Salon pet businesses choosing between an employee-based model and an independent contractor model must consider legal classifications and control over work. Employees offer consistent scheduling, training, and loyalty, ensuring quality service and brand consistency. Independent contractors provide flexibility and lower costs but may reduce control over service standards and client experience.

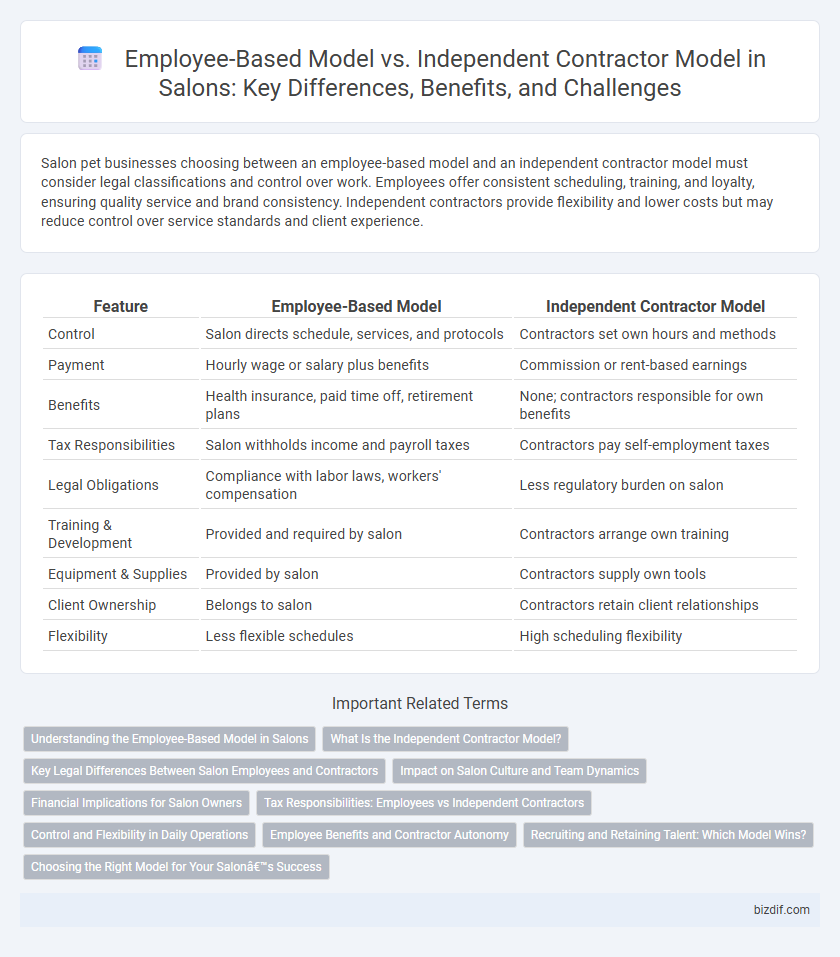

Table of Comparison

| Feature | Employee-Based Model | Independent Contractor Model |

|---|---|---|

| Control | Salon directs schedule, services, and protocols | Contractors set own hours and methods |

| Payment | Hourly wage or salary plus benefits | Commission or rent-based earnings |

| Benefits | Health insurance, paid time off, retirement plans | None; contractors responsible for own benefits |

| Tax Responsibilities | Salon withholds income and payroll taxes | Contractors pay self-employment taxes |

| Legal Obligations | Compliance with labor laws, workers' compensation | Less regulatory burden on salon |

| Training & Development | Provided and required by salon | Contractors arrange own training |

| Equipment & Supplies | Provided by salon | Contractors supply own tools |

| Client Ownership | Belongs to salon | Contractors retain client relationships |

| Flexibility | Less flexible schedules | High scheduling flexibility |

Understanding the Employee-Based Model in Salons

The Employee-Based Model in salons involves hiring stylists and staff as employees, providing them with salaries, benefits, and consistent work schedules, which ensures greater control over service quality and brand consistency. This model allows salon owners to enforce policies, maintain uniform training standards, and foster team collaboration, enhancing overall customer experience. Employee status also typically includes legal protections such as workers' compensation and payroll tax withholding, reducing risks associated with independent contractors.

What Is the Independent Contractor Model?

The Independent Contractor Model in salons refers to professionals who operate their own business within the salon, managing their own schedules, clients, and payments. These contractors are responsible for their own taxes, insurance, and supplies, providing flexibility and autonomy compared to employee roles. This model allows salons to minimize payroll costs and shift liability while fostering entrepreneurial opportunities for stylists and beauty professionals.

Key Legal Differences Between Salon Employees and Contractors

Salon employees are typically subject to employer control regarding schedules, services offered, and compliance with salon policies, while independent contractors maintain autonomy over their work hours and client interactions. Employees receive benefits such as minimum wage, overtime pay, and unemployment insurance, whereas contractors handle their own taxes and lack these employment protections. Misclassification risks legal penalties since salons must adhere to labor laws for employees, including wage and hour regulations, which do not apply to independent contractors.

Impact on Salon Culture and Team Dynamics

The Employee-based Model fosters a cohesive salon culture by encouraging collaboration and consistent service standards among staff, enhancing team dynamics through shared goals and regular communication. In contrast, the Independent Contractor Model often leads to a more fragmented environment, where stylists operate with greater autonomy but less alignment with salon values, potentially weakening team cohesion. Salons prioritizing a unified brand experience benefit from the employee model's structured integration of personnel and culture.

Financial Implications for Salon Owners

Choosing between an employee-based model and an independent contractor model significantly impacts salon owners' financial responsibilities, including payroll taxes, benefits, and unemployment insurance costs. Employee-based models require salon owners to manage withholding taxes and provide workers' compensation, which increases overhead but allows greater control over service standards. In contrast, independent contractor arrangements reduce payroll expenses and administrative burdens but limit direct supervision and may expose the salon to classification risks and potential legal penalties.

Tax Responsibilities: Employees vs Independent Contractors

In a salon setting, employees have taxes withheld from their paychecks, including Social Security, Medicare, and unemployment taxes, which the employer is required to remit to the IRS. Independent contractors, however, handle their own tax payments through estimated quarterly tax filings and are responsible for the entire self-employment tax burden. Proper classification impacts payroll tax obligations and compliance with IRS regulations, reducing risks of audits and penalties.

Control and Flexibility in Daily Operations

The Employee-based Model grants salons higher control over daily operations, including schedules, services, and client interactions, ensuring consistent quality and brand standards. In contrast, the Independent Contractor Model offers increased flexibility for workers to set their own hours and service styles, but limits salon management's ability to enforce uniform procedures. Balancing control with flexibility directly impacts operational efficiency, client experience, and compliance with labor regulations in salon management.

Employee Benefits and Contractor Autonomy

Employee-based models in salons provide workers with benefits such as health insurance, paid leave, and retirement plans, ensuring financial security and workplace protections. Independent contractor models grant stylists greater autonomy over their schedules and client management but often lack access to traditional employee benefits. Balancing employee benefits with contractor independence is essential for salon owners to attract talent while maintaining operational flexibility.

Recruiting and Retaining Talent: Which Model Wins?

The Employee-based Model fosters stronger loyalty and consistent service quality by offering benefits, structured training, and clear career paths, which enhances talent retention in salons. In contrast, the Independent Contractor Model provides flexibility and autonomy, attracting skilled professionals seeking control over their schedule but may lead to higher turnover rates. For salons prioritizing long-term team stability and cohesive branding, the Employee-based Model is often more effective in recruiting and retaining top talent.

Choosing the Right Model for Your Salon’s Success

Selecting the right employment model for your salon significantly impacts operational efficiency and financial performance. The Employee-based Model ensures greater control over staff schedules, training, and client service consistency, while the Independent Contractor Model offers flexibility and reduced payroll taxes but less managerial oversight. Evaluating factors like salon size, regulatory compliance, and desired control helps determine the optimal approach for sustainable growth.

Employee-based Model vs Independent Contractor Model Infographic

bizdif.com

bizdif.com