Effective file retention balances maintaining essential documents for pet care, health records, and legal purposes with the secure shredding of outdated or sensitive papers to prevent identity theft and clutter. Keeping files organized and systematically reviewing retention schedules ensures only necessary records are preserved, reducing physical storage and enhancing accessibility. Shredding irrelevant or expired documents not only protects personal information but also supports a streamlined, efficient environment for pet professionals and owners alike.

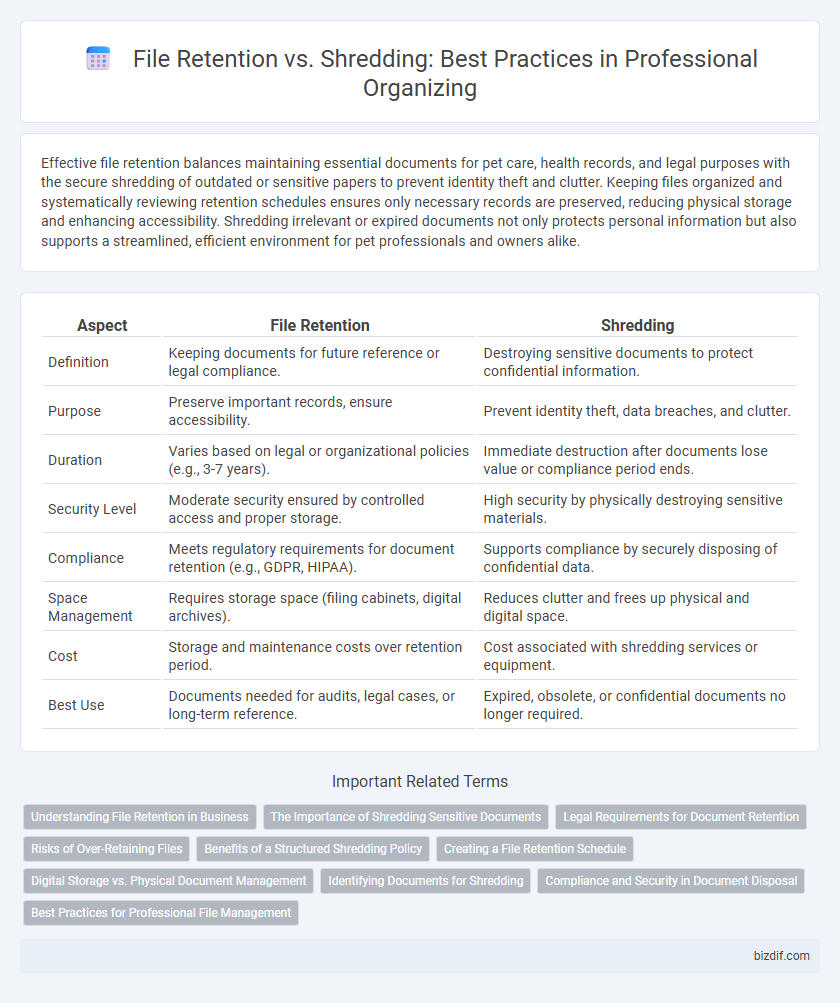

Table of Comparison

| Aspect | File Retention | Shredding |

|---|---|---|

| Definition | Keeping documents for future reference or legal compliance. | Destroying sensitive documents to protect confidential information. |

| Purpose | Preserve important records, ensure accessibility. | Prevent identity theft, data breaches, and clutter. |

| Duration | Varies based on legal or organizational policies (e.g., 3-7 years). | Immediate destruction after documents lose value or compliance period ends. |

| Security Level | Moderate security ensured by controlled access and proper storage. | High security by physically destroying sensitive materials. |

| Compliance | Meets regulatory requirements for document retention (e.g., GDPR, HIPAA). | Supports compliance by securely disposing of confidential data. |

| Space Management | Requires storage space (filing cabinets, digital archives). | Reduces clutter and frees up physical and digital space. |

| Cost | Storage and maintenance costs over retention period. | Cost associated with shredding services or equipment. |

| Best Use | Documents needed for audits, legal cases, or long-term reference. | Expired, obsolete, or confidential documents no longer required. |

Understanding File Retention in Business

Effective file retention in business balances compliance with industry regulations and cost-efficient storage management. Organizations must categorize documents by legal retention periods, ensuring sensitive information is securely stored or properly shredded to mitigate data breaches. Implementing clear retention schedules improves operational efficiency and reduces risks associated with unnecessary document accumulation.

The Importance of Shredding Sensitive Documents

Shredding sensitive documents is crucial for protecting personal and business information from identity theft and data breaches. Proper file retention policies must balance legal compliance with secure disposal methods to prevent unauthorized access. Regularly shredding outdated confidential files minimizes the risk of fraud and supports organizational privacy standards.

Legal Requirements for Document Retention

Legal requirements for document retention vary by jurisdiction and industry, mandating specific durations for keeping financial, medical, and employee records. Failure to comply with these regulations can result in penalties, legal disputes, and loss of vital information. Shredding confidential documents after the retention period protects sensitive data and ensures compliance with privacy laws such as HIPAA and GDPR.

Risks of Over-Retaining Files

Over-retaining files increases risks such as data breaches, unauthorized access, and identity theft due to sensitive information being stored longer than necessary. Excessive file retention also leads to cluttered storage spaces, making document retrieval inefficient and increasing compliance risks with data protection regulations like GDPR and HIPAA. Proper file retention policies reduce liability and enhance data security by ensuring outdated or unnecessary documents are securely shredded and disposed of.

Benefits of a Structured Shredding Policy

A structured shredding policy ensures sensitive documents are securely destroyed, reducing the risk of identity theft and corporate data breaches. It streamlines file management by clearly defining retention periods, minimizing clutter and enhancing overall office efficiency. Implementing consistent shredding protocols supports regulatory compliance, safeguarding your business from potential legal consequences.

Creating a File Retention Schedule

Creating a file retention schedule involves categorizing documents based on legal requirements, business needs, and privacy concerns to determine appropriate retention periods. Professional organizers recommend maintaining critical files such as tax records, contracts, and employee documents for specified durations before securely shredding obsolete papers. Implementing a systematic schedule minimizes clutter, reduces the risk of identity theft, and enhances overall office efficiency.

Digital Storage vs. Physical Document Management

Effective professional organizing balances digital storage with physical document management by evaluating file retention policies against the risks of data breaches and clutter. Digital storage offers scalable, searchable archives with encryption options, while physical documents require secure shredding to prevent identity theft and free up office space. Prioritizing encrypted cloud backups for digital files and scheduled shredding of outdated physical records enhances both security and organizational efficiency.

Identifying Documents for Shredding

Identifying documents for shredding involves evaluating files based on retention schedules, legal requirements, and confidentiality levels to ensure sensitive information is securely destroyed. Important criteria include expired tax records, outdated financial statements, and obsolete personal information that no longer requires preservation. Proper assessment helps minimize clutter while protecting against identity theft and maintaining compliance with data protection regulations.

Compliance and Security in Document Disposal

File retention policies ensure organizational compliance by specifying the duration sensitive documents must be securely stored, reducing legal risks and supporting audits. Shredding confidential files upon reaching retention limits enhances data security by preventing unauthorized access and identity theft. Adherence to regulatory standards such as HIPAA, GDPR, and FACTA during document disposal mitigates potential penalties and protects client information.

Best Practices for Professional File Management

Best practices for professional file management emphasize retaining critical documents such as tax records, contracts, and legal papers for a minimum of seven years, in compliance with regulatory requirements. Shredding confidential and outdated files protects sensitive information from identity theft and aligns with data privacy regulations like GDPR and HIPAA. Implementing a clear retention schedule combined with secure shredding protocols enhances organizational efficiency and minimizes risk.

file retention vs shredding Infographic

bizdif.com

bizdif.com