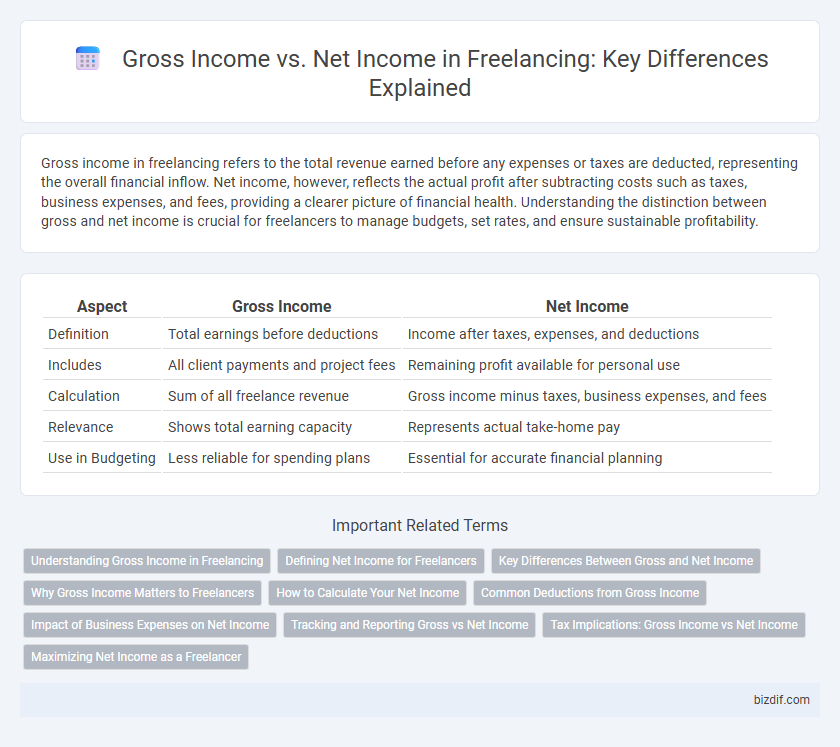

Gross income in freelancing refers to the total revenue earned before any expenses or taxes are deducted, representing the overall financial inflow. Net income, however, reflects the actual profit after subtracting costs such as taxes, business expenses, and fees, providing a clearer picture of financial health. Understanding the distinction between gross and net income is crucial for freelancers to manage budgets, set rates, and ensure sustainable profitability.

Table of Comparison

| Aspect | Gross Income | Net Income |

|---|---|---|

| Definition | Total earnings before deductions | Income after taxes, expenses, and deductions |

| Includes | All client payments and project fees | Remaining profit available for personal use |

| Calculation | Sum of all freelance revenue | Gross income minus taxes, business expenses, and fees |

| Relevance | Shows total earning capacity | Represents actual take-home pay |

| Use in Budgeting | Less reliable for spending plans | Essential for accurate financial planning |

Understanding Gross Income in Freelancing

Gross income in freelancing represents the total revenue earned from clients before deducting any expenses or taxes. It includes all payments for services rendered, project fees, and additional charges billed directly to clients. Understanding gross income helps freelancers track overall earnings and plan for tax obligations effectively.

Defining Net Income for Freelancers

Net income for freelancers is the amount earned after deducting all business expenses, taxes, and other costs from the gross income. These expenses typically include software subscriptions, marketing, office supplies, and self-employment taxes. Accurate calculation of net income helps freelancers understand true profitability and manage financial planning effectively.

Key Differences Between Gross and Net Income

Gross income represents the total earnings a freelancer receives before any expenses, taxes, or deductions are applied, while net income is the amount remaining after all business-related costs and taxes have been subtracted. Key differences include gross income reflecting overall revenue generation and net income indicating actual profitability and financial health. Understanding this distinction helps freelancers plan budgets, manage cash flow, and strategize for tax obligations effectively.

Why Gross Income Matters to Freelancers

Gross income represents the total earnings freelancers receive before any expenses or taxes are deducted, providing a clear picture of their earning potential. Understanding gross income is crucial for freelancers to set accurate rates, negotiate contracts, and plan financial goals effectively. Tracking gross income also helps freelancers evaluate business growth and secure financing or investment opportunities.

How to Calculate Your Net Income

To calculate your net income as a freelancer, start by determining your gross income, which includes all payments received from clients before any deductions. Subtract all business expenses, such as equipment costs, software subscriptions, taxes, and health insurance premiums, from your gross income to find your net income. Tracking these deductions accurately ensures a precise calculation of your take-home earnings and helps with budgeting and tax planning.

Common Deductions from Gross Income

Freelancers calculate net income by subtracting common deductions such as business expenses, self-employment taxes, health insurance premiums, and retirement contributions from their gross income. These deductions lower taxable income and include costs like office supplies, software subscriptions, and marketing expenses. Understanding these deductions is crucial for accurate tax filing and financial planning in freelancing.

Impact of Business Expenses on Net Income

Business expenses significantly reduce a freelancer's net income by deducting costs such as software subscriptions, marketing, and office supplies from the gross income. Tracking these expenses accurately is essential for tax deductions and optimizing overall profitability. Effective expense management directly increases the net income, reflecting the true earnings after all operational costs are covered.

Tracking and Reporting Gross vs Net Income

Tracking gross income involves recording the total earnings from all freelance projects before any expenses or taxes are deducted. Net income, on the other hand, reflects the actual profit after subtracting business expenses, taxes, and other deductions, providing a clearer picture of financial health. Accurate reporting of both gross and net income is essential for effective budgeting, tax compliance, and strategic business planning in freelancing.

Tax Implications: Gross Income vs Net Income

Gross income represents a freelancer's total earnings before any deductions, while net income reflects the actual take-home pay after subtracting taxes, business expenses, and other allowable deductions. Understanding the difference is crucial for accurate tax filing and financial planning, as tax liabilities are calculated on gross income but payable after deductions reduce the taxable amount. Properly managing deductible expenses helps freelancers optimize net income, minimizing tax obligations and maximizing profitability.

Maximizing Net Income as a Freelancer

Freelancers should prioritize maximizing net income by carefully tracking all business expenses such as software, equipment, and marketing costs to reduce taxable income. Understanding the distinction between gross income--the total earnings before expenses--and net income--the actual take-home pay after deductions--enables better financial planning and tax optimization. Implementing strategies like invoicing promptly, negotiating higher rates, and leveraging tax deductions can significantly increase a freelancer's net income for sustainable success.

Gross Income vs Net Income Infographic

bizdif.com

bizdif.com