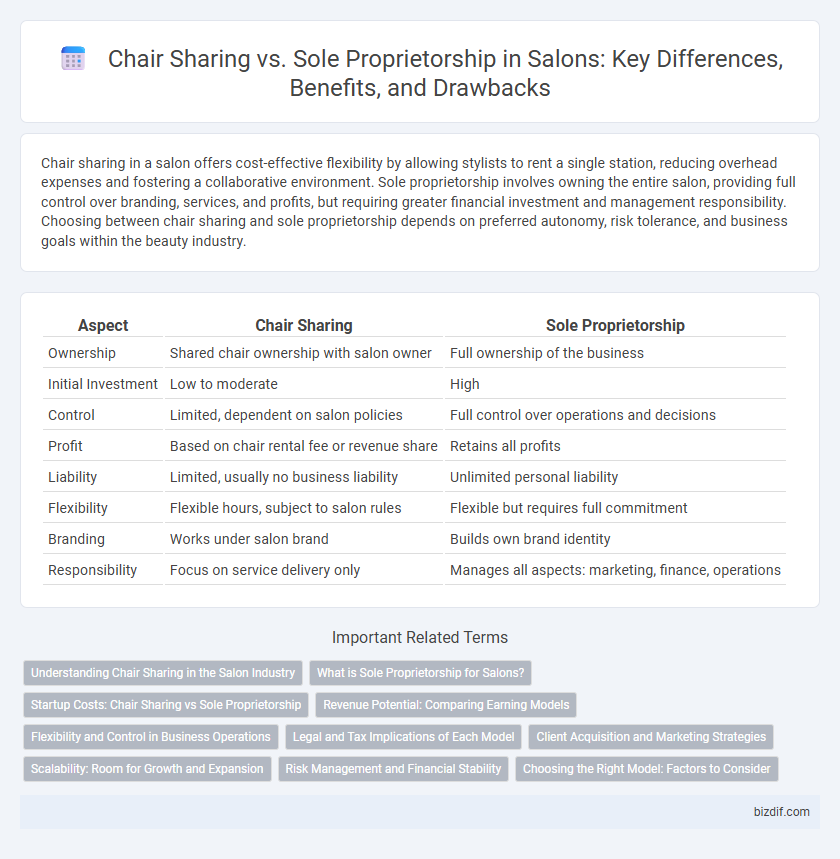

Chair sharing in a salon offers cost-effective flexibility by allowing stylists to rent a single station, reducing overhead expenses and fostering a collaborative environment. Sole proprietorship involves owning the entire salon, providing full control over branding, services, and profits, but requiring greater financial investment and management responsibility. Choosing between chair sharing and sole proprietorship depends on preferred autonomy, risk tolerance, and business goals within the beauty industry.

Table of Comparison

| Aspect | Chair Sharing | Sole Proprietorship |

|---|---|---|

| Ownership | Shared chair ownership with salon owner | Full ownership of the business |

| Initial Investment | Low to moderate | High |

| Control | Limited, dependent on salon policies | Full control over operations and decisions |

| Profit | Based on chair rental fee or revenue share | Retains all profits |

| Liability | Limited, usually no business liability | Unlimited personal liability |

| Flexibility | Flexible hours, subject to salon rules | Flexible but requires full commitment |

| Branding | Works under salon brand | Builds own brand identity |

| Responsibility | Focus on service delivery only | Manages all aspects: marketing, finance, operations |

Understanding Chair Sharing in the Salon Industry

Chair sharing in the salon industry allows hairstylists and beauty professionals to rent a chair or workstation within an established salon, offering flexibility and reduced overhead costs compared to sole proprietorship. This model enables independent stylists to retain control over their clientele and schedules while benefiting from the salon's existing infrastructure and foot traffic. Understanding chair sharing is essential for professionals seeking a cost-effective way to build their business without the full financial and administrative responsibilities of owning a salon.

What is Sole Proprietorship for Salons?

Sole proprietorship for salons refers to a business owned and operated by a single individual who assumes full responsibility for all aspects, including financial liabilities and decision-making. This structure allows salon owners to have complete control over operations, profit retention, and brand management without sharing space, revenue, or risks with others. It contrasts with chair sharing, where multiple independent stylists rent space within a salon, often leading to shared resources but split responsibilities.

Startup Costs: Chair Sharing vs Sole Proprietorship

Chair sharing in a salon significantly reduces startup costs by eliminating expenses related to lease agreements, equipment purchases, and utility bills, as stylists rent only a workstation. Sole proprietorships require higher initial investments, including salon space rental, full setup, and inventory, which can total thousands of dollars before opening. Opting for chair sharing offers a flexible and cost-effective solution for new stylists aiming to minimize financial risk while launching their careers.

Revenue Potential: Comparing Earning Models

Chair sharing in salons offers multiple stylists the ability to generate individual income streams from a shared workspace, increasing total revenue potential through diversified client bases and scheduling flexibility. Sole proprietorship centralizes all earnings and expenses under one owner, maximizing profit retention but requiring full responsibility for overhead and marketing. Evaluating these models depends on the salon's market demand, operational control preferences, and growth ambitions to optimize revenue potential.

Flexibility and Control in Business Operations

Chair sharing in a salon offers increased flexibility by allowing stylists to operate independently within a shared space, reducing overhead costs and enabling easier scalability. Sole proprietorship provides full control over business operations, decision-making, and branding, but requires managing all responsibilities and expenses alone. Choosing between the two depends on prioritizing operational autonomy versus adaptable, collaborative working environments.

Legal and Tax Implications of Each Model

Chair sharing in salons allows multiple professionals to rent space independently, thereby simplifying tax obligations as each stylist files separate returns and manages individual liability. Sole proprietorship consolidates business ownership under one individual who assumes full legal responsibility and tax reporting for the entire salon operation, increasing risk exposure but enabling direct control over finances. Understanding the distinct legal liabilities and tax benefits of chair sharing versus sole proprietorship is critical for salon owners seeking optimized financial and regulatory compliance.

Client Acquisition and Marketing Strategies

Chair sharing in salons leverages shared spaces and brand recognition to attract diverse clientele through collaborative marketing efforts, reducing individual advertising costs. Sole proprietorship offers full control over marketing strategies tailored to a specific brand identity, enabling personalized client acquisition but requiring higher investment in promotional activities. Effective client acquisition in chair sharing often relies on communal networks and online presence, while sole proprietors benefit from direct client relationships and customized loyalty programs.

Scalability: Room for Growth and Expansion

Chair sharing offers greater scalability for salon owners by minimizing upfront costs and allowing incremental expansion through renting additional chairs as demand grows. Sole proprietorships often face higher fixed expenses and limited space, which can restrict their ability to scale operations quickly. Embracing a chair sharing model enables flexibility in service offerings and client capacity, supporting sustained growth in competitive salon markets.

Risk Management and Financial Stability

Chair sharing in salons reduces individual financial risk by splitting rent and operational costs, offering increased cash flow flexibility and minimized upfront investment compared to sole proprietorship. Sole proprietors face higher financial exposure, bearing full responsibility for expenses, liabilities, and client retention, which demands stronger risk management strategies and contingency planning. Effective financial stability in chair sharing hinges on clear agreements and trust, while sole proprietorship relies heavily on consistent revenue and comprehensive insurance coverage to mitigate risks.

Choosing the Right Model: Factors to Consider

Choosing between chair sharing and sole proprietorship in a salon hinges on factors such as financial investment, control over business decisions, and flexibility. Chair sharing minimizes startup costs and provides a collaborative environment but limits autonomy, while sole proprietorship requires greater capital and responsibility yet offers full control over branding and services. Evaluate your budget, desired independence, and long-term goals to determine the optimal business model for your salon success.

Chair Sharing vs Sole Proprietorship Infographic

bizdif.com

bizdif.com