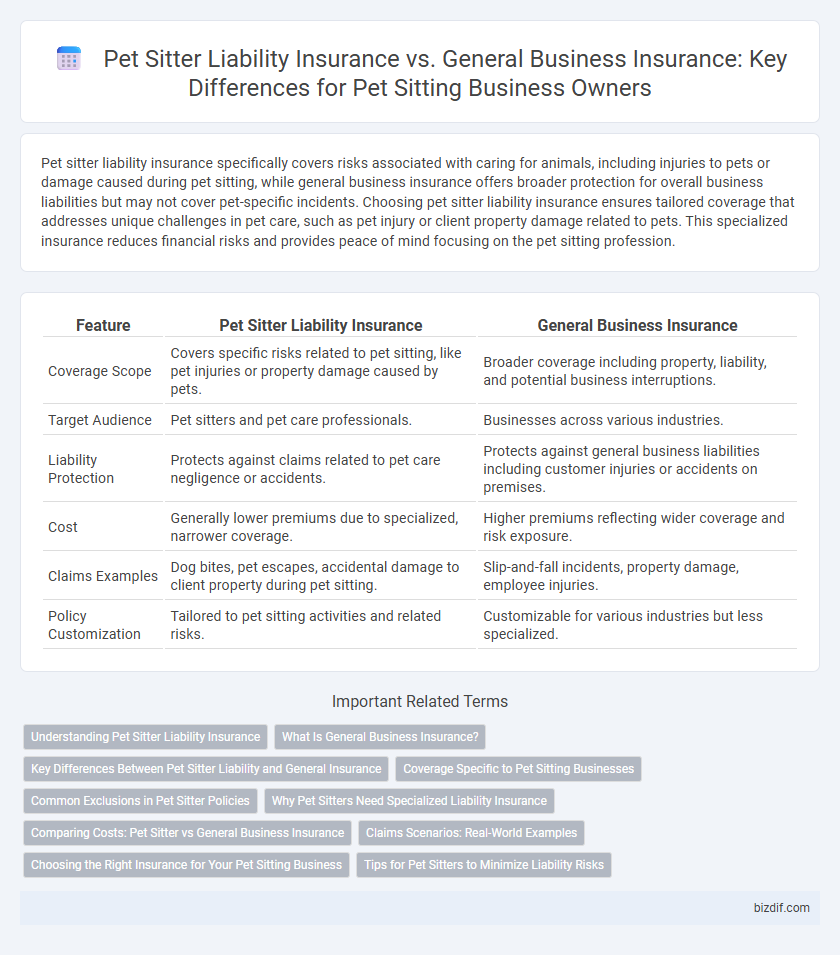

Pet sitter liability insurance specifically covers risks associated with caring for animals, including injuries to pets or damage caused during pet sitting, while general business insurance offers broader protection for overall business liabilities but may not cover pet-specific incidents. Choosing pet sitter liability insurance ensures tailored coverage that addresses unique challenges in pet care, such as pet injury or client property damage related to pets. This specialized insurance reduces financial risks and provides peace of mind focusing on the pet sitting profession.

Table of Comparison

| Feature | Pet Sitter Liability Insurance | General Business Insurance |

|---|---|---|

| Coverage Scope | Covers specific risks related to pet sitting, like pet injuries or property damage caused by pets. | Broader coverage including property, liability, and potential business interruptions. |

| Target Audience | Pet sitters and pet care professionals. | Businesses across various industries. |

| Liability Protection | Protects against claims related to pet care negligence or accidents. | Protects against general business liabilities including customer injuries or accidents on premises. |

| Cost | Generally lower premiums due to specialized, narrower coverage. | Higher premiums reflecting wider coverage and risk exposure. |

| Claims Examples | Dog bites, pet escapes, accidental damage to client property during pet sitting. | Slip-and-fall incidents, property damage, employee injuries. |

| Policy Customization | Tailored to pet sitting activities and related risks. | Customizable for various industries but less specialized. |

Understanding Pet Sitter Liability Insurance

Pet sitter liability insurance specifically protects pet sitters from claims related to injury, property damage, or negligence while caring for pets, covering incidents such as pet bites or accidents. General business insurance provides broader coverage but often lacks specialized protection for the unique risks pet sitters face, making pet sitter liability insurance essential for comprehensive risk management. Understanding the distinct scope and benefits of pet sitter liability insurance ensures professionals adequately safeguard their business and clients' pets.

What Is General Business Insurance?

General business insurance provides broad coverage designed to protect pet sitting businesses from various risks including property damage, legal claims, and employee-related issues. Unlike pet sitter liability insurance, which specifically covers injuries or damages caused by pets in the sitter's care, general business insurance encompasses multiple aspects such as business interruption, theft, and workers' compensation. Investing in general business insurance ensures comprehensive protection, safeguarding your pet sitting venture against diverse financial losses beyond pet-specific liabilities.

Key Differences Between Pet Sitter Liability and General Insurance

Pet sitter liability insurance specifically covers risks unique to pet care, such as animal bites, property damage caused by pets, and client injury claims. General business insurance offers broader protection, including coverage for property loss, employee injuries, and general liability unrelated to pet-specific incidents. Understanding these key differences helps pet sitters select appropriate policies to safeguard their specialized services efficiently.

Coverage Specific to Pet Sitting Businesses

Pet sitter liability insurance provides specialized coverage tailored to risks inherent in pet care, such as injury to pets, damage to client property, and boarding incidents. General business insurance offers broader protection but often lacks specific provisions for animal-related liabilities or pet behavioral issues. Choosing pet sitter liability insurance ensures comprehensive risk management designed explicitly for pet sitting businesses, including coverage for pet transportation and professional advice errors.

Common Exclusions in Pet Sitter Policies

Pet sitter liability insurance specifically covers risks related to pet care, such as pet injury, property damage caused by pets, and client disputes, but it often excludes coverage for employee injuries, professional errors, or damage unrelated to pets. General business insurance typically provides broader protection against risks like theft, business interruption, and general liability, yet may not cover pet-specific incidents or liabilities. Common exclusions in pet sitter policies include vehicular accidents when transporting pets, intentional harm, and illnesses pre-existing before pet care begins.

Why Pet Sitters Need Specialized Liability Insurance

Specialized pet sitter liability insurance provides tailored coverage for risks unique to pet care, such as pet injury, escape, or property damage caused by animals, which general business insurance often excludes. This specialized insurance protects pet sitters from financial losses tied to lawsuits or claims arising specifically from pet-related incidents. Without it, pet sitters may face uncovered liabilities that general business policies do not address, jeopardizing their professional and personal assets.

Comparing Costs: Pet Sitter vs General Business Insurance

Pet sitter liability insurance typically costs between $300 and $600 annually, providing coverage tailored to risks such as pet injuries or property damage during pet care. General business insurance averages $500 to $1,000 per year but covers a broader range of risks beyond pet-specific incidents. Choosing pet sitter liability insurance can be more cost-effective for professionals focusing solely on pet care services.

Claims Scenarios: Real-World Examples

Pet sitter liability insurance covers specific risks such as pet injury, property damage in clients' homes, or pet escape incidents often overlooked by general business insurance. For example, if a dog under a pet sitter's care causes harm to another pet or person, pet sitter liability insurance directly addresses claims related to these specialized situations. General business insurance may exclude these pet-specific claims, leaving pet sitters financially vulnerable in typical scenarios like pet bites or accidental pet loss.

Choosing the Right Insurance for Your Pet Sitting Business

Pet sitter liability insurance specifically covers claims related to pet injuries, property damage caused by pets, and veterinary expenses, providing tailored protection for pet sitting businesses. General business insurance offers broader coverage, including property damage, general liability, and business interruption, but may not address specific risks associated with pet care. Choosing the right insurance depends on evaluating risk exposure unique to pet sitting to ensure adequate protection and minimize financial loss.

Tips for Pet Sitters to Minimize Liability Risks

Pet sitter liability insurance specifically covers accidents, injuries, and property damage related to pet care, unlike general business insurance which offers broader but less targeted protection. Tips for minimizing liability risks include maintaining detailed pet care records, performing thorough client consultations, and using legally binding service agreements to outline responsibilities. Regularly updating certifications in pet first aid and safety can also reduce claim likelihood and demonstrate professionalism.

Pet sitter liability insurance vs General business insurance Infographic

bizdif.com

bizdif.com