment leasing in fitness training offers tax benefits by allowing businesses to deduct lease payments as operating expenses, reducing taxable income without capitalizing assets. Purchasing equipment enables depreciation deductions over time, providing long-term tax relief through asset amortization schedules like Section 179 or bonus depreciation. Choosing between leasing and buying depends on cash flow, tax strategy, and immediate versus gradual tax benefits related to fitness equipment investment.

Impact on Balance Sheets and Business Valuation

Leasing fitness equipment preserves cash flow and prevents asset depreciation from impacting the balance sheet, classifying payments as operating expenses that improve short-term financial ratios. Purchasing adds significant assets and liabilities, increasing the company's book value but potentially reducing liquidity and altering debt-to-equity ratios. Equipment ownership can enhance business valuation through tangible asset accumulation, whereas leasing offers operational flexibility without inflating balance sheet figures.

Maintenance Responsibilities and Warranty Considerations

Leasing fitness equipment typically transfers maintenance responsibilities to the leasing company, ensuring regular servicing and repairs at no extra cost, which minimizes unexpected expenses for gyms. Purchasing equipment places full maintenance duties on the owner, requiring dedicated resources for upkeep and potential costly repairs beyond warranty coverage. Warranty terms often differ, with leased equipment warranties included in the contract, while purchased machines may have limited manufacturer warranties that require separate service agreements for comprehensive protection.

Scalability and Expansion Opportunities for Growing Gyms

Leasing fitness equipment offers growing gyms greater scalability and flexibility by allowing easy upgrades and the addition of new machines without significant upfront costs. Purchasing equipment requires substantial capital investment, which can limit expansion potential and slow response to changing fitness trends. Leasing also enables gyms to maintain a modern and diverse inventory, attracting more clients and supporting steady growth.

Making the Right Choice: Factors to Consider for Your Fitness Business

Choosing between equipment leasing and equipment purchasing in a fitness business hinges on cash flow management, equipment upgrade frequency, and tax implications. Leasing offers lower initial costs and flexibility for regular technology updates, while purchasing builds asset ownership and potential tax benefits through depreciation. Assessing business stability, growth projections, and maintenance responsibilities ensures the most strategic investment aligns with long-term operational goals.

Equipment Leasing vs Equipment Purchasing Infographic

bizdif.com

bizdif.com