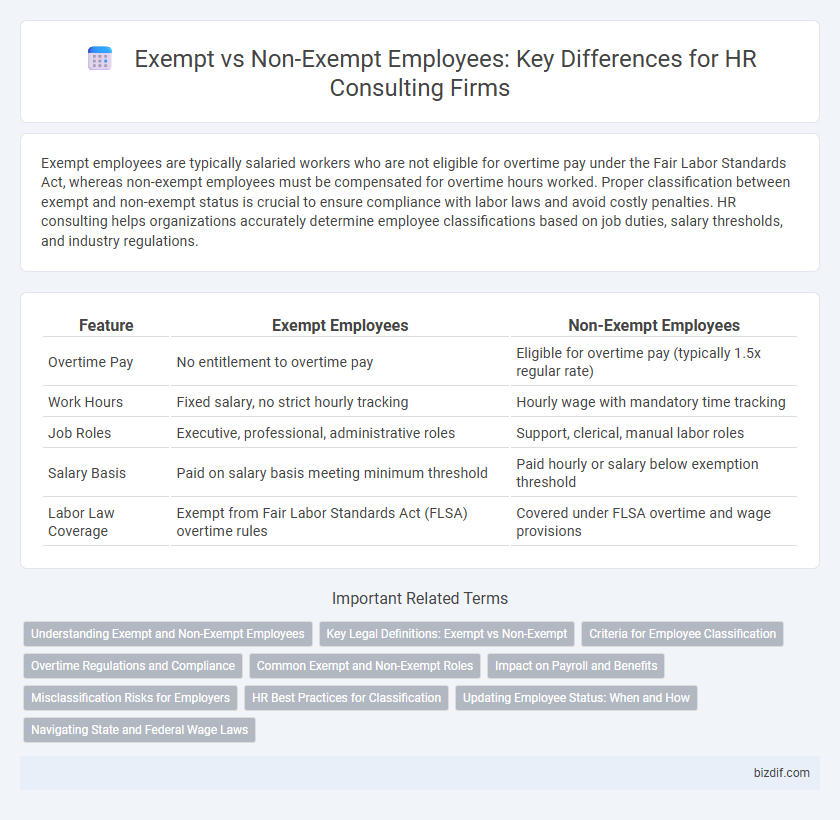

Exempt employees are typically salaried workers who are not eligible for overtime pay under the Fair Labor Standards Act, whereas non-exempt employees must be compensated for overtime hours worked. Proper classification between exempt and non-exempt status is crucial to ensure compliance with labor laws and avoid costly penalties. HR consulting helps organizations accurately determine employee classifications based on job duties, salary thresholds, and industry regulations.

Table of Comparison

| Feature | Exempt Employees | Non-Exempt Employees |

|---|---|---|

| Overtime Pay | No entitlement to overtime pay | Eligible for overtime pay (typically 1.5x regular rate) |

| Work Hours | Fixed salary, no strict hourly tracking | Hourly wage with mandatory time tracking |

| Job Roles | Executive, professional, administrative roles | Support, clerical, manual labor roles |

| Salary Basis | Paid on salary basis meeting minimum threshold | Paid hourly or salary below exemption threshold |

| Labor Law Coverage | Exempt from Fair Labor Standards Act (FLSA) overtime rules | Covered under FLSA overtime and wage provisions |

Understanding Exempt and Non-Exempt Employees

Exempt employees are salaried workers who are not eligible for overtime pay under the Fair Labor Standards Act (FLSA), typically including roles in executive, administrative, or professional capacities. Non-exempt employees are usually paid hourly and must receive overtime compensation for hours worked beyond 40 in a workweek, ensuring wage protections. Proper classification between exempt and non-exempt employees is critical for compliance with labor laws and avoiding costly penalties.

Key Legal Definitions: Exempt vs Non-Exempt

Exempt employees are defined by the Fair Labor Standards Act (FLSA) as those who meet specific salary thresholds and job duty criteria, making them ineligible for overtime pay. Non-exempt employees do not meet these criteria and are entitled to overtime compensation for hours worked beyond 40 in a workweek. Key legal definitions hinge on the employee's job duties, salary basis, and minimum wage requirements to classify them correctly under federal and state labor laws.

Criteria for Employee Classification

Employee classification between exempt and non-exempt hinges on specific criteria established by the Fair Labor Standards Act (FLSA), including salary level, salary basis, and job duties. Exempt employees typically earn a minimum weekly salary of $684 and perform executive, administrative, or professional duties as defined by the Department of Labor. Non-exempt employees are entitled to overtime pay and usually perform work that does not meet these salary thresholds or prescribed job responsibilities.

Overtime Regulations and Compliance

Exempt employees are typically salaried professionals exempt from overtime pay under the Fair Labor Standards Act (FLSA), while non-exempt employees are entitled to overtime wages for hours worked beyond 40 per week. HR consulting services ensure organizations classify employees correctly to comply with overtime regulations, minimizing legal risks and financial penalties. Understanding wage and hour laws, recordkeeping requirements, and state-specific overtime rules is crucial for maintaining compliance and protecting employer interests.

Common Exempt and Non-Exempt Roles

Common exempt roles typically include executive, administrative, professional, and outside sales positions, which are salaried and not eligible for overtime pay under the Fair Labor Standards Act (FLSA). Non-exempt roles often encompass hourly jobs such as clerical staff, technicians, and laborers, who must be paid overtime for hours worked beyond 40 per week. Accurate classification ensures compliance with wage and hour laws and helps avoid costly legal disputes.

Impact on Payroll and Benefits

Understanding the distinction between exempt and non-exempt employees is crucial for accurate payroll processing and compliance with labor laws. Exempt employees are paid a fixed salary and are not eligible for overtime, while non-exempt employees must be paid hourly with mandated overtime for hours worked beyond 40 per week. This classification directly impacts benefit eligibility, payroll calculations, and overall labor cost management within organizations.

Misclassification Risks for Employers

Misclassifying exempt and non-exempt employees exposes employers to significant legal and financial risks, including back pay for unpaid overtime, penalties, and litigation costs. Properly distinguishing between roles according to the Fair Labor Standards Act (FLSA) criteria mitigates potential violations related to wage and hour laws. HR consulting services help organizations implement accurate classification systems, ensuring compliance and reducing liability.

HR Best Practices for Classification

Proper classification of exempt vs non-exempt employees is crucial to comply with the Fair Labor Standards Act (FLSA) and avoid costly legal penalties. HR best practices include conducting thorough job analyses to determine eligibility based on salary basis, job duties, and salary threshold criteria outlined by the Department of Labor. Regular audits and updated training for HR staff ensure accurate classification, preventing wage and hour violations while optimizing workforce management.

Updating Employee Status: When and How

Updating employee status from non-exempt to exempt, or vice versa, requires careful adherence to the Fair Labor Standards Act (FLSA) and state labor laws to ensure compliance with wage and hour regulations. HR professionals must conduct thorough job evaluations and document changes in job duties, salary thresholds, and exemption criteria before implementing status updates. Timely communication with payroll and accurate record-keeping are essential to avoid legal risks and ensure proper employee compensation.

Navigating State and Federal Wage Laws

Understanding the distinction between exempt and non-exempt employees is crucial for HR compliance with state and federal wage laws, as exempt employees are typically salaried and not entitled to overtime pay, while non-exempt employees must receive overtime compensation under the Fair Labor Standards Act (FLSA). State wage and hour laws may impose stricter regulations than federal standards, requiring HR professionals to stay informed about variations in minimum wage, overtime thresholds, and mandatory breaks across jurisdictions. Accurate classification helps mitigate legal risks, ensures proper payroll processing, and maintains adherence to Department of Labor guidelines.

Exempt vs Non-Exempt Employees Infographic

bizdif.com

bizdif.com