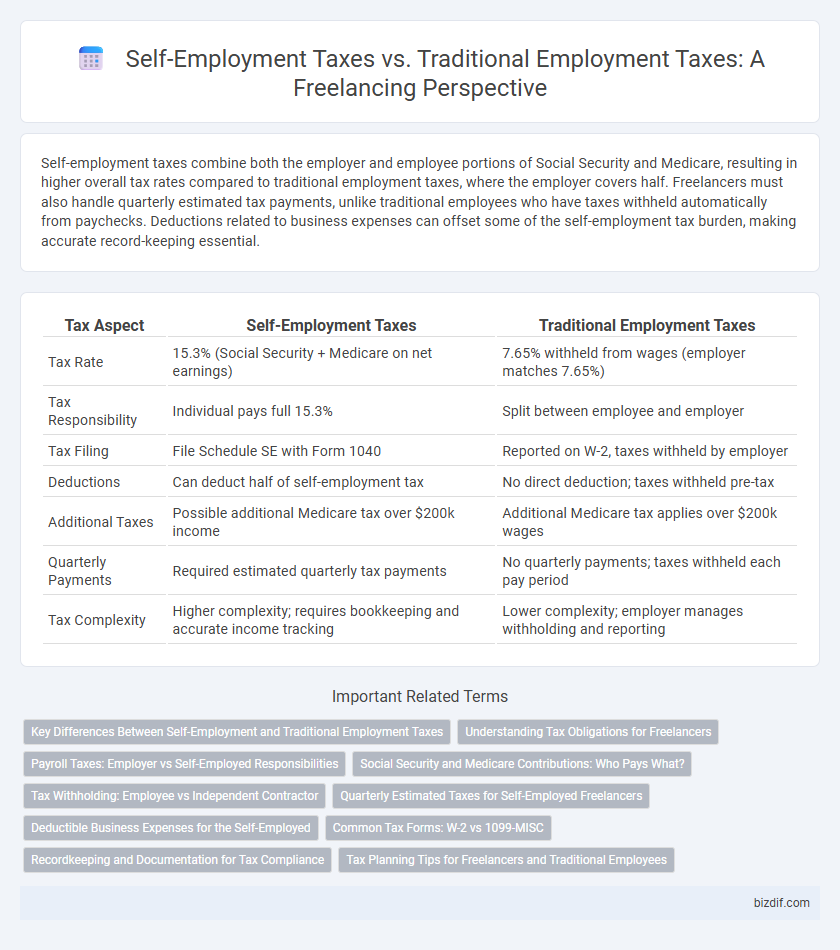

Self-employment taxes combine both the employer and employee portions of Social Security and Medicare, resulting in higher overall tax rates compared to traditional employment taxes, where the employer covers half. Freelancers must also handle quarterly estimated tax payments, unlike traditional employees who have taxes withheld automatically from paychecks. Deductions related to business expenses can offset some of the self-employment tax burden, making accurate record-keeping essential.

Table of Comparison

| Tax Aspect | Self-Employment Taxes | Traditional Employment Taxes |

|---|---|---|

| Tax Rate | 15.3% (Social Security + Medicare on net earnings) | 7.65% withheld from wages (employer matches 7.65%) |

| Tax Responsibility | Individual pays full 15.3% | Split between employee and employer |

| Tax Filing | File Schedule SE with Form 1040 | Reported on W-2, taxes withheld by employer |

| Deductions | Can deduct half of self-employment tax | No direct deduction; taxes withheld pre-tax |

| Additional Taxes | Possible additional Medicare tax over $200k income | Additional Medicare tax applies over $200k wages |

| Quarterly Payments | Required estimated quarterly tax payments | No quarterly payments; taxes withheld each pay period |

| Tax Complexity | Higher complexity; requires bookkeeping and accurate income tracking | Lower complexity; employer manages withholding and reporting |

Key Differences Between Self-Employment and Traditional Employment Taxes

Self-employment taxes combine Social Security and Medicare contributions, totaling 15.3%, while traditional employees typically pay half of this amount through payroll deductions, with employers covering the rest. Self-employed individuals must calculate, report, and remit these taxes quarterly using Schedule SE on their Form 1040. Unlike withholding in traditional employment, self-employment taxes require proactive financial management to avoid penalties and ensure compliance with IRS deadlines.

Understanding Tax Obligations for Freelancers

Freelancers face self-employment taxes that encompass both the employer and employee portions of Social Security and Medicare, totaling 15.3%, whereas traditional employees pay only half of this amount with the other half covered by their employer. Understanding quarterly estimated tax payments and maintaining detailed income and expense records are crucial for compliance and avoiding penalties. Unlike traditional employment taxes, freelancers must also navigate additional deductions related to business expenses, which can significantly impact their taxable income.

Payroll Taxes: Employer vs Self-Employed Responsibilities

Self-employed individuals are responsible for the full 15.3% self-employment tax, covering both the employer and employee portions of Social Security and Medicare taxes, unlike traditional employees whose payroll taxes are split between employer and employee. Employers withhold half of these payroll taxes from employees' paychecks and remit the other half directly, reducing the employees' tax burden. Understanding these differences is crucial for freelancers to accurately estimate tax liabilities and make timely quarterly tax payments.

Social Security and Medicare Contributions: Who Pays What?

Freelancers are responsible for the entire 15.3% self-employment tax, covering both the 12.4% Social Security and 2.9% Medicare contributions, whereas traditional employees split these costs evenly with their employers, each paying 6.2% for Social Security and 1.45% for Medicare. Self-employed individuals can deduct half of the self-employment tax from their taxable income, providing some tax relief. Understanding these tax responsibilities is crucial for freelancers to accurately budget and comply with IRS regulations.

Tax Withholding: Employee vs Independent Contractor

Employees have taxes automatically withheld from their paychecks by employers, covering income tax, Social Security, and Medicare contributions. Independent contractors must calculate and pay self-employment taxes directly, including both the employer and employee portions of Social Security and Medicare. This difference necessitates careful quarterly tax payments and record-keeping for freelancers to avoid penalties and ensure compliance.

Quarterly Estimated Taxes for Self-Employed Freelancers

Self-employed freelancers must pay quarterly estimated taxes to cover income tax and self-employment tax, which includes Social Security and Medicare contributions typically withheld by employers in traditional jobs. Unlike traditional employment taxes deducted from each paycheck, freelancers calculate and remit these payments every three months to avoid penalties and ensure accurate tax compliance. Properly estimating quarterly taxes helps freelancers manage cash flow and meet IRS deadlines, reducing the risk of underpayment penalties and interest.

Deductible Business Expenses for the Self-Employed

Self-employment taxes require freelancers to pay both the employer and employee portions of Social Security and Medicare taxes, amounting to 15.3%, unlike traditional employment where these are partially covered by the employer. Deductible business expenses such as home office costs, equipment, software, and internet fees significantly reduce taxable income for the self-employed. Proper tracking and categorization of these expenses are crucial to maximize deductions and minimize overall tax liability.

Common Tax Forms: W-2 vs 1099-MISC

Freelancers receive a 1099-MISC form, reporting income without tax withholding, requiring them to calculate and pay self-employment taxes, including Social Security and Medicare contributions. Traditional employees receive a W-2 form, which includes income and tax withholdings, simplifying their tax filing process since employers handle Social Security, Medicare, and income tax payments. Understanding these tax forms helps freelancers manage quarterly estimated tax payments to avoid penalties, unlike traditional employees who experience tax withholding through payroll.

Recordkeeping and Documentation for Tax Compliance

Freelancers must maintain detailed records of all income and deductible expenses, including receipts, invoices, and bank statements, to ensure accurate self-employment tax reporting and avoid IRS penalties. Unlike traditional employees whose employers handle tax withholding and documentation, self-employed individuals are responsible for tracking quarterly estimated tax payments and calculating both income and self-employment taxes. Proper documentation supports expense claims such as home office deductions and business-related costs, reducing taxable income and enhancing compliance with IRS tax regulations.

Tax Planning Tips for Freelancers and Traditional Employees

Freelancers face self-employment taxes including both the employer and employee portions of Social Security and Medicare, requiring careful quarterly estimated tax payments to avoid penalties. Traditional employees have taxes withheld by employers, simplifying compliance but offering fewer deductions. Effective tax planning for freelancers involves tracking all business expenses, maximizing deductible costs, and setting aside funds for quarterly payments, while traditional employees benefit from maximizing pre-tax contributions to retirement and health savings accounts.

Self-employment taxes vs Traditional employment taxes Infographic

bizdif.com

bizdif.com