One-time payment options for online course creation provide instant access and simplicity, making budget management easier for customers. Payment plans increase affordability by spreading costs over time, attracting a wider audience and reducing financial barriers. Choosing the right pricing strategy impacts enrollment rates and overall revenue for your online course business.

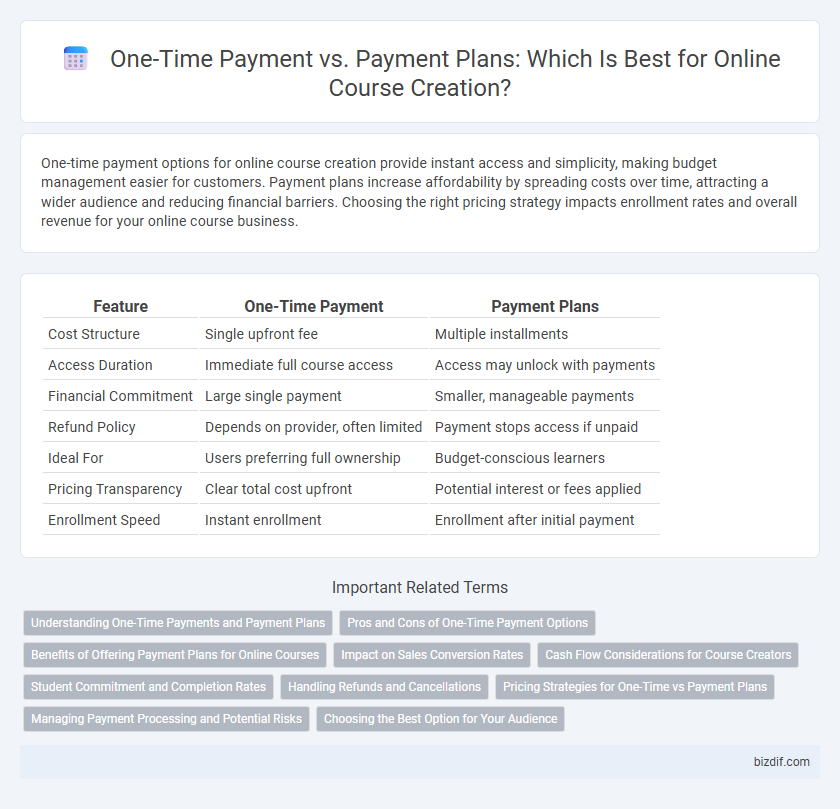

Table of Comparison

| Feature | One-Time Payment | Payment Plans |

|---|---|---|

| Cost Structure | Single upfront fee | Multiple installments |

| Access Duration | Immediate full course access | Access may unlock with payments |

| Financial Commitment | Large single payment | Smaller, manageable payments |

| Refund Policy | Depends on provider, often limited | Payment stops access if unpaid |

| Ideal For | Users preferring full ownership | Budget-conscious learners |

| Pricing Transparency | Clear total cost upfront | Potential interest or fees applied |

| Enrollment Speed | Instant enrollment | Enrollment after initial payment |

Understanding One-Time Payments and Payment Plans

One-time payments offer immediate full access to online courses, simplifying budgeting and eliminating recurring charges, which appeals to learners seeking straightforward transactions. Payment plans distribute the course fee into smaller, manageable installments, increasing affordability and attracting a broader audience by reducing upfront costs. Choosing between these options depends on customer cash flow preferences and the instructor's goal to maximize enrollment and revenue stability.

Pros and Cons of One-Time Payment Options

One-time payment options for online courses provide immediate revenue and simplify the purchasing process, reducing friction for buyers who prefer a single, upfront transaction. This method eliminates ongoing billing concerns and potential payment failures, ensuring full payment is received without administrative overhead. However, it can deter potential students unwilling to make a large initial financial commitment and limits the instructor's ability to generate recurring income through installment plans.

Benefits of Offering Payment Plans for Online Courses

Offering payment plans for online courses significantly increases enrollment by lowering the financial barrier for potential students, making education more accessible. Payment plans encourage higher completion rates by reducing immediate financial stress and allowing learners to focus on course content without worrying about upfront costs. Flexible payment options also improve cash flow predictability for course creators, fostering long-term student relationships and overall revenue growth.

Impact on Sales Conversion Rates

Offering a one-time payment option often boosts sales conversion rates by appealing to customers who prefer to avoid ongoing financial commitments. Payment plans can increase accessibility, attracting budget-conscious buyers and expanding the potential customer base, which may lead to a higher volume of sales transactions. Balancing these options enables course creators to address diverse purchasing preferences, optimizing overall conversion performance.

Cash Flow Considerations for Course Creators

One-time payments provide immediate cash flow, enabling course creators to reinvest in marketing and course development quickly. Payment plans offer steady, predictable income over time, reducing financial strain but delaying full revenue access. Balancing both methods can optimize cash flow management and support sustainable business growth in online course creation.

Student Commitment and Completion Rates

One-time payments tend to increase student commitment by requiring full upfront investment, which correlates with higher course completion rates as learners feel more accountable for their purchase. Payment plans can lower financial barriers, attracting a broader audience, but may result in lower commitment and increased dropout rates due to ongoing financial obligations. Data from multiple e-learning platforms show a 20% higher completion rate among students who make one-time payments compared to those using installment plans.

Handling Refunds and Cancellations

One-time payments simplify refund and cancellation processes by providing a clear transaction history and a straightforward refund policy, reducing administrative complexity. Payment plans require detailed tracking of installment payments, making prorated refunds and partial cancellations more complex to manage. Effective refund handling in both models depends on transparent policies that balance customer satisfaction with financial risk management.

Pricing Strategies for One-Time vs Payment Plans

One-time payment pricing offers simplicity and immediate revenue, appealing to buyers seeking full access without recurring commitments, typically resulting in higher upfront cash flow. Payment plans increase affordability and attract a broader audience by dividing the total cost into manageable installments, improving enrollment rates and customer retention. Balancing these strategies involves analyzing customer purchasing behavior, cash flow needs, and competitive market pricing to optimize revenue and scalability in online course creation.

Managing Payment Processing and Potential Risks

One-time payments simplify payment processing by reducing transaction frequency and minimizing administrative overhead, lowering the chance of technical errors or missed payments. Payment plans spread revenue over time but increase the complexity of payment management, requiring robust systems to handle recurring billing and potential defaults. Effective management of payment processing includes monitoring transaction success rates and implementing safeguards to mitigate risks such as chargebacks and fraud, crucial for maintaining cash flow stability in online course creation.

Choosing the Best Option for Your Audience

Offering a one-time payment option provides simplicity and immediate access, catering to learners who prefer a straightforward transaction without ongoing commitments. Payment plans increase affordability by spreading the cost over time, which can attract budget-conscious students and boost enrollment rates. Analyzing your audience's financial preferences and behavior using tools like surveys or A/B testing helps determine the optimal pricing strategy to maximize conversions and learner satisfaction.

One-Time Payment vs Payment Plans Infographic

bizdif.com

bizdif.com