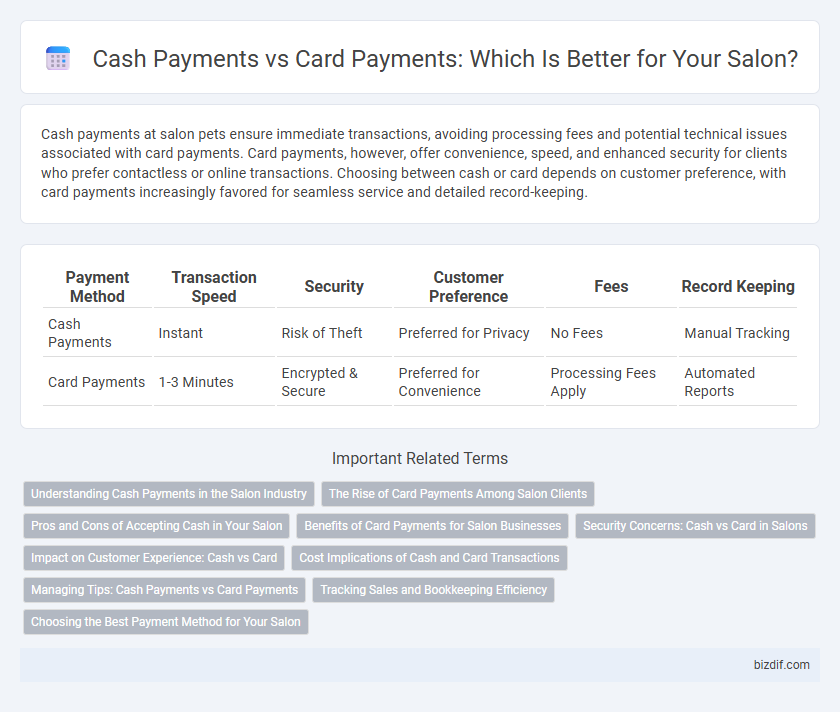

Cash payments at salon pets ensure immediate transactions, avoiding processing fees and potential technical issues associated with card payments. Card payments, however, offer convenience, speed, and enhanced security for clients who prefer contactless or online transactions. Choosing between cash or card depends on customer preference, with card payments increasingly favored for seamless service and detailed record-keeping.

Table of Comparison

| Payment Method | Transaction Speed | Security | Customer Preference | Fees | Record Keeping |

|---|---|---|---|---|---|

| Cash Payments | Instant | Risk of Theft | Preferred for Privacy | No Fees | Manual Tracking |

| Card Payments | 1-3 Minutes | Encrypted & Secure | Preferred for Convenience | Processing Fees Apply | Automated Reports |

Understanding Cash Payments in the Salon Industry

Cash payments in the salon industry provide immediate transaction completion without processing fees or delays, benefiting both clients and salon owners. Handling cash requires strict adherence to security protocols and accurate record-keeping to prevent errors and theft. Understanding cash flow patterns helps salons optimize inventory management and staff scheduling for enhanced operational efficiency.

The Rise of Card Payments Among Salon Clients

The rise of card payments among salon clients reflects a growing preference for convenience and security, driving a significant shift away from traditional cash transactions. Salons that offer multiple card payment options, including contactless and mobile wallets, report increased client satisfaction and higher transaction volumes. This trend aligns with broader consumer behavior shifts, emphasizing efficiency and seamless digital experiences in personal care services.

Pros and Cons of Accepting Cash in Your Salon

Accepting cash payments in your salon reduces transaction fees, ensures immediate fund availability, and eliminates issues related to card processing failures. However, cash handling increases the risk of theft, requires meticulous record-keeping for accurate accounting, and can slow down the payment process during busy hours. Balancing these pros and cons helps salon owners decide if cash payments align with their operational needs and customer preferences.

Benefits of Card Payments for Salon Businesses

Card payments streamline transactions, reducing cash handling errors and theft risks for salon businesses. They enable faster checkouts, enhancing customer experience and increasing appointment turnover. Digital payment records also simplify accounting, improve cash flow management, and support loyalty program integration.

Security Concerns: Cash vs Card in Salons

Cash payments in salons present increased risks such as theft, loss, and lack of transaction traceability, posing significant security challenges for both clients and salon owners. Card payments offer enhanced security features, including encryption, fraud detection, and detailed digital transaction records that improve accountability and reduce financial risks. Implementing secure point-of-sale systems tailored for salons mitigates vulnerabilities associated with cash handling, ensuring safer and more reliable financial operations.

Impact on Customer Experience: Cash vs Card

Cash payments in salons often provide a quick and straightforward transaction process, minimizing technical issues and enhancing customer satisfaction. Card payments offer convenience through contactless options and digital receipts, which many clients prefer for hygiene and record-keeping. The choice between cash and card impacts the overall customer experience by balancing speed, security, and ease of use during the payment process.

Cost Implications of Cash and Card Transactions

Cash payments in salons incur minimal processing fees, often making them more cost-effective for small transactions, though handling and security costs may rise. Card payments involve merchant fees averaging 1.5% to 3.5% per transaction, impacting overall profit margins, especially on high-volume sales. Salons must balance the convenience and customer preference for card payments against the lower transactional costs associated with cash.

Managing Tips: Cash Payments vs Card Payments

Managing tips in salons requires careful tracking to ensure fair distribution between staff members. Cash payments provide immediate access to tips but demand thorough record-keeping to avoid discrepancies, while card payments integrate tips directly into digital payroll systems, simplifying accounting and transparent reporting. Salons benefit from implementing clear policies and secure tracking tools to balance accuracy and convenience in tip management.

Tracking Sales and Bookkeeping Efficiency

Cash payments in salons provide immediate liquidity but complicate tracking sales due to manual entry and risk of errors, slowing bookkeeping efficiency. Card payments integrate seamlessly with digital point-of-sale (POS) systems, enabling real-time transaction records and automated sales tracking that enhance accuracy and simplify financial reporting. Salons leveraging card payments benefit from streamlined bookkeeping processes, faster reconciliation, and detailed sales analytics that improve overall financial management.

Choosing the Best Payment Method for Your Salon

Cash payments offer salons immediate liquidity and no transaction fees, enhancing daily cash flow management. Card payments provide convenience, customer preference satisfaction, and secure record-keeping, which can improve transaction tracking and reduce errors. Evaluating transaction costs, client demographics, and operational efficiency helps salons decide the optimal payment method to boost profitability and customer experience.

Cash Payments vs Card Payments Infographic

bizdif.com

bizdif.com