Self-employed stylists enjoy the freedom to set their own schedules, choose their clients, and retain a larger portion of their earnings, while shouldering the responsibility of managing their own business expenses and marketing. Salon employees benefit from a steady paycheck, access to salon resources, and a built-in client base, but face less flexibility and share income with salon management. Both career paths require skill and dedication but offer distinct advantages depending on personal priorities and professional goals.

Table of Comparison

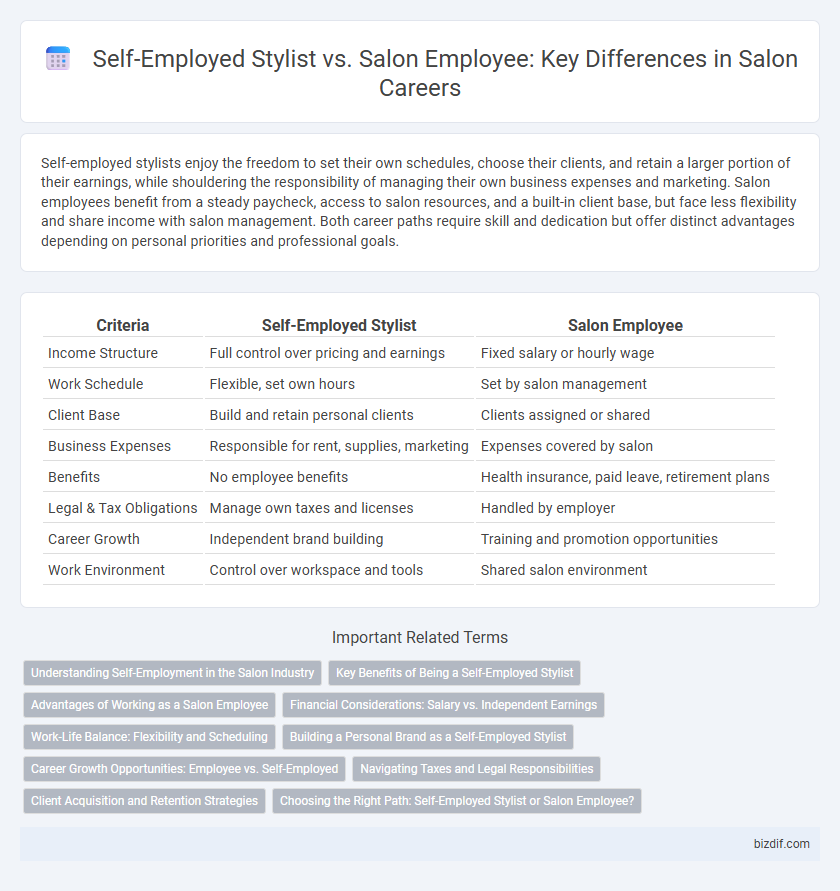

| Criteria | Self-Employed Stylist | Salon Employee |

|---|---|---|

| Income Structure | Full control over pricing and earnings | Fixed salary or hourly wage |

| Work Schedule | Flexible, set own hours | Set by salon management |

| Client Base | Build and retain personal clients | Clients assigned or shared |

| Business Expenses | Responsible for rent, supplies, marketing | Expenses covered by salon |

| Benefits | No employee benefits | Health insurance, paid leave, retirement plans |

| Legal & Tax Obligations | Manage own taxes and licenses | Handled by employer |

| Career Growth | Independent brand building | Training and promotion opportunities |

| Work Environment | Control over workspace and tools | Shared salon environment |

Understanding Self-Employment in the Salon Industry

Self-employed stylists in the salon industry operate as independent contractors, managing their own schedules, client lists, and business expenses, providing greater autonomy compared to salon employees who work under the salon's direct supervision and follow set hours. Understanding self-employment involves recognizing tax responsibilities, such as managing quarterly tax payments and handling supplies out-of-pocket, which differs significantly from the salaried income of salon employees. This distinction affects income potential, work-life balance, and legal obligations within the beauty industry.

Key Benefits of Being a Self-Employed Stylist

Self-employed stylists enjoy greater flexibility in setting their schedules and choosing clientele, which boosts work-life balance and job satisfaction. They retain full control over pricing, services offered, and creative direction, leading to higher earning potential compared to salon employees. Tax benefits, including deductions for business expenses such as supplies and workspace, further enhance the financial advantages of independent styling careers.

Advantages of Working as a Salon Employee

Working as a salon employee offers consistent income stability through a regular paycheck and benefits such as health insurance, paid time off, and retirement plans. Employees benefit from reduced administrative responsibilities, allowing them to focus on enhancing client services without managing bookings, taxes, or supply purchases. Additionally, salon employees often receive ongoing training and access to professional resources, fostering skill development and career growth within a supportive team environment.

Financial Considerations: Salary vs. Independent Earnings

Self-employed stylists retain full control over their income by setting their own prices and managing client appointments, resulting in potentially higher earnings but with variable cash flow and responsibility for business expenses. Salon employees receive a steady, predictable salary or hourly wage, accompanied by benefits such as health insurance and paid time off, reducing financial uncertainty. Evaluating tax obligations, commission structures, and overhead costs is essential when comparing these financial models in the salon industry.

Work-Life Balance: Flexibility and Scheduling

Self-employed stylists enjoy greater flexibility in setting their own schedules, allowing for a customized work-life balance that can adapt to personal priorities. Salon employees typically adhere to fixed hours determined by management, which may limit spontaneous time off and personal appointments. The autonomy in scheduling for self-employed stylists often leads to improved work satisfaction and the ability to balance client demands with personal life more effectively.

Building a Personal Brand as a Self-Employed Stylist

Building a personal brand as a self-employed stylist involves leveraging social media platforms and client testimonials to showcase unique skills and creativity. Developing a consistent visual identity and engaging content helps attract and retain a loyal clientele independently of a salon's reputation. This approach contrasts with salon employees who rely primarily on the salon's established brand for customer trust and visibility.

Career Growth Opportunities: Employee vs. Self-Employed

Self-employed stylists have the flexibility to build their brand, set their schedules, and expand their client base, which can accelerate career growth through entrepreneurship and personalized marketing strategies. Salon employees benefit from structured career paths, steady income, and access to professional development programs and mentorship within the salon environment. Both paths offer unique growth opportunities, with self-employment fostering independence and innovation, while employment provides stability and collaborative learning.

Navigating Taxes and Legal Responsibilities

Self-employed stylists must manage quarterly estimated tax payments and maintain detailed expense records to maximize deductions and comply with IRS regulations. Salon employees typically have taxes withheld by employers, simplifying tax filing but limiting deduction opportunities. Understanding the differences in tax liabilities, business licenses, and insurance requirements is crucial for stylists to ensure legal compliance and financial efficiency.

Client Acquisition and Retention Strategies

Self-employed stylists often leverage personalized marketing and social media to build a loyal client base, focusing on one-on-one relationships and word-of-mouth referrals. Salon employees benefit from the salon's built-in clientele and collaborative environment, which provides steady client flow but limits individual branding opportunities. Both play crucial roles in client retention, with self-employed stylists emphasizing tailored service experiences and salon employees relying on salon reputation and team-driven loyalty programs.

Choosing the Right Path: Self-Employed Stylist or Salon Employee?

Choosing between being a self-employed stylist or a salon employee hinges on factors like financial stability, creative control, and scheduling flexibility. Self-employed stylists enjoy autonomy, the ability to set their own rates, and retain full client relationships but face responsibilities such as marketing, booking, and managing expenses. Salon employees benefit from steady income, access to salon resources, and a built-in client base but may have less freedom in pricing, schedules, and service offerings.

Self-Employed Stylist vs Salon Employee Infographic

bizdif.com

bizdif.com