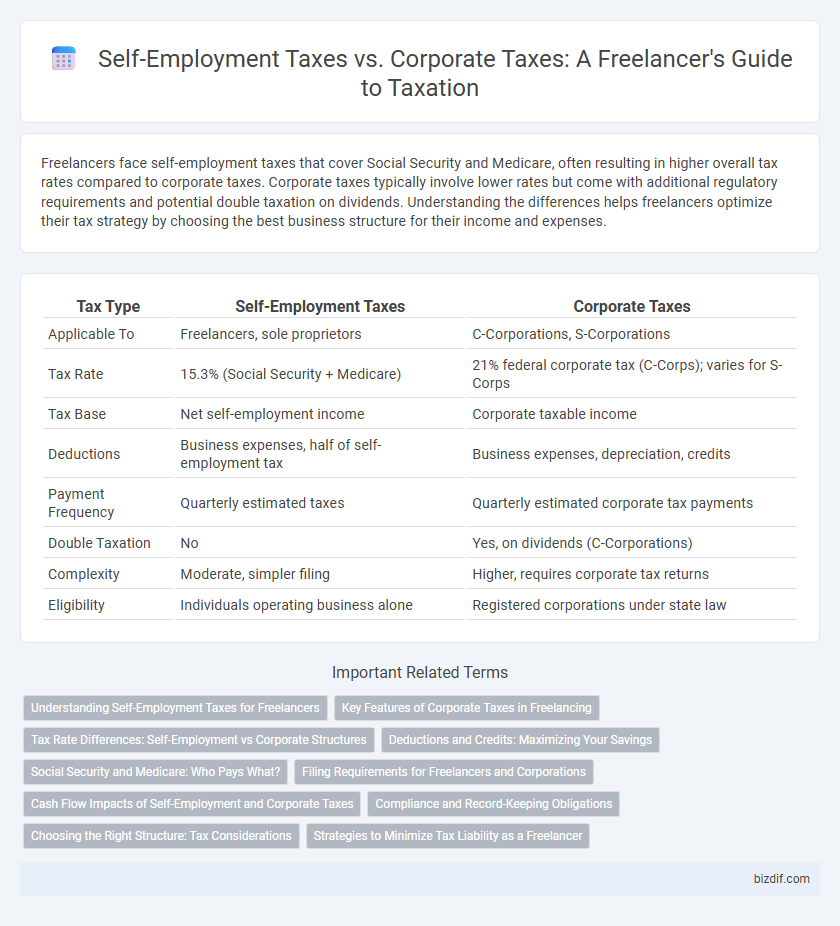

Freelancers face self-employment taxes that cover Social Security and Medicare, often resulting in higher overall tax rates compared to corporate taxes. Corporate taxes typically involve lower rates but come with additional regulatory requirements and potential double taxation on dividends. Understanding the differences helps freelancers optimize their tax strategy by choosing the best business structure for their income and expenses.

Table of Comparison

| Tax Type | Self-Employment Taxes | Corporate Taxes |

|---|---|---|

| Applicable To | Freelancers, sole proprietors | C-Corporations, S-Corporations |

| Tax Rate | 15.3% (Social Security + Medicare) | 21% federal corporate tax (C-Corps); varies for S-Corps |

| Tax Base | Net self-employment income | Corporate taxable income |

| Deductions | Business expenses, half of self-employment tax | Business expenses, depreciation, credits |

| Payment Frequency | Quarterly estimated taxes | Quarterly estimated corporate tax payments |

| Double Taxation | No | Yes, on dividends (C-Corporations) |

| Complexity | Moderate, simpler filing | Higher, requires corporate tax returns |

| Eligibility | Individuals operating business alone | Registered corporations under state law |

Understanding Self-Employment Taxes for Freelancers

Self-employment taxes for freelancers primarily cover Social Security and Medicare contributions, which total 15.3% on net earnings, significantly impacting independent contractors' income compared to corporate tax structures. Unlike corporations, freelancers report income on Schedule C and pay self-employment tax directly, without employer withholding, requiring careful quarterly estimated tax payments to avoid penalties. Understanding these taxes enables freelancers to manage cash flow effectively and leverage potential deductions to reduce taxable income.

Key Features of Corporate Taxes in Freelancing

Corporate taxes in freelancing apply when freelancers establish a corporation, separating personal and business finances to benefit from potentially lower tax rates and deductible business expenses. Key features include taxation on corporate profits, possible double taxation when dividends are distributed, and eligibility for various tax credits and deductions unique to corporations. Understanding these features helps freelancers optimize their tax strategy and manage liabilities effectively.

Tax Rate Differences: Self-Employment vs Corporate Structures

Self-employment taxes typically include Social Security and Medicare contributions at a combined rate of 15.3%, directly impacting freelancers' net income. In contrast, corporate tax rates vary, with C corporations taxed at a flat federal rate of 21%, while S corporations pass income to shareholders avoiding double taxation but requiring reasonable salary payments subject to payroll taxes. Understanding these tax rate differences helps freelancers determine the most tax-efficient business structure for maximizing earnings and minimizing liabilities.

Deductions and Credits: Maximizing Your Savings

Self-employment taxes require freelancers to pay both the employer and employee portions of Social Security and Medicare taxes, while corporate taxes often allow businesses to claim more extensive deductions and credits, such as qualified business income (QBI) deductions and employee benefit expenses. Freelancers can maximize savings by carefully tracking deductible expenses like home office costs, equipment, and professional services, reducing taxable income. Corporate entities benefit from additional tax credits, including research and development credits and tax incentives for employee health plans, which can significantly lower overall tax liability.

Social Security and Medicare: Who Pays What?

Freelancers pay self-employment taxes covering both the employer and employee portions of Social Security (12.4%) and Medicare (2.9%), totaling 15.3%, while corporations split these payroll taxes between employer and employee, with the company covering half. In a corporate structure, employees contribute 6.2% for Social Security and 1.45% for Medicare, and the corporation matches these amounts, reducing the individual tax burden compared to self-employed individuals. Understanding these differences is crucial for freelancers choosing between sole proprietorships or forming corporate entities to optimize tax liabilities related to Social Security and Medicare contributions.

Filing Requirements for Freelancers and Corporations

Freelancers must file self-employment taxes using Schedule SE alongside their personal income tax return, reporting all earned income from independent contracting. Corporations are required to file distinct corporate tax returns, such as Form 1120 for C-Corporations or Form 1120S for S-Corporations, which detail the company's income, deductions, and credits separately from personal tax filings. Understanding these filing requirements ensures compliance with IRS regulations and accurate tax obligations for both freelancers and corporate entities.

Cash Flow Impacts of Self-Employment and Corporate Taxes

Self-employment taxes directly reduce freelancers' cash flow by requiring payment of both Social Security and Medicare taxes, totaling approximately 15.3% on net earnings, which can significantly impact monthly income availability. Corporate taxes, while potentially lower due to tax deductions and profit retention strategies, often necessitate complex accounting and periodic payments that affect the company's operating cash flow but may allow owners to defer personal tax liabilities. Efficient tax planning is critical for freelancers and corporations to optimize cash flow management and maintain financial stability throughout the fiscal year.

Compliance and Record-Keeping Obligations

Freelancers must navigate self-employment taxes, which require detailed record-keeping of income and business expenses to ensure accurate quarterly estimated tax payments and compliance with IRS regulations. Corporate taxes involve more complex compliance, including maintaining formal financial statements, payroll records, and adhering to state and federal filing requirements. Efficient and organized record-keeping is essential in both scenarios to avoid penalties and streamline tax reporting processes.

Choosing the Right Structure: Tax Considerations

Choosing the right business structure significantly impacts your tax obligations, with self-employment taxes applying to sole proprietors and freelancers, covering Social Security and Medicare contributions at a rate of 15.3%. Corporate structures, such as S-Corps or LLCs electing corporate taxation, often offer opportunities to reduce self-employment taxes by allowing owners to pay themselves salaries and take additional income as distributions, which are taxed differently. Analyzing your income level, administrative capacity, and long-term goals helps determine whether self-employment taxes or corporate taxes provide the most tax-efficient outcome for your freelancing business.

Strategies to Minimize Tax Liability as a Freelancer

Freelancers can minimize self-employment taxes by strategically electing S-corporation status, allowing income to be split between salary and distributions, which reduces payroll taxes. Deducting legitimate business expenses like home office costs, equipment, and professional services directly lowers taxable income. Utilizing retirement plans such as SEP IRAs or Solo 401(k)s offers additional tax deferral opportunities, effectively decreasing overall tax liability.

Self-Employment Taxes vs Corporate Taxes Infographic

bizdif.com

bizdif.com