Payroll outsourcing specializes in managing employee payroll functions, ensuring accurate salary processing, tax compliance, and timely payments, which reduces administrative burdens for businesses. In contrast, a Professional Employer Organization (PEO) offers comprehensive HR services, including payroll, benefits administration, risk management, and regulatory compliance, acting as a co-employer to provide broader workforce solutions. Choosing between payroll outsourcing and a PEO depends on a company's need for either focused payroll management or extensive HR support and shared employment responsibilities.

Table of Comparison

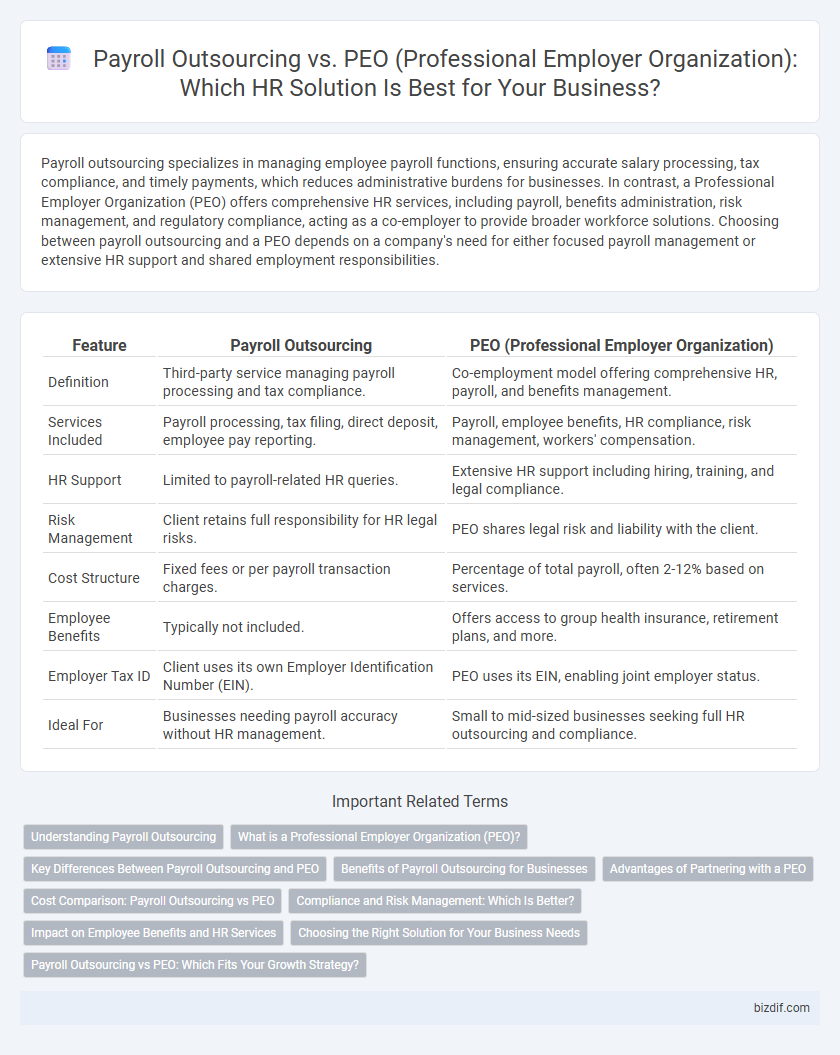

| Feature | Payroll Outsourcing | PEO (Professional Employer Organization) |

|---|---|---|

| Definition | Third-party service managing payroll processing and tax compliance. | Co-employment model offering comprehensive HR, payroll, and benefits management. |

| Services Included | Payroll processing, tax filing, direct deposit, employee pay reporting. | Payroll, employee benefits, HR compliance, risk management, workers' compensation. |

| HR Support | Limited to payroll-related HR queries. | Extensive HR support including hiring, training, and legal compliance. |

| Risk Management | Client retains full responsibility for HR legal risks. | PEO shares legal risk and liability with the client. |

| Cost Structure | Fixed fees or per payroll transaction charges. | Percentage of total payroll, often 2-12% based on services. |

| Employee Benefits | Typically not included. | Offers access to group health insurance, retirement plans, and more. |

| Employer Tax ID | Client uses its own Employer Identification Number (EIN). | PEO uses its EIN, enabling joint employer status. |

| Ideal For | Businesses needing payroll accuracy without HR management. | Small to mid-sized businesses seeking full HR outsourcing and compliance. |

Understanding Payroll Outsourcing

Payroll outsourcing involves delegating all payroll processing tasks to an external service provider who manages employee wage calculations, tax withholdings, and compliance with government regulations. This approach ensures accurate, timely payroll management while reducing administrative burden and minimizing the risk of penalties related to tax filings and labor law compliance. Companies benefit from specialized expertise, enhanced data security, and scalability without the need to invest in in-house payroll infrastructure.

What is a Professional Employer Organization (PEO)?

A Professional Employer Organization (PEO) is a comprehensive HR service provider that manages payroll, benefits administration, compliance, and employee risk management for businesses. By entering into a co-employment relationship, the PEO handles critical HR functions while allowing companies to maintain control over daily operations. Utilizing a PEO can improve regulatory compliance, reduce administrative burdens, and provide access to better employee benefits typically available to larger organizations.

Key Differences Between Payroll Outsourcing and PEO

Payroll outsourcing exclusively manages employee wage processing, tax filings, and compliance, whereas a Professional Employer Organization (PEO) offers comprehensive HR solutions including employee benefits administration, risk management, and regulatory compliance. PEOs assume co-employer status, sharing legal responsibilities and liability for employment-related issues, unlike payroll outsourcing services that do not engage in employer responsibilities. Cost structures differ, with payroll outsourcing generally priced per payroll transaction and PEOs charging a percentage of total payroll, reflecting their broader scope of services.

Benefits of Payroll Outsourcing for Businesses

Payroll outsourcing streamlines salary processing by reducing administrative burdens and ensuring compliance with tax regulations, which minimizes risks of costly errors and penalties. Businesses benefit from enhanced data security and timely payroll delivery through specialized provider expertise. Cost efficiency is improved as companies avoid investing in payroll software and dedicated personnel, allowing them to focus resources on core operations.

Advantages of Partnering with a PEO

Partnering with a Professional Employer Organization (PEO) offers comprehensive HR solutions including streamlined payroll processing, tax compliance, and employee benefits administration under a single platform. PEOs enable businesses to reduce administrative burdens, minimize legal risks, and access competitive health insurance and retirement plans that are typically available to larger companies. This integrated support helps improve workforce management, enhances employee satisfaction, and allows companies to focus on core business growth.

Cost Comparison: Payroll Outsourcing vs PEO

Payroll outsourcing typically incurs lower upfront costs with a straightforward fee structure based on payroll volume, making it cost-effective for companies focused solely on payroll processing. PEO services, while more expensive due to bundled HR functions such as benefits administration and compliance support, can provide greater overall value by reducing indirect costs associated with human resources management. Analyzing total cost of ownership reveals payroll outsourcing favors companies seeking simplicity and transparency, whereas PEOs suit businesses prioritizing comprehensive HR solutions despite higher fees.

Compliance and Risk Management: Which Is Better?

Payroll outsourcing ensures precise tax filing and wage calculations, reducing compliance errors through specialized software and expert oversight. Professional Employer Organizations (PEOs) offer comprehensive risk management by co-employing staff, sharing liability for employment laws, benefits administration, and workers' compensation. While payroll outsourcing handles routine payroll compliance, PEOs provide broader legal protection and proactive mitigation of employment-related risks.

Impact on Employee Benefits and HR Services

Payroll outsourcing primarily handles salary processing and tax compliance, offering limited support for employee benefits management. A Professional Employer Organization (PEO) extends beyond payroll by co-employing staff, providing comprehensive HR services such as benefits administration, workers' compensation, and regulatory compliance. Utilizing a PEO can enhance employee benefits offerings and streamline HR operations, leading to improved workforce satisfaction and reduced administrative burdens for employers.

Choosing the Right Solution for Your Business Needs

Payroll outsourcing offers streamlined management of employee compensation, tax compliance, and reporting, ideal for businesses seeking to reduce administrative burden while maintaining control over HR functions. Professional Employer Organizations (PEOs) provide comprehensive HR solutions including payroll, benefits administration, risk management, and regulatory compliance by entering a co-employment relationship with the client. Selecting the right solution depends on factors such as company size, desired level of HR support, budget constraints, and the need for integrated employee benefits and regulatory assistance.

Payroll Outsourcing vs PEO: Which Fits Your Growth Strategy?

Payroll outsourcing streamlines employee salary processing by entrusting payroll functions to specialized providers, ensuring accuracy and compliance while allowing businesses to maintain full control over HR policies. In contrast, a Professional Employer Organization (PEO) offers comprehensive HR management, including payroll, benefits administration, risk management, and regulatory compliance, effectively co-employing workers to share responsibilities and liabilities. Choosing between payroll outsourcing and a PEO depends on your company's growth trajectory, desired level of HR support, and the need for scalable workforce solutions aligned with strategic expansion goals.

Payroll Outsourcing vs PEO (Professional Employer Organization) Infographic

bizdif.com

bizdif.com