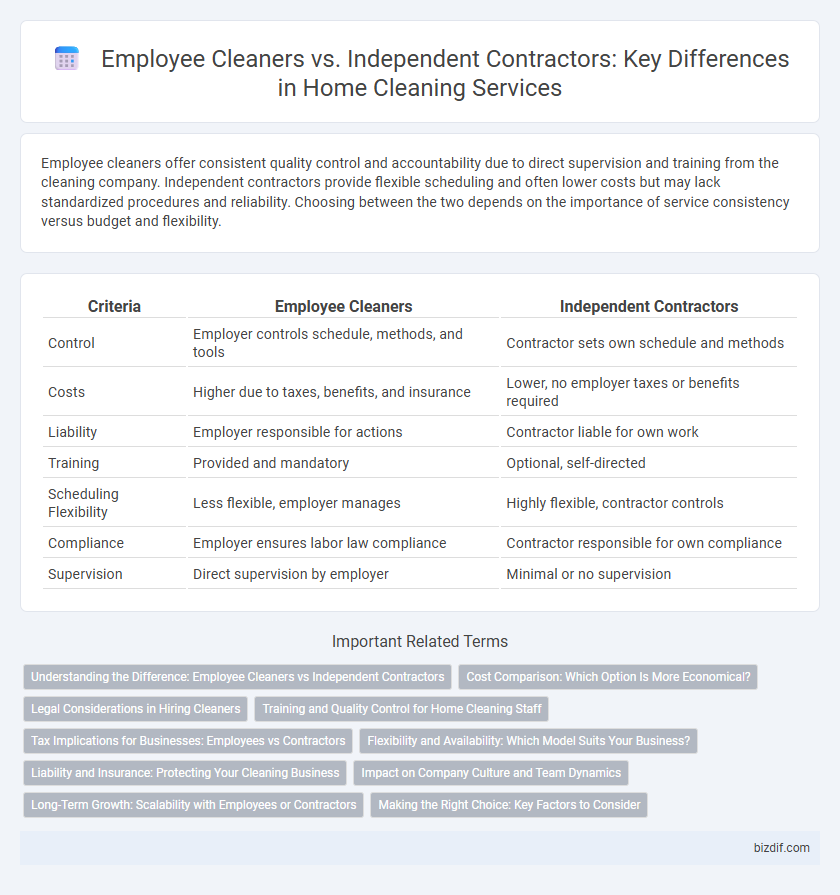

Employee cleaners offer consistent quality control and accountability due to direct supervision and training from the cleaning company. Independent contractors provide flexible scheduling and often lower costs but may lack standardized procedures and reliability. Choosing between the two depends on the importance of service consistency versus budget and flexibility.

Table of Comparison

| Criteria | Employee Cleaners | Independent Contractors |

|---|---|---|

| Control | Employer controls schedule, methods, and tools | Contractor sets own schedule and methods |

| Costs | Higher due to taxes, benefits, and insurance | Lower, no employer taxes or benefits required |

| Liability | Employer responsible for actions | Contractor liable for own work |

| Training | Provided and mandatory | Optional, self-directed |

| Scheduling Flexibility | Less flexible, employer manages | Highly flexible, contractor controls |

| Compliance | Employer ensures labor law compliance | Contractor responsible for own compliance |

| Supervision | Direct supervision by employer | Minimal or no supervision |

Understanding the Difference: Employee Cleaners vs Independent Contractors

Employee cleaners are typically hired directly by cleaning companies, receiving benefits such as consistent wages, tax withholdings, and workplace protections under labor laws. Independent contractors, on the other hand, operate as self-employed individuals who manage their own taxes, set their schedules, and provide services to multiple clients without traditional employee benefits. Understanding this distinction is crucial for businesses to ensure compliance with legal standards and optimize staffing strategies in the home cleaning industry.

Cost Comparison: Which Option Is More Economical?

Employee cleaners typically incur higher costs for homeowners due to expenses such as payroll taxes, benefits, insurance, and workers' compensation. Independent contractors often offer a more economical option since they cover their own taxes and benefits, reducing the overall price for cleaning services. However, evaluating total value includes considering potential variability in service quality and legal responsibilities associated with each arrangement.

Legal Considerations in Hiring Cleaners

Hiring employee cleaners involves adhering to labor laws such as minimum wage, overtime pay, and workers' compensation, ensuring compliance with federal and state regulations. Independent contractors require clear contracts defining their status to avoid misclassification issues that can result in penalties and back taxes. Proper classification impacts tax obligations, liability, and benefits, making legal guidance essential for businesses in the home cleaning sector.

Training and Quality Control for Home Cleaning Staff

Employee cleaners typically receive comprehensive training programs provided by the cleaning company, ensuring standardized techniques and adherence to safety protocols. Independent contractors often vary in training quality, leading to inconsistent service levels and challenges in enforcing uniform quality control. Regular supervision and performance evaluations are more effective with employee staff, resulting in higher accountability and consistent home cleaning outcomes.

Tax Implications for Businesses: Employees vs Contractors

Classifying home cleaning workers as employees requires businesses to handle payroll taxes, including Social Security, Medicare, and unemployment taxes, increasing overall tax liability and administrative responsibilities. Independent contractors relieve businesses from withholding taxes and paying employment benefits but necessitate strict compliance with IRS guidelines to avoid misclassification penalties. Properly distinguishing between employee cleaners and contractors is critical to align tax reporting obligations and reduce risks of audits or fines.

Flexibility and Availability: Which Model Suits Your Business?

Employee cleaners offer consistent availability and a structured schedule, ensuring reliable service for clients who require regular home cleaning. Independent contractors provide greater flexibility, allowing businesses to scale their workforce based on fluctuating demand and handle peak cleaning periods efficiently. Choosing between these models depends on prioritizing either steady workforce control or adaptive staffing to optimize service delivery and operational costs.

Liability and Insurance: Protecting Your Cleaning Business

Employee cleaners offer greater liability protection since businesses can provide workers' compensation and liability insurance, reducing financial risks from accidents or damages. Independent contractors require cleaning businesses to verify their insurance coverage individually, potentially leaving gaps in liability protection and increasing the risk of costly claims. Ensuring comprehensive insurance policies and proper classification of workers is essential to safeguarding a home cleaning business from legal and financial liabilities.

Impact on Company Culture and Team Dynamics

Employee cleaners foster a unified company culture by adhering to shared values, consistent training, and standardized procedures, which enhances teamwork and accountability. Independent contractors often work autonomously, resulting in less interaction and collaboration that can fragment team dynamics and weaken a cohesive organizational identity. Prioritizing employee cleaners helps cultivate a collaborative environment, driving improved service quality and stronger brand loyalty.

Long-Term Growth: Scalability with Employees or Contractors

Home cleaning businesses experience long-term growth differently when scaling with employee cleaners versus independent contractors. Employing cleaners allows for greater control over training, quality assurance, and scheduling, which supports consistent service standards essential for brand reputation and customer retention. Independent contractors offer flexibility and lower overhead costs but pose challenges in maintaining uniform quality and reliability, potentially hindering scalable growth and customer loyalty.

Making the Right Choice: Key Factors to Consider

Choosing between employee cleaners and independent contractors hinges on factors like control over work schedules, quality assurance, and legal responsibilities. Employee cleaners offer consistent reliability and stricter oversight, while independent contractors provide flexibility and potential cost savings. Understanding state labor laws, tax implications, and the nature of your cleaning needs ensures the optimal decision for maintaining a spotless home.

Employee cleaners vs independent contractors Infographic

bizdif.com

bizdif.com