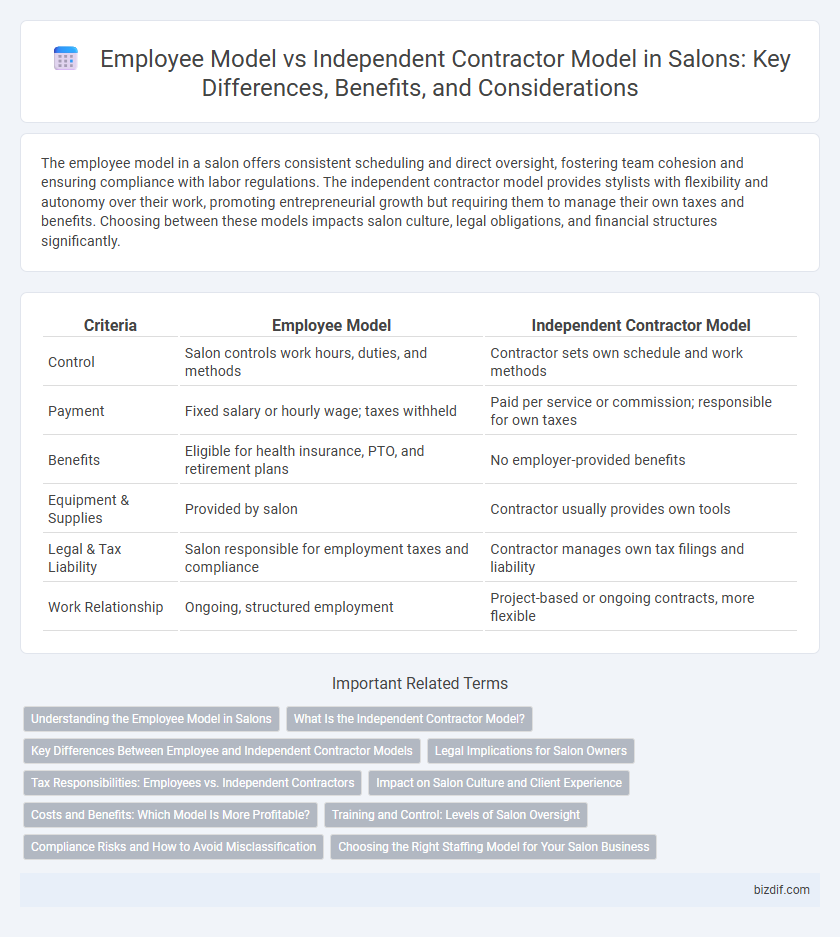

The employee model in a salon offers consistent scheduling and direct oversight, fostering team cohesion and ensuring compliance with labor regulations. The independent contractor model provides stylists with flexibility and autonomy over their work, promoting entrepreneurial growth but requiring them to manage their own taxes and benefits. Choosing between these models impacts salon culture, legal obligations, and financial structures significantly.

Table of Comparison

| Criteria | Employee Model | Independent Contractor Model |

|---|---|---|

| Control | Salon controls work hours, duties, and methods | Contractor sets own schedule and work methods |

| Payment | Fixed salary or hourly wage; taxes withheld | Paid per service or commission; responsible for own taxes |

| Benefits | Eligible for health insurance, PTO, and retirement plans | No employer-provided benefits |

| Equipment & Supplies | Provided by salon | Contractor usually provides own tools |

| Legal & Tax Liability | Salon responsible for employment taxes and compliance | Contractor manages own tax filings and liability |

| Work Relationship | Ongoing, structured employment | Project-based or ongoing contracts, more flexible |

Understanding the Employee Model in Salons

The Employee Model in salons involves hiring stylists and staff as salaried or hourly workers, offering them benefits such as health insurance, paid leave, and workers' compensation. This model ensures consistent service quality, greater control over work schedules, and compliance with labor laws, which reduces legal risks for salon owners. Salons benefit from fostering team loyalty and maintaining a stable workforce through payroll management and employee training programs.

What Is the Independent Contractor Model?

The independent contractor model in salons refers to professionals who operate their own businesses, renting space or chairs rather than being traditional employees. These contractors maintain control over their schedules, services offered, and client relationships while managing their own taxes and expenses. This model provides flexibility and entrepreneurial opportunities but requires adherence to IRS guidelines distinguishing contractors from employees.

Key Differences Between Employee and Independent Contractor Models

The Employee model requires salons to provide benefits, control work hours, and withhold taxes, ensuring more regulatory compliance and job security. The Independent Contractor model offers greater flexibility, where stylists operate as separate businesses responsible for their own taxes and equipment costs. This distinction impacts payroll management, legal liabilities, and worker classification under labor laws.

Legal Implications for Salon Owners

Salon owners must navigate complex legal implications when choosing between employee and independent contractor models, as misclassification can lead to costly lawsuits, tax liabilities, and penalties from labor authorities. Employees typically grant salons greater control over work schedules, performance standards, and benefits but require adherence to wage laws, overtime, and workers' compensation regulations. Independent contractors offer flexibility and reduced payroll obligations yet demand careful contract structuring to avoid violations of the Fair Labor Standards Act (FLSA) and IRS guidelines on worker classification.

Tax Responsibilities: Employees vs. Independent Contractors

Salon employees receive W-2 forms and have taxes such as Social Security, Medicare, and income tax withheld by the employer, ensuring consistent tax contributions and simplified filing. Independent contractors receive 1099 forms, are responsible for paying self-employment taxes including both the employer and employee portions of Social Security and Medicare, and must manage quarterly estimated tax payments to the IRS. Misclassification between these models can result in penalties, making clear delineation of tax responsibilities critical for salon owners and workers.

Impact on Salon Culture and Client Experience

The Employee model fosters consistent salon culture by ensuring stylists adhere to unified standards and training, creating a cohesive client experience. In contrast, the Independent contractor model offers stylist autonomy, which can lead to varied service quality and less predictable brand alignment. Maintaining control over employee schedules and professional development under the Employee model enhances client trust and loyalty within the salon environment.

Costs and Benefits: Which Model Is More Profitable?

The Employee model in a salon entails higher fixed costs such as salaries, benefits, and payroll taxes, but provides greater control over staff schedules and service quality, potentially leading to consistent customer experiences. The Independent Contractor model reduces overhead by shifting costs like taxes and benefits onto the contractor, increasing short-term profitability but risking less control over work hours and client management. Profitability depends on salon size and management style; employee models suit larger salons seeking brand consistency while independent contractor models favor flexibility and lower immediate expenses for smaller businesses.

Training and Control: Levels of Salon Oversight

Employee models in salons require structured training programs and ongoing supervision to ensure adherence to brand standards and service quality, reflecting high levels of salon oversight. Independent contractor models offer stylists greater autonomy in their techniques and client management, resulting in minimal salon control over daily operations and training. This distinction significantly impacts compliance with labor laws and the consistency of the customer experience.

Compliance Risks and How to Avoid Misclassification

Choosing between the employee model and independent contractor model in salons involves critical compliance risks related to misclassification, which can lead to costly penalties and back taxes from the IRS and labor departments. Key factors such as control over work schedules, provision of tools, and payment structure must align clearly with the selected model to avoid misclassification. Implementing detailed contracts, regular audits, and adhering to guidance from the Department of Labor and IRS guidelines helps salons maintain compliance and protect against legal disputes.

Choosing the Right Staffing Model for Your Salon Business

Selecting the appropriate staffing model for your salon business significantly impacts operational efficiency and regulatory compliance. The employee model offers greater control over work schedules, training, and service standards, ensuring consistency in client experience. In contrast, the independent contractor model provides flexibility and reduced payroll expenses but requires careful management of legal classifications to avoid labor law violations.

Employee model vs Independent contractor model Infographic

bizdif.com

bizdif.com