Pet sitting insurance specifically covers risks associated with pet care, including injury to pets, theft, or property damage during pet sitting services, while general liability insurance provides broader protection against bodily injury and property damage claims but may not cover pet-related incidents. Choosing pet sitting insurance ensures tailor-made coverage that addresses unique liabilities in pet care, safeguarding both the sitter and clients more effectively. Relying solely on general liability insurance can leave pet sitters exposed to gaps in coverage, risking financial loss from pet-specific claims.

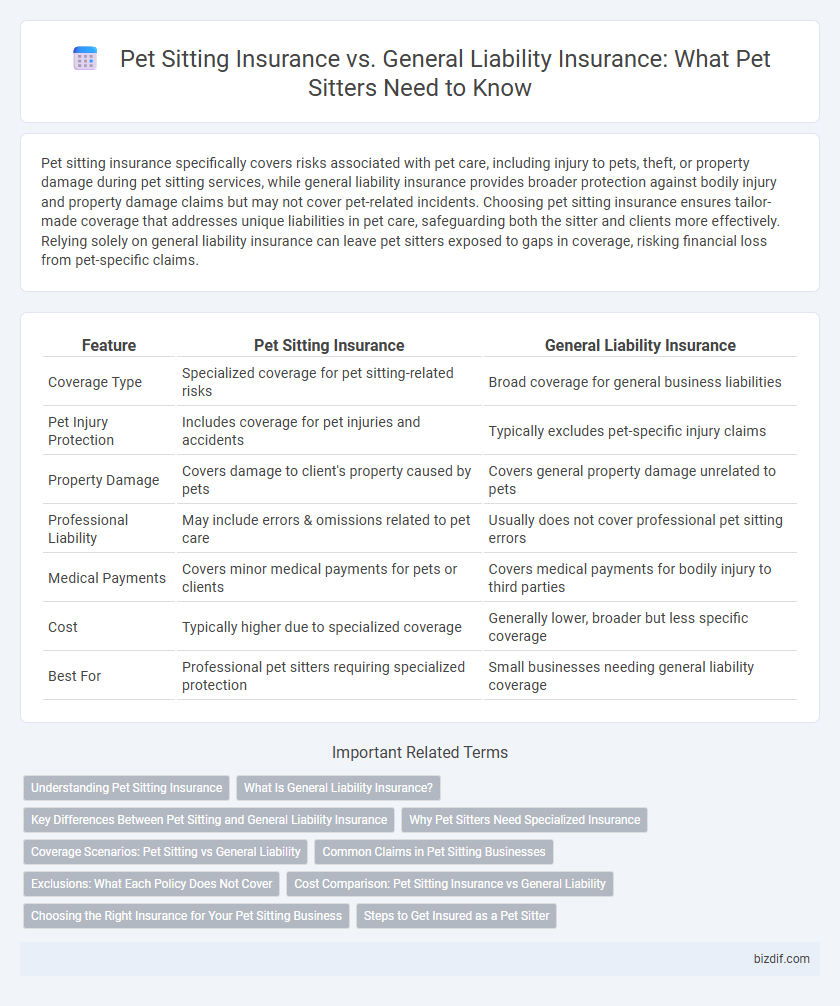

Table of Comparison

| Feature | Pet Sitting Insurance | General Liability Insurance |

|---|---|---|

| Coverage Type | Specialized coverage for pet sitting-related risks | Broad coverage for general business liabilities |

| Pet Injury Protection | Includes coverage for pet injuries and accidents | Typically excludes pet-specific injury claims |

| Property Damage | Covers damage to client's property caused by pets | Covers general property damage unrelated to pets |

| Professional Liability | May include errors & omissions related to pet care | Usually does not cover professional pet sitting errors |

| Medical Payments | Covers minor medical payments for pets or clients | Covers medical payments for bodily injury to third parties |

| Cost | Typically higher due to specialized coverage | Generally lower, broader but less specific coverage |

| Best For | Professional pet sitters requiring specialized protection | Small businesses needing general liability coverage |

Understanding Pet Sitting Insurance

Pet sitting insurance specifically covers risks unique to pet care, such as pet injury, pet illness, and property damage caused by pets, providing tailored protection for pet sitters. General liability insurance offers broader coverage for bodily injury and property damage to third parties but may not cover incidents directly related to handling animals. Understanding pet sitting insurance ensures pet sitters receive appropriate coverage for professional risks that general liability policies typically exclude.

What Is General Liability Insurance?

General liability insurance protects pet sitters against claims of bodily injury, property damage, and advertising mistakes that may occur during business operations. It covers legal fees and settlements if a client or third party sues due to accidents or negligence unrelated to professional services. Unlike pet sitting insurance, which specifically addresses issues like pet injuries or escape, general liability provides broader coverage essential for overall business protection.

Key Differences Between Pet Sitting and General Liability Insurance

Pet sitting insurance specifically covers risks associated with caring for pets, such as injuries to animals, accidental damage to client property, and pet-related illnesses, which general liability insurance typically excludes. General liability insurance mainly protects against third-party bodily injury and property damage in broader business contexts but does not address the unique liabilities of pet sitting services. Understanding that pet sitting insurance offers tailored coverage for pet care accidents and liabilities is essential for professional pet sitters aiming to mitigate risks effectively.

Why Pet Sitters Need Specialized Insurance

Pet sitters require specialized pet sitting insurance because it covers unique risks such as pet injury, property damage caused by pets, and client vet bills that general liability insurance often excludes. General liability insurance primarily protects against bodily injury and property damage to third parties but usually does not address accidents involving animals under care. Specialized insurance ensures pet sitters have comprehensive protection tailored to their profession, reducing financial exposure when handling pets.

Coverage Scenarios: Pet Sitting vs General Liability

Pet sitting insurance specifically covers risks associated with pet care, including injury or illness to pets under your supervision, property damage to clients' homes, and claims related to pet aggression. General liability insurance provides broader protection against bodily injury and property damage claims that occur on business premises but often excludes pet-related incidents and animal-related liabilities. Understanding the distinction helps pet sitters choose coverage that protects against unique scenarios like pet bites, loss, or accidental death, which general liability insurance typically does not cover.

Common Claims in Pet Sitting Businesses

Pet sitting insurance specifically covers common claims such as pet injuries, bites, and property damage caused by pets, which are frequent in pet sitting businesses, while general liability insurance primarily protects against third-party bodily injury and property damage claims unrelated to pet care. Claims like dog bites, pet escapes, or damage to pet owners' homes are typically excluded from general liability policies but included in pet sitting insurance. Understanding these coverage differences is essential to managing risks and protecting a pet sitting business from financial losses related to pet-specific incidents.

Exclusions: What Each Policy Does Not Cover

Pet sitting insurance excludes coverage for incidents unrelated to pet care, such as property damage caused by clients' pets outside the sitter's control. General liability insurance typically excludes animal-related claims like bites or injuries caused by pets under the sitter's care. Understanding these exclusions helps pet sitters choose a policy that specifically addresses risks associated with pet handling and client property.

Cost Comparison: Pet Sitting Insurance vs General Liability

Pet sitting insurance typically costs between $300 and $600 annually, offering specialized coverage tailored to pet care risks such as injury to pets and property damage related to pet activities. General liability insurance ranges from $400 to $1,000 per year but provides broader protection that is not specific to pet sitting, often excluding critical pet-related liabilities. Choosing pet sitting insurance can be more cost-effective for professionals seeking comprehensive protection for pet-specific incidents without paying for unnecessary generalized coverage.

Choosing the Right Insurance for Your Pet Sitting Business

Pet sitting insurance specifically covers risks like pet injury, pet owner property damage, and professional negligence unique to pet care services, while general liability insurance typically protects against broader third-party bodily injury or property damage claims. Choosing the right insurance involves evaluating your pet sitting business's scope, including the number of pets cared for, service types, and location-specific legal requirements. Investing in tailored pet sitting insurance ensures comprehensive protection against liabilities directly related to pet care, which general liability coverage may not fully encompass.

Steps to Get Insured as a Pet Sitter

Pet sitters should first evaluate their specific coverage needs, prioritizing pet sitting insurance that offers protection against animal-related incidents such as bites or property damage caused by pets. Next, obtain a detailed policy quote from specialized pet sitting insurance providers to ensure coverage includes both property and injury liabilities relevant to pet care. Finally, compare the policy terms with general liability insurance to identify gaps, confirming that chosen coverage adequately protects against the unique risks faced in pet sitting services.

Pet sitting insurance vs General liability insurance Infographic

bizdif.com

bizdif.com