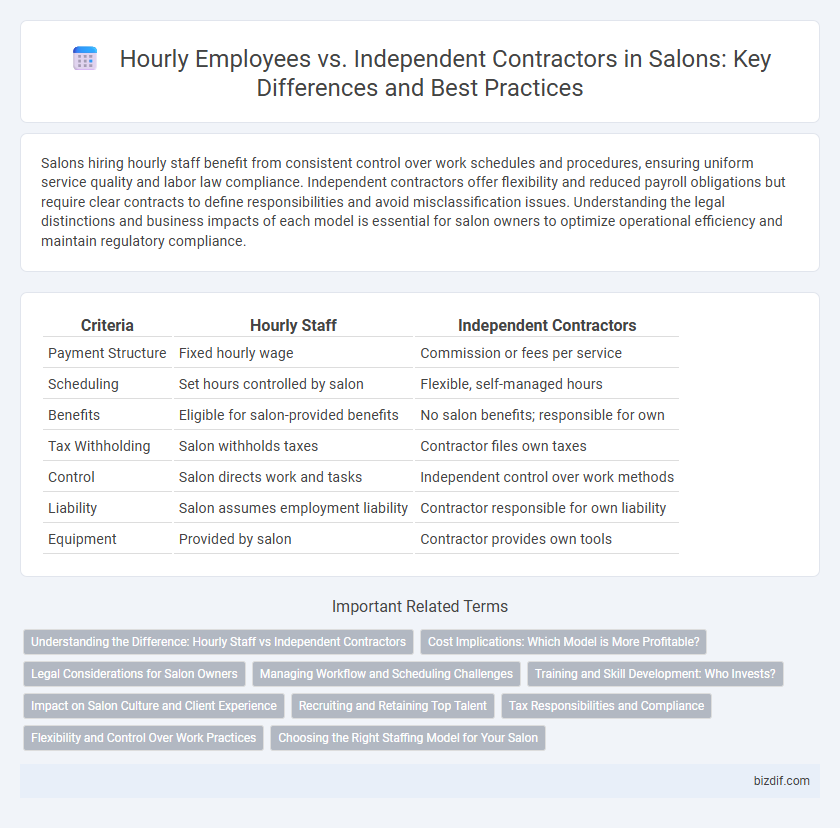

Salons hiring hourly staff benefit from consistent control over work schedules and procedures, ensuring uniform service quality and labor law compliance. Independent contractors offer flexibility and reduced payroll obligations but require clear contracts to define responsibilities and avoid misclassification issues. Understanding the legal distinctions and business impacts of each model is essential for salon owners to optimize operational efficiency and maintain regulatory compliance.

Table of Comparison

| Criteria | Hourly Staff | Independent Contractors |

|---|---|---|

| Payment Structure | Fixed hourly wage | Commission or fees per service |

| Scheduling | Set hours controlled by salon | Flexible, self-managed hours |

| Benefits | Eligible for salon-provided benefits | No salon benefits; responsible for own |

| Tax Withholding | Salon withholds taxes | Contractor files own taxes |

| Control | Salon directs work and tasks | Independent control over work methods |

| Liability | Salon assumes employment liability | Contractor responsible for own liability |

| Equipment | Provided by salon | Contractor provides own tools |

Understanding the Difference: Hourly Staff vs Independent Contractors

Hourly staff in salons work under direct supervision, receiving fixed wages based on hours worked, and are entitled to benefits and labor protections under employment law. Independent contractors operate their own business within the salon, control their schedule, and are responsible for their taxes, insurance, and tools, without typical employee benefits. Understanding these distinctions is essential for compliance with labor regulations and optimizing operational efficiency in salon management.

Cost Implications: Which Model is More Profitable?

Salon owners face significant cost implications when choosing between hourly staff and independent contractors, as hourly employees often incur higher expenses due to wages, taxes, and benefits, whereas independent contractors typically handle their own expenses but may demand higher service fees. Hourly staff models provide predictable labor costs with potential overtime liabilities, while independent contractor arrangements reduce payroll taxes and benefits obligations but require careful management to ensure compliance with labor laws. Profitability hinges on balancing these cost factors with service volume and pricing strategies to optimize salon revenue and operational efficiency.

Legal Considerations for Salon Owners

Salon owners must carefully evaluate the legal distinctions between hourly staff and independent contractors to ensure compliance with labor laws and avoid costly penalties. Hourly employees are entitled to minimum wage, overtime pay, and benefits under the Fair Labor Standards Act (FLSA), while independent contractors typically lack these protections but require proper classification based on IRS guidelines to prevent misclassification risks. Understanding state-specific regulations and maintaining accurate contracts and documentation are crucial for salon owners to navigate wage and tax obligations effectively.

Managing Workflow and Scheduling Challenges

Managing workflow in salons differs significantly between hourly staff and independent contractors, impacting scheduling flexibility and efficiency. Hourly staff require fixed shifts and consistent hours, facilitating predictable client appointments but limiting adaptability during peak times. Independent contractors offer greater scheduling flexibility, allowing salons to accommodate fluctuating demand, though coordinating availability and ensuring coverage can present logistical challenges.

Training and Skill Development: Who Invests?

Salon owners typically invest in training and skill development for hourly staff to ensure consistent service quality and brand standards. Independent contractors, responsible for their own professional growth, often seek external courses and workshops to enhance their expertise. This distinction influences how salons allocate resources and structure ongoing education programs.

Impact on Salon Culture and Client Experience

Hourly staff tend to foster a consistent salon culture through steady team collaboration and standardized service protocols, enhancing client trust and loyalty. Independent contractors offer diverse skills and flexible schedules that can attract a broader clientele but may challenge uniformity in service quality and salon atmosphere. Balancing these employment models is crucial for maintaining a cohesive work environment while delivering personalized client experiences.

Recruiting and Retaining Top Talent

Recruiting and retaining top talent in salons requires a clear understanding of the differences between hourly staff and independent contractors. Hourly employees offer consistent availability and loyalty through structured schedules and benefits, which enhances team stability and client satisfaction. Independent contractors bring specialized skills and flexibility, attracting seasoned professionals who prefer autonomy, but salons must implement effective communication and incentive strategies to ensure long-term collaboration.

Tax Responsibilities and Compliance

Salon owners must understand the distinct tax responsibilities and compliance requirements for hourly staff versus independent contractors. Hourly employees require payroll tax withholding, including Social Security, Medicare, and federal and state income taxes, while independent contractors are responsible for paying their own self-employment taxes without employer withholding. Proper classification ensures compliance with IRS regulations, avoiding penalties related to misclassification and ensuring accurate tax reporting using forms W-2 for employees and 1099-NEC for contractors.

Flexibility and Control Over Work Practices

Hourly staff in salons typically have set schedules determined by management, offering less flexibility but ensuring consistent working hours and adherence to salon policies. Independent contractors enjoy greater control over their work practices, choosing their own clients, hours, and services provided, which fosters entrepreneurial freedom. This autonomy, however, requires self-management of taxes, supplies, and marketing, contrasting with the structured environment staffed employees experience.

Choosing the Right Staffing Model for Your Salon

Choosing the right staffing model for your salon significantly impacts operational efficiency and financial management. Hourly staff provide consistent availability and direct control but increase payroll expenses and require managing benefits, while independent contractors offer flexibility and reduced overhead costs yet pose challenges in quality control and scheduling reliability. Assessing factors like salon size, service demand, local labor laws, and desired staff autonomy helps determine whether hourly employees or independent contractors align best with your business goals.

Hourly Staff vs Independent Contractors Infographic

bizdif.com

bizdif.com