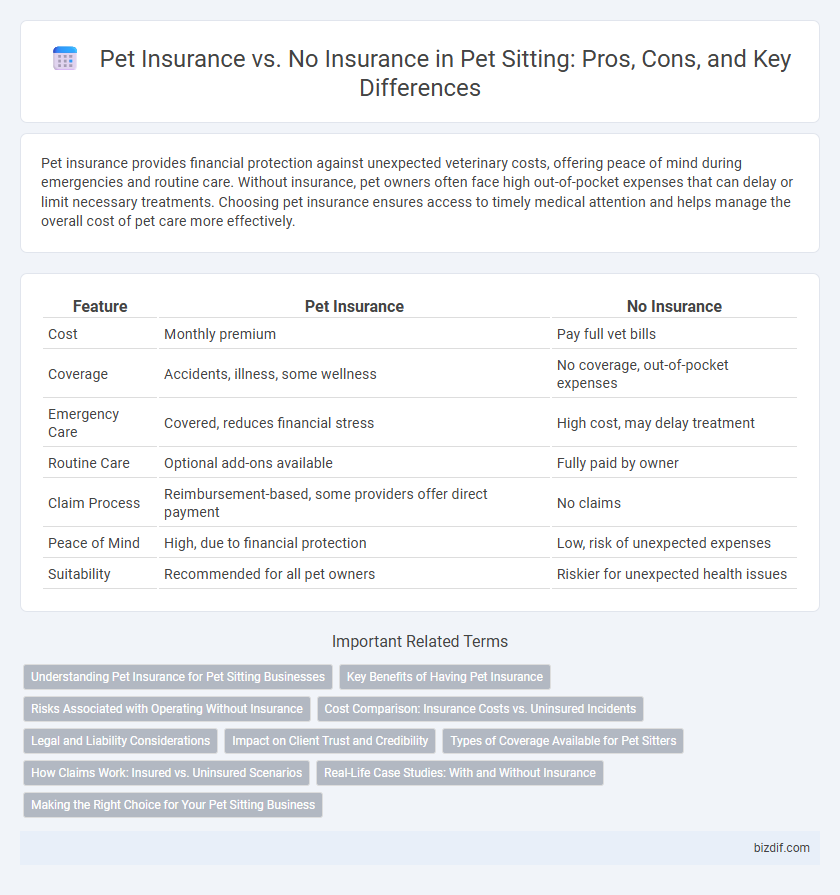

Pet insurance provides financial protection against unexpected veterinary costs, offering peace of mind during emergencies and routine care. Without insurance, pet owners often face high out-of-pocket expenses that can delay or limit necessary treatments. Choosing pet insurance ensures access to timely medical attention and helps manage the overall cost of pet care more effectively.

Table of Comparison

| Feature | Pet Insurance | No Insurance |

|---|---|---|

| Cost | Monthly premium | Pay full vet bills |

| Coverage | Accidents, illness, some wellness | No coverage, out-of-pocket expenses |

| Emergency Care | Covered, reduces financial stress | High cost, may delay treatment |

| Routine Care | Optional add-ons available | Fully paid by owner |

| Claim Process | Reimbursement-based, some providers offer direct payment | No claims |

| Peace of Mind | High, due to financial protection | Low, risk of unexpected expenses |

| Suitability | Recommended for all pet owners | Riskier for unexpected health issues |

Understanding Pet Insurance for Pet Sitting Businesses

Pet insurance provides essential financial protection for pet sitting businesses by covering unexpected veterinary expenses and minimizing liability risks associated with pet care. Without insurance, pet sitters bear full responsibility for emergency medical costs, which can lead to significant out-of-pocket expenses and potential legal claims. Understanding the benefits of pet insurance enables pet sitting businesses to offer trusted services while safeguarding their financial stability.

Key Benefits of Having Pet Insurance

Pet insurance provides financial protection against expensive veterinary bills, covering accidents, illnesses, and routine care to ensure pets receive timely medical attention without financial strain. It often includes benefits like coverage for hereditary conditions, emergency care, and prescription medications, which are typically costly without insurance. Having pet insurance offers peace of mind and promotes proactive health management, reducing stress during unexpected health events.

Risks Associated with Operating Without Insurance

Operating a pet sitting business without insurance exposes pet sitters to significant financial risks from accidents, injuries, or illnesses occurring under their care. Without proper coverage, costs related to veterinary bills, legal claims, or property damage can lead to substantial out-of-pocket expenses. Pet insurance safeguards pet sitters by mitigating liabilities and ensuring protection against unforeseen incidents that could otherwise jeopardize their business.

Cost Comparison: Insurance Costs vs. Uninsured Incidents

Pet insurance typically involves monthly premiums averaging $30 to $50, providing financial protection against unexpected veterinary bills that can exceed $1,000 per incident. Without insurance, pet owners face the full cost of emergencies such as surgeries or treatments, often leading to higher out-of-pocket expenses and potential financial strain. Comparing costs, insurance may save money in the long term by mitigating the risk of large, unforeseen veterinary expenses, despite the regular payment of premiums.

Legal and Liability Considerations

Pet insurance provides financial protection against unexpected veterinary expenses and reduces liability risks for pet sitters by covering injuries or illnesses that occur during the care period. Without insurance, pet sitters may face significant out-of-pocket costs and potential legal claims if a pet is injured, becomes ill, or causes harm to others. Understanding local regulations and having clear liability agreements can help mitigate legal risks, but insurance remains a critical safeguard for both pet owners and sitters.

Impact on Client Trust and Credibility

Pet insurance significantly enhances client trust and credibility by demonstrating a commitment to responsible pet care and risk management. Clients are more likely to choose pet sitters who offer insurance coverage, as it provides reassurance against unexpected medical expenses and potential liabilities. Without insurance, pet sitters risk losing credibility and client confidence, which can negatively impact their reputation and business growth.

Types of Coverage Available for Pet Sitters

Pet insurance for pet sitters typically includes coverage for accidental injuries, illnesses, and liability protection against damages or injuries caused by the pet during the sitting period. Without insurance, pet sitters assume full financial responsibility for veterinary bills and potential legal claims, which can be substantial depending on the severity of incidents. Selecting a comprehensive pet insurance plan mitigates risks by covering emergency care, theft, and third-party liability, ensuring both pet sitters and pet owners are protected.

How Claims Work: Insured vs. Uninsured Scenarios

Pet insurance claims involve submitting veterinary bills and documentation to the insurance provider, which then reimburses a percentage of the covered expenses according to the policy terms. Uninsured pet owners must pay out-of-pocket for all veterinary services, with no reimbursement or financial protection. Insured scenarios provide a structured claims process that can mitigate unexpected costs, while uninsured owners bear full financial risk during emergencies or routine care.

Real-Life Case Studies: With and Without Insurance

Pet insurance can significantly reduce out-of-pocket expenses during emergencies, as demonstrated by multiple real-life case studies where insured pet owners avoided thousands of dollars in vet bills for surgeries or treatments. In contrast, cases without insurance often highlight difficult decisions due to high costs, sometimes resulting in delayed care or financial hardship. These scenarios underscore the value of pet insurance in ensuring timely and comprehensive medical attention for pets.

Making the Right Choice for Your Pet Sitting Business

Choosing pet insurance for your pet sitting business protects against unexpected veterinary costs, ensuring financial stability when accidents or illnesses occur. Without insurance, you risk significant out-of-pocket expenses that can compromise your business's reputation and client trust. Evaluating coverage options and potential liabilities helps make an informed decision that balances cost with peace of mind for both you and your clients.

Pet insurance vs No insurance Infographic

bizdif.com

bizdif.com