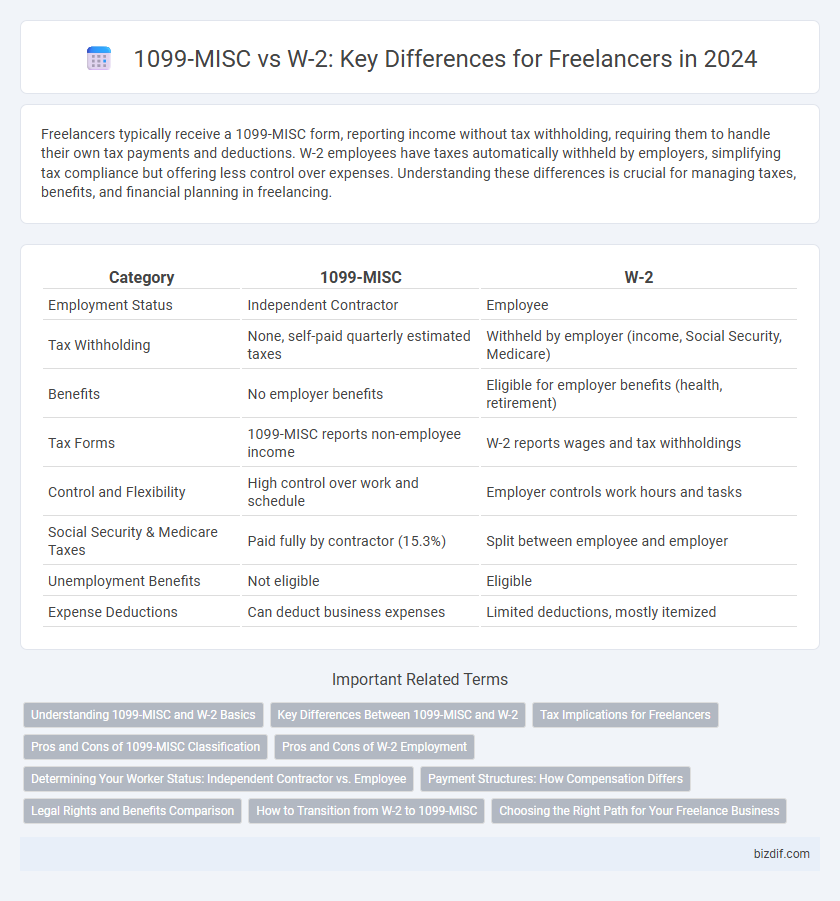

Freelancers typically receive a 1099-MISC form, reporting income without tax withholding, requiring them to handle their own tax payments and deductions. W-2 employees have taxes automatically withheld by employers, simplifying tax compliance but offering less control over expenses. Understanding these differences is crucial for managing taxes, benefits, and financial planning in freelancing.

Table of Comparison

| Category | 1099-MISC | W-2 |

|---|---|---|

| Employment Status | Independent Contractor | Employee |

| Tax Withholding | None, self-paid quarterly estimated taxes | Withheld by employer (income, Social Security, Medicare) |

| Benefits | No employer benefits | Eligible for employer benefits (health, retirement) |

| Tax Forms | 1099-MISC reports non-employee income | W-2 reports wages and tax withholdings |

| Control and Flexibility | High control over work and schedule | Employer controls work hours and tasks |

| Social Security & Medicare Taxes | Paid fully by contractor (15.3%) | Split between employee and employer |

| Unemployment Benefits | Not eligible | Eligible |

| Expense Deductions | Can deduct business expenses | Limited deductions, mostly itemized |

Understanding 1099-MISC and W-2 Basics

Freelancers typically receive a 1099-MISC form, which reports non-employee compensation and indicates they are responsible for self-employment taxes and quarterly estimated tax payments. In contrast, W-2 forms are issued to employees, showing wages earned with taxes withheld by the employer, including Social Security and Medicare. Understanding these differences is crucial for accurate tax filing and financial planning in freelance work.

Key Differences Between 1099-MISC and W-2

1099-MISC forms report income for independent contractors who manage their own taxes and expenses, while W-2 forms apply to employees whose taxes are withheld by employers. Contractors receiving 1099-MISC bear responsibility for self-employment taxes, including Social Security and Medicare, whereas W-2 employees benefit from employer contributions toward these taxes. Understanding these distinctions impacts tax filing requirements, eligibility for benefits, and legal classification under labor laws.

Tax Implications for Freelancers

Freelancers receiving a 1099-MISC form are classified as independent contractors and must handle self-employment taxes, including both the employer and employee portions of Social Security and Medicare, often resulting in higher tax liabilities. In contrast, W-2 employees have taxes withheld by their employer, who also contributes to payroll taxes, relieving the employee from self-employment tax responsibilities. Understanding the distinction between 1099-MISC and W-2 forms is crucial for freelancers to accurately estimate tax obligations and plan for quarterly estimated tax payments.

Pros and Cons of 1099-MISC Classification

The 1099-MISC classification offers freelancers higher control over their work schedule and the potential for tax deductions on business expenses, increasing overall income efficiency. However, it lacks benefits such as health insurance, retirement plans, and unemployment protection which are typically provided with W-2 employment, placing greater responsibility on the freelancer. Tax filing complexity also increases under 1099-MISC, requiring careful record-keeping and quarterly payments to avoid penalties.

Pros and Cons of W-2 Employment

W-2 employment offers benefits such as employer-paid taxes, consistent paychecks, and eligibility for benefits like health insurance and retirement plans, providing financial stability and reduced tax filing complexity. However, W-2 employees often face less flexibility, potential limitations on deducting work-related expenses, and may experience wage stagnation due to fixed salaries. Employers control work hours and conditions, which can limit autonomy compared to 1099-MISC freelancing arrangements.

Determining Your Worker Status: Independent Contractor vs. Employee

Determining your worker status hinges on the degree of control and independence in your job role, where independent contractors typically receive a 1099-MISC form, and employees receive a W-2 form. The IRS uses criteria such as behavioral control, financial control, and the relationship of the parties to classify workers accurately. Misclassifying a worker can lead to significant tax consequences, so understanding the differences between 1099-MISC and W-2 statuses is essential for freelancers and employers.

Payment Structures: How Compensation Differs

Freelancers paid via 1099-MISC receive compensation as independent contractors, often through project-based or milestone payments without tax withholding, granting flexibility but requiring self-managed tax obligations. W-2 employees earn regular wages subject to employer tax withholding, including Social Security, Medicare, and income taxes, providing consistency and benefits eligibility. The 1099-MISC payment structure emphasizes variable, client-driven income, while W-2 arrangements prioritize stable salary and formal employer-employee relationships.

Legal Rights and Benefits Comparison

Freelancers receiving 1099-MISC forms are classified as independent contractors, which means they have fewer legal protections and benefits compared to W-2 employees, such as limited access to unemployment insurance, workers' compensation, and employer-sponsored health plans. W-2 employees benefit from labor law protections including minimum wage, overtime pay, and eligibility for employer retirement contributions, whereas 1099 workers must independently manage taxes and lack guaranteed paid leave or job security. Understanding these differences is crucial for freelancers to navigate tax obligations and secure their legal rights and benefits effectively.

How to Transition from W-2 to 1099-MISC

To transition from a W-2 employee to a 1099-MISC freelancer, start by obtaining an Employer Identification Number (EIN) from the IRS to establish your independent business entity. Set up a separate business bank account and track expenses meticulously to maximize deductions and simplify tax filing. Finally, update contracts with clients to reflect your freelance status and consider quarterly estimated tax payments to avoid penalties.

Choosing the Right Path for Your Freelance Business

Choosing between 1099-MISC and W-2 forms is critical when structuring your freelance business, as 1099-MISC classifies you as an independent contractor with greater tax responsibilities and fewer benefits, while W-2 denotes an employee status with tax withholding and employer-provided benefits. Understanding the implications on tax reporting, deductions, Social Security contributions, and healthcare options can optimize your financial outcomes and legal compliance. Evaluating your business goals, work flexibility, and income stability helps determine the best classification to support sustainable freelance success.

1099-MISC vs W-2 Infographic

bizdif.com

bizdif.com