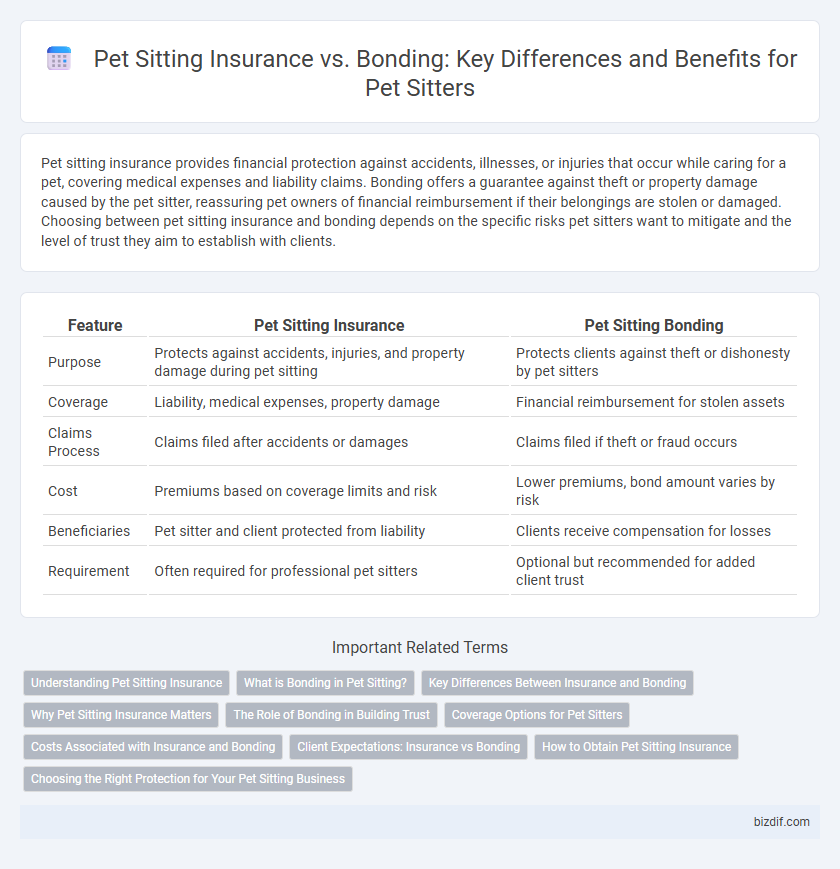

Pet sitting insurance provides financial protection against accidents, illnesses, or injuries that occur while caring for a pet, covering medical expenses and liability claims. Bonding offers a guarantee against theft or property damage caused by the pet sitter, reassuring pet owners of financial reimbursement if their belongings are stolen or damaged. Choosing between pet sitting insurance and bonding depends on the specific risks pet sitters want to mitigate and the level of trust they aim to establish with clients.

Table of Comparison

| Feature | Pet Sitting Insurance | Pet Sitting Bonding |

|---|---|---|

| Purpose | Protects against accidents, injuries, and property damage during pet sitting | Protects clients against theft or dishonesty by pet sitters |

| Coverage | Liability, medical expenses, property damage | Financial reimbursement for stolen assets |

| Claims Process | Claims filed after accidents or damages | Claims filed if theft or fraud occurs |

| Cost | Premiums based on coverage limits and risk | Lower premiums, bond amount varies by risk |

| Beneficiaries | Pet sitter and client protected from liability | Clients receive compensation for losses |

| Requirement | Often required for professional pet sitters | Optional but recommended for added client trust |

Understanding Pet Sitting Insurance

Pet sitting insurance provides coverage for accidents, injuries, or property damage that may occur while caring for clients' pets, protecting both the sitter and their business financially. This insurance typically includes liability protection and may also cover veterinary expenses caused by accidental harm during pet care. Understanding pet sitting insurance is crucial for sitters to ensure comprehensive risk management beyond what bonding can offer, as bonding mainly protects clients against theft or dishonesty.

What is Bonding in Pet Sitting?

Bonding in pet sitting is a type of financial protection that safeguards clients against theft or property damage caused by the pet sitter. It involves obtaining a surety bond, which acts as a guarantee that the sitter will perform duties ethically and responsibly. Unlike insurance that covers accidents or injuries, bonding specifically protects the client's valuables and provides reimbursement if dishonesty occurs.

Key Differences Between Insurance and Bonding

Pet sitting insurance provides financial protection against accidents, injuries, or property damage that may occur during pet care, covering medical expenses and liability claims. Bonding specifically protects pet sitters against theft or dishonesty by providing reimbursement to clients if valuables are stolen. Insurance covers broader risks related to the pet sitting business, while bonding focuses primarily on trust and financial security regarding client property.

Why Pet Sitting Insurance Matters

Pet sitting insurance provides essential financial protection against accidents, injuries, or damages that may occur while caring for a pet, covering medical expenses and liability claims. Unlike bonding, which guarantees reimbursement for theft or property loss caused by a pet sitter, insurance safeguards the sitter's business and personal assets from a broader range of risks. Securing pet sitting insurance ensures peace of mind for both pet sitters and clients by legitimizing the service and minimizing financial exposure.

The Role of Bonding in Building Trust

Bonding plays a crucial role in building trust between pet sitters and clients by providing a financial guarantee that protects against theft or damage caused by the sitter. Unlike pet sitting insurance, which covers liability and accidents, bonding specifically assures clients that their property and pets are safeguarded, enhancing the sitter's credibility. This trust-building factor is essential for pet sitters aiming to establish a reliable and professional reputation in the pet care industry.

Coverage Options for Pet Sitters

Pet sitting insurance primarily covers medical emergencies, liability claims, and property damage, protecting pet sitters against accidents or injuries involving pets or clients' belongings. Bonding provides financial protection against theft or dishonesty by the pet sitter, reassuring clients of reimbursement if valuables go missing. Combining both coverage options ensures comprehensive protection for pet sitters and their clients, addressing risks from health issues to trustworthiness concerns.

Costs Associated with Insurance and Bonding

Pet sitting insurance typically costs between $300 and $600 annually, covering liability claims up to $1 million, while bonding expenses average around $100 to $250 per year, providing financial protection against theft by the sitter. Insurance premiums vary based on coverage limits, location, and business size, whereas bonding costs depend on the bond amount and applicant credit history. Investing in both insurance and bonding can safeguard pet sitters from potential financial losses and enhance client trust by ensuring comprehensive protection.

Client Expectations: Insurance vs Bonding

Pet sitting insurance provides financial protection against accidents, injuries, or property damage caused during pet care, meeting client expectations for coverage against unforeseen incidents. Bonding offers security by protecting clients from theft or dishonesty by the pet sitter, addressing concerns about trust and liability. Clients often expect pet sitters to have both insurance and bonding to ensure comprehensive protection and peace of mind throughout the pet sitting service.

How to Obtain Pet Sitting Insurance

Obtaining pet sitting insurance involves researching providers that specialize in coverage tailored to pet care professionals, such as liability for accidents or injuries during pet sitting services. Pet sitters must gather necessary documentation, including business licenses and proof of experience, to apply for a policy that typically requires premium payments based on coverage limits and risk factors. Comparing policy options and consulting with insurance agents ensures selecting the appropriate insurance, providing financial protection and building client trust.

Choosing the Right Protection for Your Pet Sitting Business

Pet sitting insurance provides comprehensive coverage against accidents, injuries, and property damage during pet care, while bonding protects clients against theft or dishonesty by the sitter. Choosing the right protection depends on assessing the risks specific to your pet sitting business, such as liability exposure versus financial security concerns. Combining both insurance and bonding offers a balanced approach to safeguarding your business reputation and client trust.

Pet sitting insurance vs bonding Infographic

bizdif.com

bizdif.com