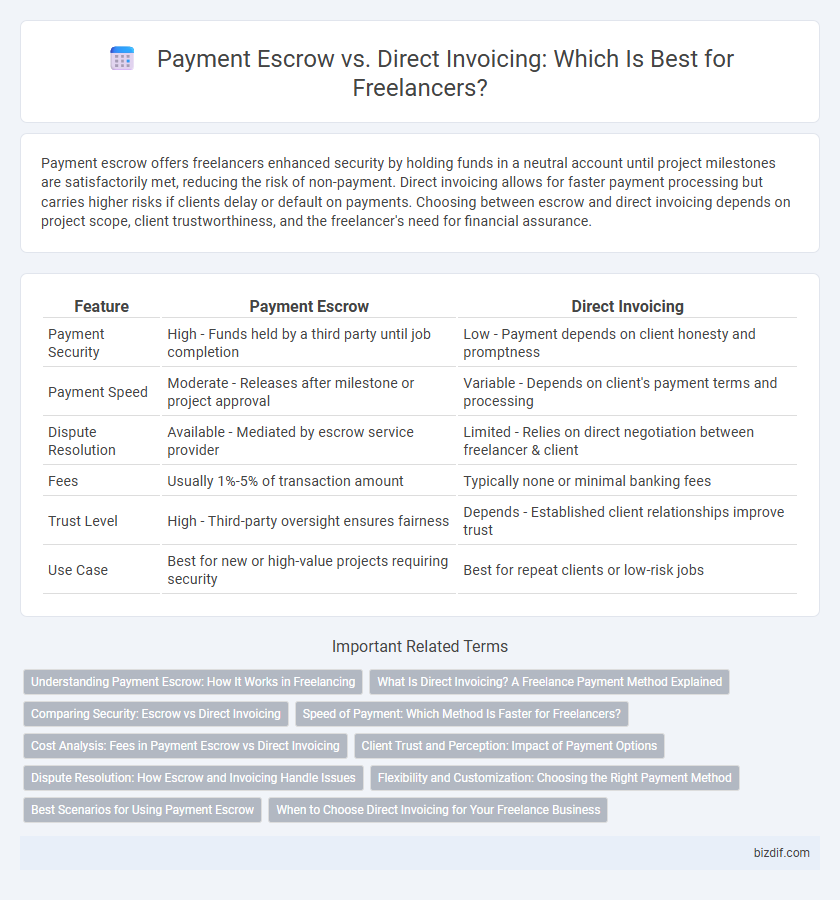

Payment escrow offers freelancers enhanced security by holding funds in a neutral account until project milestones are satisfactorily met, reducing the risk of non-payment. Direct invoicing allows for faster payment processing but carries higher risks if clients delay or default on payments. Choosing between escrow and direct invoicing depends on project scope, client trustworthiness, and the freelancer's need for financial assurance.

Table of Comparison

| Feature | Payment Escrow | Direct Invoicing |

|---|---|---|

| Payment Security | High - Funds held by a third party until job completion | Low - Payment depends on client honesty and promptness |

| Payment Speed | Moderate - Releases after milestone or project approval | Variable - Depends on client's payment terms and processing |

| Dispute Resolution | Available - Mediated by escrow service provider | Limited - Relies on direct negotiation between freelancer & client |

| Fees | Usually 1%-5% of transaction amount | Typically none or minimal banking fees |

| Trust Level | High - Third-party oversight ensures fairness | Depends - Established client relationships improve trust |

| Use Case | Best for new or high-value projects requiring security | Best for repeat clients or low-risk jobs |

Understanding Payment Escrow: How It Works in Freelancing

Payment escrow in freelancing functions as a secure third-party holding account where funds are deposited before work begins, ensuring both client and freelancer are protected throughout the project. This method mitigates risks by releasing payment only when predefined milestones or deliverables are met, fostering trust and accountability between parties. Compared to direct invoicing, escrow services reduce payment disputes and guarantee timely compensation after project approval.

What Is Direct Invoicing? A Freelance Payment Method Explained

Direct invoicing in freelancing involves the freelancer sending a detailed invoice directly to the client, specifying services rendered and payment terms. This method allows for immediate payment processing without intermediaries, giving freelancers full control over their finances and cash flow. Unlike escrow services, direct invoicing relies on trust, making clear contract terms and timely follow-ups essential for securing payments.

Comparing Security: Escrow vs Direct Invoicing

Payment escrow offers enhanced security by holding funds in a neutral account until project milestones are verified, protecting both freelancers and clients from fraud or disputes. Direct invoicing lacks this safeguard, relying on client trust and timely payment, which can increase the risk of delayed or non-payment for freelancers. Escrow services facilitate dispute resolution through platform mediation, whereas direct invoicing depends solely on legal recourse or personal agreements.

Speed of Payment: Which Method Is Faster for Freelancers?

Payment escrow offers faster security and release of funds for freelancers, typically clearing within 24 to 48 hours after project approval, minimizing payment delays. Direct invoicing depends heavily on client promptness and payment terms, often taking from several days to weeks, risking slower cash flow. Platforms like Upwork and Freelancer enhance escrow efficiency, providing more reliable and quicker access to payments than traditional invoicing methods.

Cost Analysis: Fees in Payment Escrow vs Direct Invoicing

Payment escrow services typically charge fees ranging from 1% to 5% per transaction, which can increase overall project costs for freelancers and clients. Direct invoicing often incurs lower fees, primarily limited to standard payment processing charges of around 2% to 3%, making it more cost-effective for low-risk projects. Understanding these fee structures helps freelancers optimize profit margins by selecting the appropriate payment method based on project size and trust level.

Client Trust and Perception: Impact of Payment Options

Payment escrow enhances client trust by providing a secure, neutral platform that holds funds until project milestones are met, reducing risks of non-delivery. Direct invoicing may create doubts, especially with new clients, as funds are transferred before confirming satisfactory work completion. Choosing escrow services signals professionalism and transparency, positively influencing client perception and encouraging long-term freelance engagements.

Dispute Resolution: How Escrow and Invoicing Handle Issues

Escrow payment systems provide a secure dispute resolution process by holding funds until both parties approve the work, reducing the risk of non-payment and ensuring contract fulfillment. Direct invoicing relies on the client's timely payment and may require legal intervention or mediation if disagreements arise, often prolonging resolution. Escrow offers a structured mechanism for resolving conflicts efficiently, while invoicing depends largely on trust and external dispute handling methods.

Flexibility and Customization: Choosing the Right Payment Method

Payment escrow offers enhanced security and structured payment schedules, ideal for projects requiring milestone-based releases and reducing payment disputes. Direct invoicing provides greater flexibility and customization in billing cycles and payment terms, allowing freelancers to tailor invoicing according to client preferences and project scope. Selecting the right payment method depends on balancing the need for payment protection against the desire for adaptable financial arrangements.

Best Scenarios for Using Payment Escrow

Payment escrow is ideal for high-value or complex freelance projects where trust and security between clients and freelancers are paramount, ensuring funds are securely held until agreed milestones are completed. It benefits scenarios involving new client relationships, reducing payment risk and providing a formal dispute resolution process. Freelancers working on platforms like Upwork or Freelancer often prefer escrow to increase transparency and guarantee timely payment.

When to Choose Direct Invoicing for Your Freelance Business

Direct invoicing is ideal for freelance projects with trusted, repeat clients who have a proven track record of timely payments and clear communication. It streamlines the payment process by eliminating intermediaries, reducing fees, and allowing freelancers to maintain full control over their invoicing and cash flow. When the project scope is straightforward and both parties have established payment terms, direct invoicing enhances efficiency and builds stronger client relationships.

Payment escrow vs Direct invoicing Infographic

bizdif.com

bizdif.com