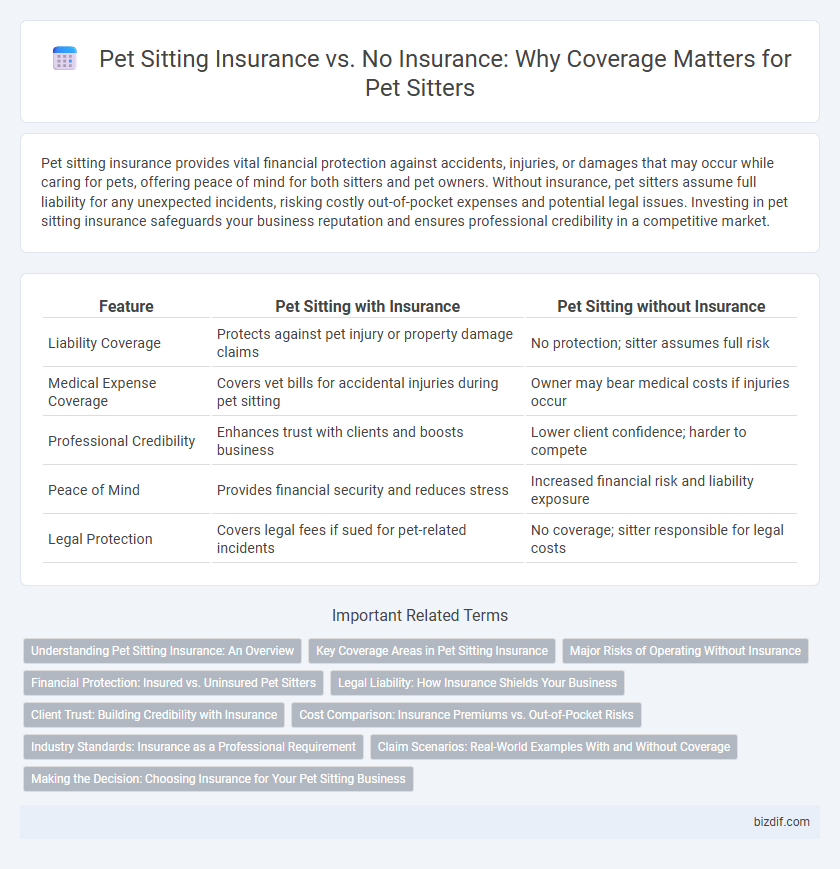

Pet sitting insurance provides vital financial protection against accidents, injuries, or damages that may occur while caring for pets, offering peace of mind for both sitters and pet owners. Without insurance, pet sitters assume full liability for any unexpected incidents, risking costly out-of-pocket expenses and potential legal issues. Investing in pet sitting insurance safeguards your business reputation and ensures professional credibility in a competitive market.

Table of Comparison

| Feature | Pet Sitting with Insurance | Pet Sitting without Insurance |

|---|---|---|

| Liability Coverage | Protects against pet injury or property damage claims | No protection; sitter assumes full risk |

| Medical Expense Coverage | Covers vet bills for accidental injuries during pet sitting | Owner may bear medical costs if injuries occur |

| Professional Credibility | Enhances trust with clients and boosts business | Lower client confidence; harder to compete |

| Peace of Mind | Provides financial security and reduces stress | Increased financial risk and liability exposure |

| Legal Protection | Covers legal fees if sued for pet-related incidents | No coverage; sitter responsible for legal costs |

Understanding Pet Sitting Insurance: An Overview

Pet sitting insurance provides essential coverage for liability, property damage, and pet injury, safeguarding pet sitters against unforeseen accidents during care. Without insurance, pet sitters risk financial losses from medical expenses or legal claims that may arise from pet-related incidents. Understanding the scope and benefits of pet sitting insurance is crucial for protecting both the sitter's livelihood and the clients' pets.

Key Coverage Areas in Pet Sitting Insurance

Pet sitting insurance provides critical protection covering liability for pet injuries, property damage, and theft, which uninsured sitters risk personally bearing. Key coverage areas include general liability, which protects against accidents during pet care, and professional liability, shielding against claims of negligence or errors. Without insurance, pet sitters face significant financial exposure and decreased client trust, making comprehensive coverage essential for responsible service and business growth.

Major Risks of Operating Without Insurance

Operating as a pet sitter without insurance exposes you to major risks such as liability for pet injuries, property damage, and potential legal claims from pet owners. Without insurance coverage, you may face significant financial losses from medical expenses, lawsuits, or settlement costs that can jeopardize your business's sustainability. Pet sitting insurance provides essential protection by covering these risks, ensuring peace of mind and professional credibility.

Financial Protection: Insured vs. Uninsured Pet Sitters

Pet sitting insurance provides crucial financial protection by covering potential liabilities such as pet injuries, property damage, or legal fees, which uninsured pet sitters must pay out-of-pocket. Insured pet sitters can confidently manage risks, safeguarding their income and reputation from unexpected claims. Uninsured sitters face significant financial vulnerability, risking costly expenses that can jeopardize their business stability.

Legal Liability: How Insurance Shields Your Business

Pet sitting insurance provides critical protection against legal liability claims arising from pet injuries, property damage, or client disputes, safeguarding your financial assets. Without insurance, pet sitters risk incurring significant out-of-pocket expenses and potential lawsuits that could jeopardize their business operations. Comprehensive insurance coverage acts as a legal shield, ensuring peace of mind and professional credibility in the pet care industry.

Client Trust: Building Credibility with Insurance

Pet sitting insurance significantly enhances client trust by demonstrating professionalism and commitment to pet safety, reducing liability concerns for owners. Insured pet sitters provide assurance that any accidents or damages during care will be financially covered, fostering peace of mind among clients. Trust in pet sitting services increases when clients see verified insurance, positioning insured sitters as credible and reliable providers.

Cost Comparison: Insurance Premiums vs. Out-of-Pocket Risks

Pet sitting insurance premiums typically range from $300 to $600 annually, offering financial protection against accidents, injuries, or property damage during care. Without insurance, pet sitters face potentially high out-of-pocket costs that can exceed thousands of dollars in legal fees and medical expenses if incidents occur. Investing in insurance provides a cost-effective safeguard compared to the unpredictable and often substantial financial risks of operating uninsured.

Industry Standards: Insurance as a Professional Requirement

Pet sitting insurance is widely recognized as an industry standard, reflecting a professional commitment to client and pet safety that uninsured sitters often lack. Licensed pet sitters typically secure liability and bonding coverage to protect against accidents, property damage, or pet injuries, ensuring compliance with legal and business regulations. Operating without insurance not only risks financial liability but may also violate local industry guidelines, potentially harming reputation and client trust.

Claim Scenarios: Real-World Examples With and Without Coverage

Pet sitting insurance provides essential protection in claim scenarios such as accidental injury to a pet, property damage, or client disputes, ensuring financial coverage and peace of mind for pet sitters. Without insurance, pet sitters face out-of-pocket expenses and potential legal liabilities, risking significant financial loss from medical bills or lawsuits. Real-world cases highlight insured sitters being reimbursed promptly, whereas uninsured sitters often bear costly consequences alone.

Making the Decision: Choosing Insurance for Your Pet Sitting Business

Choosing pet sitting insurance safeguards your business against liability claims, property damage, and potential legal costs, providing peace of mind and professional credibility. Without insurance, pet sitters face significant financial risks from accidents or pet injuries that can lead to costly lawsuits or compensation demands. Investing in comprehensive coverage enhances client trust, strengthens your business reputation, and ensures long-term sustainability in the competitive pet care industry.

Pet sitting insurance vs No insurance Infographic

bizdif.com

bizdif.com