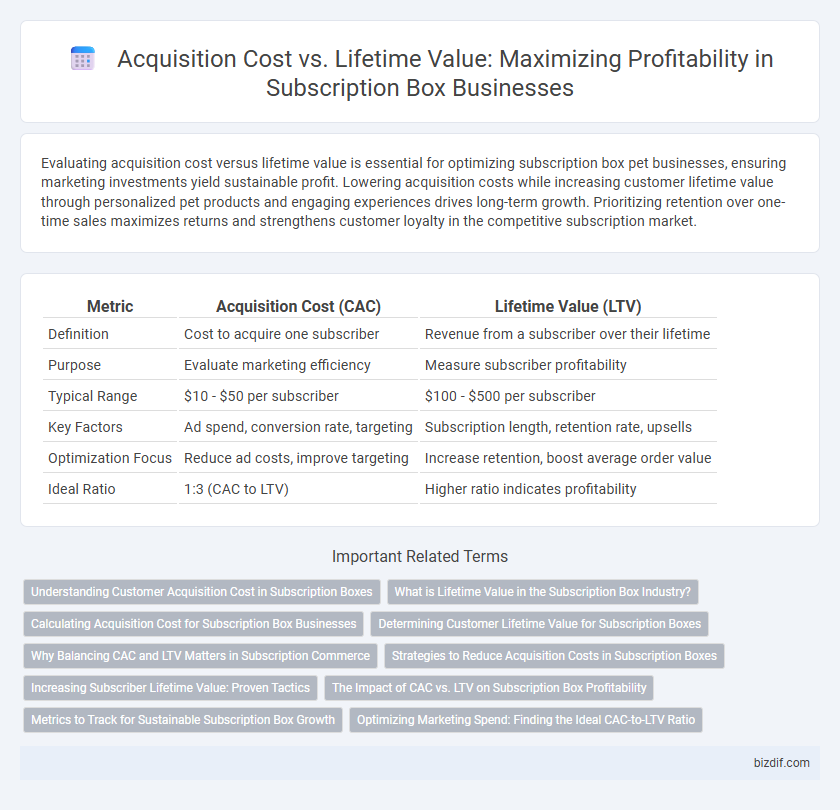

Evaluating acquisition cost versus lifetime value is essential for optimizing subscription box pet businesses, ensuring marketing investments yield sustainable profit. Lowering acquisition costs while increasing customer lifetime value through personalized pet products and engaging experiences drives long-term growth. Prioritizing retention over one-time sales maximizes returns and strengthens customer loyalty in the competitive subscription market.

Table of Comparison

| Metric | Acquisition Cost (CAC) | Lifetime Value (LTV) |

|---|---|---|

| Definition | Cost to acquire one subscriber | Revenue from a subscriber over their lifetime |

| Purpose | Evaluate marketing efficiency | Measure subscriber profitability |

| Typical Range | $10 - $50 per subscriber | $100 - $500 per subscriber |

| Key Factors | Ad spend, conversion rate, targeting | Subscription length, retention rate, upsells |

| Optimization Focus | Reduce ad costs, improve targeting | Increase retention, boost average order value |

| Ideal Ratio | 1:3 (CAC to LTV) | Higher ratio indicates profitability |

Understanding Customer Acquisition Cost in Subscription Boxes

Understanding Customer Acquisition Cost (CAC) in subscription boxes is essential for optimizing marketing budgets and maximizing profitability. CAC measures the total expense of acquiring a new subscriber, including advertising, promotions, and onboarding efforts. Comparing CAC to Lifetime Value (LTV) helps subscription businesses determine sustainable growth by ensuring that the revenue from subscribers over time exceeds the costs to attract them.

What is Lifetime Value in the Subscription Box Industry?

Lifetime Value (LTV) in the subscription box industry represents the total revenue a customer generates throughout their entire relationship with the brand, encompassing recurring subscription fees and potential upsells. Accurate calculation of LTV helps businesses determine how much they can spend on acquisition cost while remaining profitable. Understanding LTV allows subscription box companies to optimize marketing strategies and improve customer retention for sustained growth.

Calculating Acquisition Cost for Subscription Box Businesses

Calculating acquisition cost for subscription box businesses involves dividing total marketing expenses by the number of new subscribers acquired within a specific period, ensuring precise measurement of cost efficiency. A lower customer acquisition cost (CAC) relative to the lifetime value (LTV) of subscribers indicates profitable growth, as LTV represents the total revenue generated from a subscriber over their engagement period. Accurate tracking of CAC enables subscription box companies to optimize marketing budgets and balance customer acquisition strategies against long-term subscriber profitability.

Determining Customer Lifetime Value for Subscription Boxes

Determining customer lifetime value (CLV) for subscription boxes involves analyzing the average subscription duration, monthly revenue per subscriber, and retention rates to forecast total earnings per customer. Accurately calculating CLV helps businesses optimize acquisition costs by ensuring marketing spend remains below expected lifetime revenue. Focusing on metrics such as churn rate and average order value enhances the precision of CLV estimates, enabling scalable growth strategies.

Why Balancing CAC and LTV Matters in Subscription Commerce

Balancing Customer Acquisition Cost (CAC) and Lifetime Value (LTV) is critical in subscription commerce to ensure sustainable growth and profitability. When CAC exceeds LTV, businesses face financial losses despite acquiring new customers, while optimal balance maximizes long-term revenue and customer retention. Precise management of marketing expenses and enhancing subscriber value through personalized experiences contribute to improving LTV and reducing CAC in subscription box models.

Strategies to Reduce Acquisition Costs in Subscription Boxes

Reducing acquisition costs in subscription box businesses involves optimizing targeted advertising campaigns through data-driven audience segmentation and leveraging referral programs to encourage organic growth. Implementing content marketing strategies, such as engaging blog posts and influencer partnerships, enhances brand visibility without high ad spend. Enhancing user experience on the website with clear calls-to-action and streamlined checkout processes also boosts conversion rates, lowering overall acquisition costs while increasing customer lifetime value.

Increasing Subscriber Lifetime Value: Proven Tactics

Increasing subscriber lifetime value (LTV) is crucial for subscription box businesses to offset initial acquisition costs and improve overall profitability. Proven tactics include personalized product recommendations, flexible subscription plans, and exclusive member rewards that foster customer retention and engagement. Leveraging data analytics to tailor marketing efforts and enhance the subscriber experience significantly boosts LTV while reducing churn rates.

The Impact of CAC vs. LTV on Subscription Box Profitability

The balance between Customer Acquisition Cost (CAC) and Lifetime Value (LTV) directly influences subscription box profitability, with lower CACs enhancing margins and higher LTVs indicating sustained revenue streams. Optimizing marketing strategies to reduce CAC while increasing subscriber retention effectively maximizes LTV, driving long-term growth. Monitoring key metrics such as churn rate and average order value provides critical insights for improving the CAC to LTV ratio in subscription businesses.

Metrics to Track for Sustainable Subscription Box Growth

Tracking customer Acquisition Cost (CAC) alongside Lifetime Value (LTV) is essential for sustainable subscription box growth. Key metrics include CAC payback period, churn rate, and average subscription duration to evaluate profitability and customer retention efficiency. Monitoring these indicators helps optimize marketing spend, improve customer lifetime profitability, and ensure long-term business scalability.

Optimizing Marketing Spend: Finding the Ideal CAC-to-LTV Ratio

Optimizing marketing spend in subscription box businesses hinges on balancing Customer Acquisition Cost (CAC) against Lifetime Value (LTV). Aiming for a CAC-to-LTV ratio of 1:3 ensures profitable growth by maximizing return on investment while maintaining sustainable customer retention. Businesses should continuously analyze customer behavior and adjust marketing strategies to reduce CAC and enhance LTV for long-term success.

Acquisition cost vs Lifetime value Infographic

bizdif.com

bizdif.com