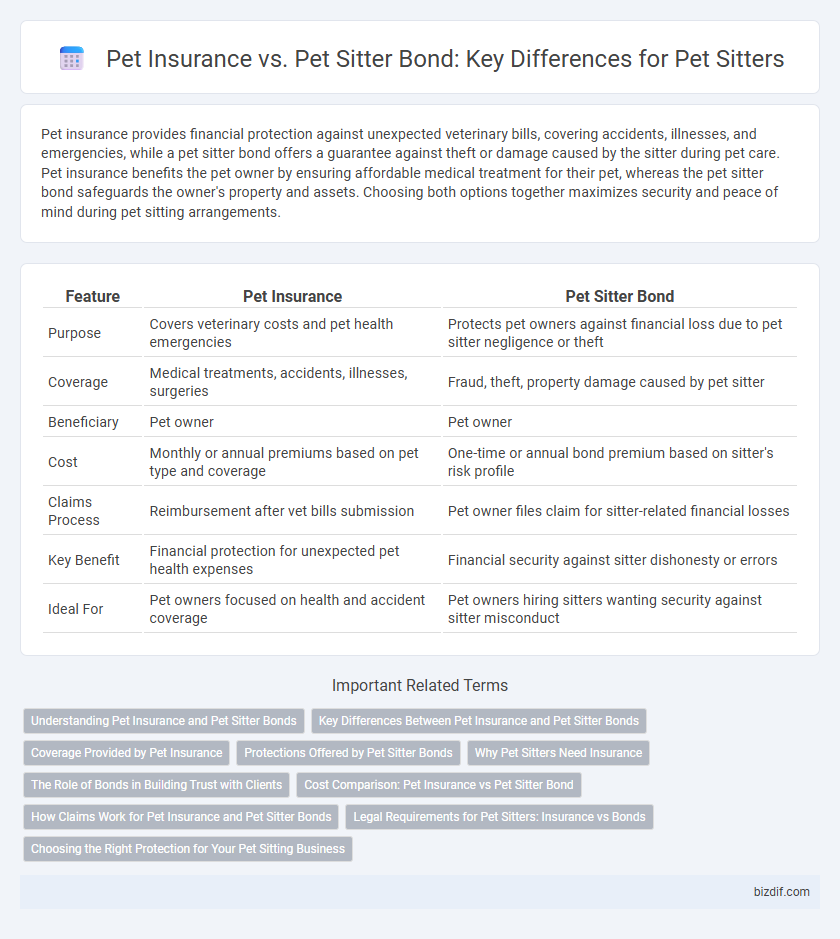

Pet insurance provides financial protection against unexpected veterinary bills, covering accidents, illnesses, and emergencies, while a pet sitter bond offers a guarantee against theft or damage caused by the sitter during pet care. Pet insurance benefits the pet owner by ensuring affordable medical treatment for their pet, whereas the pet sitter bond safeguards the owner's property and assets. Choosing both options together maximizes security and peace of mind during pet sitting arrangements.

Table of Comparison

| Feature | Pet Insurance | Pet Sitter Bond |

|---|---|---|

| Purpose | Covers veterinary costs and pet health emergencies | Protects pet owners against financial loss due to pet sitter negligence or theft |

| Coverage | Medical treatments, accidents, illnesses, surgeries | Fraud, theft, property damage caused by pet sitter |

| Beneficiary | Pet owner | Pet owner |

| Cost | Monthly or annual premiums based on pet type and coverage | One-time or annual bond premium based on sitter's risk profile |

| Claims Process | Reimbursement after vet bills submission | Pet owner files claim for sitter-related financial losses |

| Key Benefit | Financial protection for unexpected pet health expenses | Financial security against sitter dishonesty or errors |

| Ideal For | Pet owners focused on health and accident coverage | Pet owners hiring sitters wanting security against sitter misconduct |

Understanding Pet Insurance and Pet Sitter Bonds

Pet insurance provides financial coverage for veterinary expenses due to accidents, illnesses, or emergencies affecting pets, ensuring pet owners can afford necessary medical care. A pet sitter bond, on the other hand, protects pet owners from potential financial losses caused by negligence or misconduct by the pet sitter during their service. Understanding the distinctions between pet insurance and pet sitter bonds helps pet owners make informed decisions about safeguarding their pets' health and property during pet sitting arrangements.

Key Differences Between Pet Insurance and Pet Sitter Bonds

Pet insurance provides coverage for veterinary expenses related to illness, accidents, and preventive care, protecting the pet owner's financial responsibility. Pet sitter bonds offer financial protection against negligence, theft, or damage caused by the pet sitter during their services. Key differences include pet insurance focusing on the pet's health while pet sitter bonds cover potential liabilities and trustworthiness of the pet sitter.

Coverage Provided by Pet Insurance

Pet insurance covers veterinary expenses, including accidents, illnesses, and routine care, ensuring financial protection for unexpected medical costs. It reimburses pet owners for treatments, surgeries, and medications prescribed by licensed veterinarians. This coverage helps maintain pets' health without the burden of high out-of-pocket veterinary bills.

Protections Offered by Pet Sitter Bonds

Pet sitter bonds provide financial protection by covering losses caused by a pet sitter's dishonest actions, such as theft or property damage, safeguarding pet owners from potential risks. Unlike pet insurance, which covers health-related expenses for pets, pet sitter bonds specifically protect against negligence or misconduct during pet care services. This financial guarantee ensures pet owners receive compensation if their trusted sitter fails to uphold agreed responsibilities.

Why Pet Sitters Need Insurance

Pet sitters need insurance to protect against potential liabilities such as pet injuries, property damage, or client disputes that may occur during pet care. Pet insurance covers the pets' medical expenses, while a pet sitter bond safeguards the sitter against theft or financial loss claims. Having pet sitter insurance ensures comprehensive protection, fostering trust with clients and safeguarding the sitter's professional reputation.

The Role of Bonds in Building Trust with Clients

Pet sitter bonds play a critical role in building trust with clients by providing financial protection against theft, property damage, or negligence during pet care services. Unlike pet insurance, which covers the pet's health and medical expenses, a pet sitter bond safeguards clients' property and ensures accountability for the sitter's actions. This financial guarantee enhances client confidence and fosters long-term relationships in the pet sitting industry.

Cost Comparison: Pet Insurance vs Pet Sitter Bond

Pet insurance typically involves a monthly premium averaging $30 to $50, providing comprehensive coverage for medical emergencies, illnesses, and preventive care. A pet sitter bond, costing between $100 and $200 annually, offers financial protection against theft or damage caused by the sitter, but does not cover veterinary expenses. While pet insurance presents ongoing health-related financial security, a pet sitter bond is a cost-effective safeguard specifically for trust and liability issues during pet sitting services.

How Claims Work for Pet Insurance and Pet Sitter Bonds

Pet insurance claims cover veterinary expenses when a pet suffers illness or injury, requiring a detailed submission of medical records and receipts for reimbursement. Pet sitter bonds protect clients from financial loss caused by the sitter's negligence, theft, or damage, with claims handled through the bonding company after an investigation of the incident. Understanding the difference in claim processes helps pet owners decide between direct medical coverage and protection against service provider misconduct.

Legal Requirements for Pet Sitters: Insurance vs Bonds

Pet sitters must navigate legal requirements by understanding the distinction between pet insurance and pet sitter bonds; pet insurance protects against medical costs and liability claims related to pet care incidents, while pet sitter bonds offer financial protection to clients if the sitter causes theft or property damage. Many states do not mandate pet insurance but may require a surety bond to cover potential client losses and ensure trustworthiness in pet sitting contracts. Proper compliance with local regulations involves evaluating both options to safeguard the sitter's business and the pet owner's interests effectively.

Choosing the Right Protection for Your Pet Sitting Business

Selecting proper protection for a pet sitting business involves understanding the difference between pet insurance and a pet sitter bond. Pet insurance primarily covers the pet's medical expenses during care, while a pet sitter bond protects the business from financial losses caused by employee dishonesty or theft. Prioritizing a pet sitter bond ensures liability coverage for client property, whereas pet insurance safeguards the pet's health, making both essential based on specific business risks.

Pet insurance vs Pet sitter bond Infographic

bizdif.com

bizdif.com