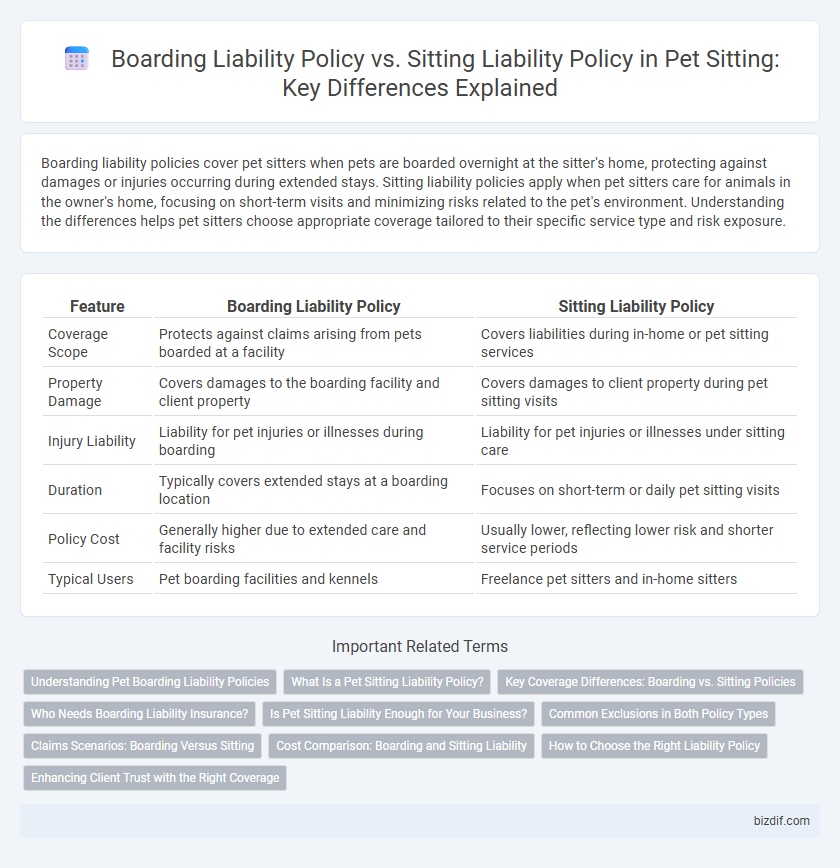

Boarding liability policies cover pet sitters when pets are boarded overnight at the sitter's home, protecting against damages or injuries occurring during extended stays. Sitting liability policies apply when pet sitters care for animals in the owner's home, focusing on short-term visits and minimizing risks related to the pet's environment. Understanding the differences helps pet sitters choose appropriate coverage tailored to their specific service type and risk exposure.

Table of Comparison

| Feature | Boarding Liability Policy | Sitting Liability Policy |

|---|---|---|

| Coverage Scope | Protects against claims arising from pets boarded at a facility | Covers liabilities during in-home or pet sitting services |

| Property Damage | Covers damages to the boarding facility and client property | Covers damages to client property during pet sitting visits |

| Injury Liability | Liability for pet injuries or illnesses during boarding | Liability for pet injuries or illnesses under sitting care |

| Duration | Typically covers extended stays at a boarding location | Focuses on short-term or daily pet sitting visits |

| Policy Cost | Generally higher due to extended care and facility risks | Usually lower, reflecting lower risk and shorter service periods |

| Typical Users | Pet boarding facilities and kennels | Freelance pet sitters and in-home sitters |

Understanding Pet Boarding Liability Policies

Pet boarding liability policies specifically cover risks associated with housing pets overnight or for extended stays, protecting against potential property damage, pet injury, or escape incidents during boarding. In contrast, pet sitting liability policies typically address shorter-term, in-home care with coverage tailored to activities like feeding, walking, and companionship. Understanding pet boarding liability policies involves recognizing their broader scope for extended care environments, higher liability limits for continuous supervision, and specific clauses for damage to property or pets while in your care.

What Is a Pet Sitting Liability Policy?

A pet sitting liability policy provides coverage for pet sitters against claims of injury, property damage, or negligence while caring for pets in clients' homes, ensuring financial protection if an incident occurs. Boarding liability policies specifically cover risks associated with housing pets overnight at a facility or sitter's home, addressing potential illnesses, injuries, or escape during extended stays. Understanding the distinction helps pet sitters choose the appropriate insurance to safeguard their business based on whether pets are cared for on-site or in a dedicated boarding environment.

Key Coverage Differences: Boarding vs. Sitting Policies

Boarding liability policies typically provide coverage for extended stays where pets are housed on-premises, addressing risks such as property damage, injury to pets, and potential disease transmission over longer periods. Sitting liability policies focus on short-term care, often in the pet owner's home, covering incidents like pet escape, injury during walks, and immediate medical emergencies. Key coverage differences include the scope of property coverage, duration of care, and specific liabilities related to off-site activities versus on-site accommodation.

Who Needs Boarding Liability Insurance?

Boarding liability insurance is essential for pet boarding facilities that care for multiple animals on their premises, providing coverage for accidents, injuries, or illnesses that occur during the pet's stay. Pet sitters who provide services in the owner's home typically require sitting liability insurance, which focuses on incidents that happen under their direct supervision. Boarding liability insurance is critical for kennels, pet hotels, and similar businesses to protect against claims related to property damage, injury, or loss while pets are housed at their facility.

Is Pet Sitting Liability Enough for Your Business?

Pet sitting liability policies typically cover services performed in the pet sitter's or client's home, while boarding liability policies address risks associated with keeping pets overnight at a facility. Businesses offering extended stays or multiple pet care services may require boarding liability to ensure comprehensive protection against injury, illness, or property damage claims. Evaluating the scope of your pet care services is crucial to determine if a pet sitting liability policy alone provides sufficient coverage for your business operations.

Common Exclusions in Both Policy Types

Common exclusions in both boarding liability policies and sitting liability policies often include pre-existing pet illnesses, intentional harm caused by the pet sitter, and damage resulting from natural disasters or acts of God. These policies typically do not cover incidents related to pet theft, loss, or escape, nor do they cover injuries or damages occurring outside the agreed services or premises. Understanding these exclusions is essential for pet sitters to manage risk and ensure adequate coverage while providing care.

Claims Scenarios: Boarding Versus Sitting

Boarding liability policies cover claims arising from injuries or illnesses pets sustain while staying at the sitter's premises, including property damage or escape incidents. Sitting liability policies typically address incidents occurring at the owner's home, such as pet bites or accidents during daily care routines. Understanding these distinctions helps pet sitters manage risks and ensures appropriate coverage is in place for varied claims scenarios.

Cost Comparison: Boarding and Sitting Liability

Boarding liability policies typically incur higher premiums than sitting liability policies due to increased risks associated with housing multiple pets overnight in a facility. Sitting liability policies often cost less as they cover in-home care or short-term visits with fewer animals and reduced exposure to property damage or injury claims. Pet sitters should evaluate the cost-benefit by comparing the scope of coverage, limits, and deductibles tailored to their specific services to ensure adequate protection without overpaying.

How to Choose the Right Liability Policy

Selecting the right liability policy for pet sitting requires understanding the differences between boarding liability and sitting liability policies. Boarding liability policies typically cover risks associated with keeping pets overnight in a designated facility, while sitting liability policies focus on in-home pet care and daily visits. Assess the scope of services offered, property use, and potential risks to ensure the policy aligns with your pet sitting business activities and provides adequate protection.

Enhancing Client Trust with the Right Coverage

Boarding liability policies protect pet sitters during overnight stays at their own or clients' homes, covering property damage and pet injuries, while sitting liability policies focus on shorter visits, addressing risks during daily care. Selecting the appropriate insurance not only mitigates financial risks but also signals professionalism and reliability to clients. Clear communication of tailored coverage boosts client confidence, enhancing trust and fostering long-term relationships in pet sitting services.

Boarding liability policy vs Sitting liability policy Infographic

bizdif.com

bizdif.com