Payroll outsourcing offers HR consulting pet businesses specialized expertise and reduces administrative burdens, allowing better focus on core operations. In-house payroll provides direct control over employee payment processes but requires significant time and resources to manage compliance and accuracy. Choosing between these options depends on the company's size, budget, and preference for control versus convenience.

Table of Comparison

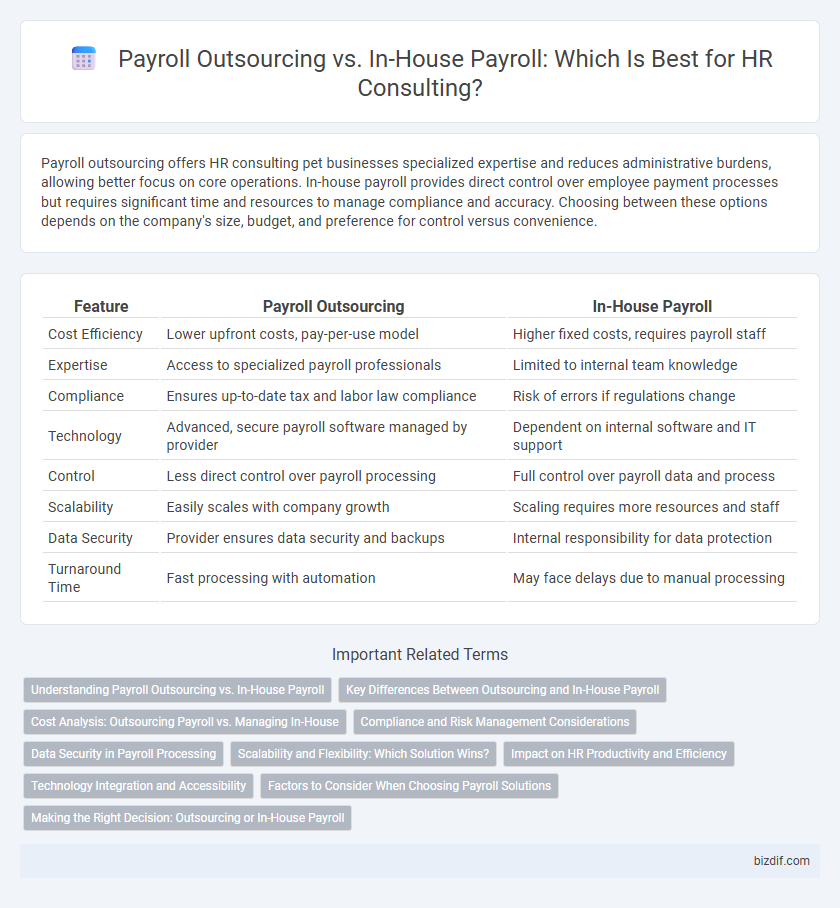

| Feature | Payroll Outsourcing | In-House Payroll |

|---|---|---|

| Cost Efficiency | Lower upfront costs, pay-per-use model | Higher fixed costs, requires payroll staff |

| Expertise | Access to specialized payroll professionals | Limited to internal team knowledge |

| Compliance | Ensures up-to-date tax and labor law compliance | Risk of errors if regulations change |

| Technology | Advanced, secure payroll software managed by provider | Dependent on internal software and IT support |

| Control | Less direct control over payroll processing | Full control over payroll data and process |

| Scalability | Easily scales with company growth | Scaling requires more resources and staff |

| Data Security | Provider ensures data security and backups | Internal responsibility for data protection |

| Turnaround Time | Fast processing with automation | May face delays due to manual processing |

Understanding Payroll Outsourcing vs. In-House Payroll

Payroll outsourcing offers HR departments access to specialized expertise, advanced technology, and compliance support, reducing the risk of errors and penalties. In-house payroll provides direct control and immediate access to payroll data but requires dedicated staff, ongoing training, and investment in payroll software. Evaluating total costs, scalability, data security, and regulatory compliance helps organizations determine the best payroll management approach.

Key Differences Between Outsourcing and In-House Payroll

Payroll outsourcing offers access to specialized expertise, advanced technology, and compliance management, reducing the risk of costly errors and penalties. In-house payroll provides greater control and direct oversight but requires significant investment in software, training, and ongoing administrative workload. Key differences include cost structure, scalability, compliance responsibility, and data security management, impacting overall efficiency and risk exposure for businesses.

Cost Analysis: Outsourcing Payroll vs. Managing In-House

Outsourcing payroll typically reduces overhead costs by eliminating the need for dedicated staff, software licenses, and ongoing training expenses associated with in-house payroll management. Third-party providers leverage economies of scale, offering competitive fixed fees that often undercut the total cost of maintaining internal payroll systems. While in-house payroll allows for direct control, the cumulative expenses of personnel, technology upgrades, and compliance risks usually make outsourcing a more cost-effective solution for many organizations.

Compliance and Risk Management Considerations

Payroll outsourcing offers specialized expertise in compliance with evolving tax laws and labor regulations, minimizing the risk of costly penalties and audits. In-house payroll requires dedicated resources to stay updated on legal changes and maintain accurate records, increasing the potential for human error and regulatory non-compliance. Effective risk management in payroll processes hinges on thorough knowledge of statutory requirements and robust internal controls, which outsourcing partners typically provide through advanced compliance systems.

Data Security in Payroll Processing

Outsourcing payroll to specialized HR consulting firms enhances data security through advanced encryption protocols and dedicated cybersecurity teams, minimizing risks of data breaches. In-house payroll processing may lack robust security infrastructure and continuous monitoring, increasing vulnerability to internal and external threats. Choosing payroll outsourcing ensures compliance with data protection regulations such as GDPR and HIPAA, safeguarding sensitive employee information effectively.

Scalability and Flexibility: Which Solution Wins?

Payroll outsourcing offers superior scalability and flexibility, adapting quickly to fluctuating workforce sizes and complex payroll requirements without the need for additional internal resources. In-house payroll may struggle with scalability during rapid growth or seasonal variations due to limited staff and infrastructure constraints. Companies seeking dynamic, cost-effective payroll management often find outsourcing to be the optimal solution for maintaining operational agility.

Impact on HR Productivity and Efficiency

Payroll outsourcing significantly enhances HR productivity by reducing administrative burdens and minimizing errors, allowing HR teams to focus on strategic initiatives. In-house payroll management often demands considerable time and resources, potentially diverting attention from core HR functions and slowing overall efficiency. Leveraging outsourced payroll solutions can streamline processes, ensure compliance, and improve data accuracy, ultimately leading to greater operational effectiveness within the HR department.

Technology Integration and Accessibility

Payroll outsourcing leverages advanced cloud-based platforms that ensure seamless technology integration, providing real-time data access and automated compliance updates. In-house payroll often struggles with outdated software and limited scalability, hindering accessibility for remote teams and timely reporting. Outsourced solutions enhance security protocols and offer mobile-friendly interfaces, improving efficiency and accessibility across global workforces.

Factors to Consider When Choosing Payroll Solutions

Evaluating payroll outsourcing versus in-house payroll requires analyzing factors such as cost efficiency, compliance complexity, and scalability to match organizational growth. Payroll outsourcing offers expert management of tax filing, benefits administration, and regulatory updates, reducing internal errors and legal risks. In contrast, in-house payroll provides greater control and customization but demands dedicated HR resources and continuous training to stay compliant with evolving labor laws.

Making the Right Decision: Outsourcing or In-House Payroll

Choosing between payroll outsourcing and in-house payroll requires evaluating factors such as cost efficiency, compliance risk, and internal expertise. Payroll outsourcing firms offer advanced technology, reduced errors, and updated regulatory knowledge, which can minimize legal penalties and administrative burden. In-house payroll may provide greater control and immediate access to sensitive data but demands dedicated staff and ongoing training to manage complex tax laws and ensure accuracy.

Payroll outsourcing vs in-house payroll Infographic

bizdif.com

bizdif.com