Understanding the balance between Customer Acquisition Cost (CAC) and Lifetime Value (LTV) is crucial for subscription box pet businesses to achieve sustainable growth. A lower CAC combined with a higher LTV indicates efficient marketing strategies and strong customer loyalty, maximizing profitability over time. Monitoring this ratio helps optimize spending, ensuring that each subscribed customer generates significant revenue throughout their lifetime.

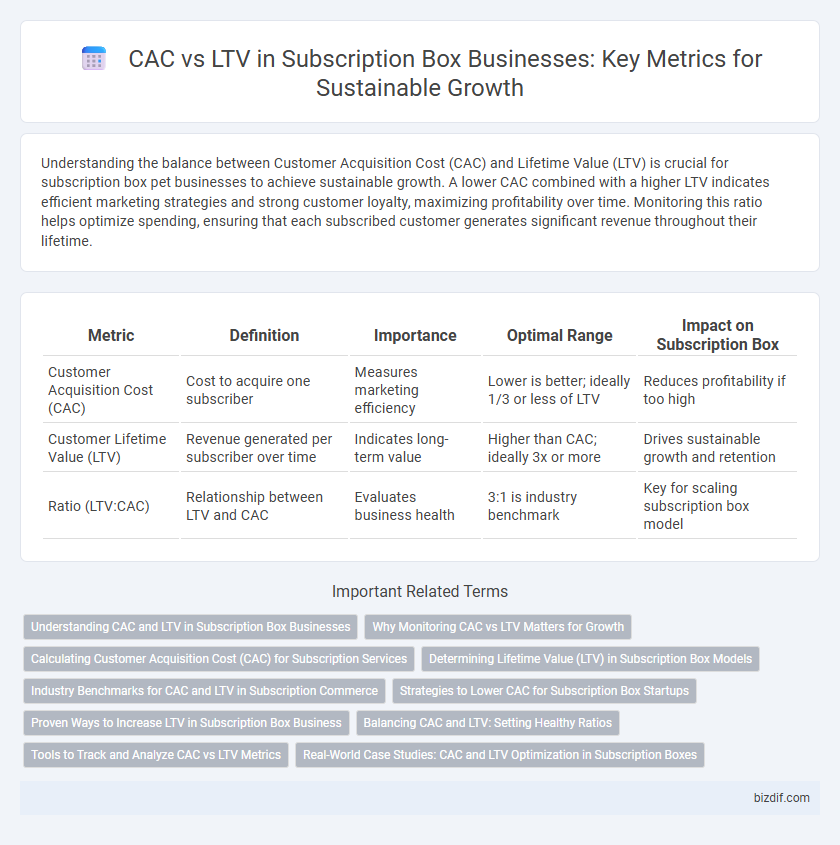

Table of Comparison

| Metric | Definition | Importance | Optimal Range | Impact on Subscription Box |

|---|---|---|---|---|

| Customer Acquisition Cost (CAC) | Cost to acquire one subscriber | Measures marketing efficiency | Lower is better; ideally 1/3 or less of LTV | Reduces profitability if too high |

| Customer Lifetime Value (LTV) | Revenue generated per subscriber over time | Indicates long-term value | Higher than CAC; ideally 3x or more | Drives sustainable growth and retention |

| Ratio (LTV:CAC) | Relationship between LTV and CAC | Evaluates business health | 3:1 is industry benchmark | Key for scaling subscription box model |

Understanding CAC and LTV in Subscription Box Businesses

Customer Acquisition Cost (CAC) measures the expenses incurred to gain a new subscriber, including marketing and promotions. Lifetime Value (LTV) estimates the total revenue generated from a customer during their subscription period, factoring in retention rates and average order value. Balancing CAC and LTV is crucial for subscription box businesses to ensure profitability and sustainable growth.

Why Monitoring CAC vs LTV Matters for Growth

Monitoring Customer Acquisition Cost (CAC) versus Lifetime Value (LTV) is crucial for subscription box businesses to ensure sustainable growth and profitability. Understanding this ratio helps optimize marketing spend by identifying how much a company can afford to invest in acquiring each subscriber relative to the revenue generated over their subscription lifespan. A higher LTV compared to CAC indicates efficient customer retention and value extraction, driving scalable expansion and long-term financial health.

Calculating Customer Acquisition Cost (CAC) for Subscription Services

Calculating Customer Acquisition Cost (CAC) for subscription services involves dividing total marketing and sales expenses by the number of new subscribers acquired during a specific period. Accurate CAC measurement requires including costs such as advertising, promotions, referral incentives, and sales team salaries. Subscription businesses must compare CAC against Customer Lifetime Value (LTV) to ensure sustainable growth and profitability.

Determining Lifetime Value (LTV) in Subscription Box Models

Accurately determining Lifetime Value (LTV) in subscription box models involves analyzing average revenue per user (ARPU), subscriber retention rates, and average subscription duration to forecast total customer revenue. Customer Acquisition Cost (CAC) should be compared against LTV to ensure profitability, with a healthy subscription business typically requiring an LTV to CAC ratio of at least 3:1. Advanced metrics such as churn rate, upsell potential, and customer engagement are crucial for refining LTV calculations in subscription-based services.

Industry Benchmarks for CAC and LTV in Subscription Commerce

Subscription commerce typically sees Customer Acquisition Costs (CAC) ranging from $30 to $100, depending on niche and marketing channels, while Lifetime Value (LTV) averages between $150 and $500 per customer. Industry benchmarks suggest a healthy LTV to CAC ratio of 3:1, indicating profitability and sustainable growth. Monitoring these metrics helps subscription box businesses optimize marketing spend and customer retention strategies effectively.

Strategies to Lower CAC for Subscription Box Startups

Subscription box startups can lower Customer Acquisition Cost (CAC) by optimizing targeted social media advertising, leveraging influencer partnerships, and implementing referral programs that encourage word-of-mouth growth. Utilizing data analytics to identify high-converting customer segments allows for more efficient ad spend and personalized marketing campaigns. Offering trial boxes or limited-time discounts helps attract first-time buyers while reducing upfront marketing expenses and increasing customer lifetime value (LTV).

Proven Ways to Increase LTV in Subscription Box Business

Maximizing Customer Lifetime Value (LTV) in a subscription box business hinges on boosting customer retention and upselling opportunities through personalized product offerings and exclusive member perks. Implementing loyalty programs and enhancing customer onboarding experiences significantly elevate engagement, encouraging longer subscription durations and higher average order values. Data-driven segmentation and targeted communication foster deeper connections, effectively increasing LTV while reducing Customer Acquisition Cost (CAC) over time.

Balancing CAC and LTV: Setting Healthy Ratios

Balancing Customer Acquisition Cost (CAC) and Lifetime Value (LTV) is crucial for subscription box businesses to ensure profitability and sustainable growth. A healthy CAC to LTV ratio typically falls between 1:3 and 1:5, meaning the revenue generated from a subscriber should be three to five times the cost of acquiring them. Maintaining this ratio helps optimize marketing spend while maximizing subscriber retention and long-term revenue.

Tools to Track and Analyze CAC vs LTV Metrics

Tracking and analyzing Customer Acquisition Cost (CAC) versus Lifetime Value (LTV) requires tools like Google Analytics, ChartMogul, and Baremetrics that provide detailed insights into subscription metrics and customer behavior. These platforms enable subscription box businesses to monitor acquisition costs, churn rates, and revenue trends, facilitating data-driven decisions to optimize marketing spend and improve profitability. Integrating tools such as Mixpanel or Kissmetrics further enhances tracking capabilities by offering cohort analyses and customer lifetime segmentation.

Real-World Case Studies: CAC and LTV Optimization in Subscription Boxes

Real-world case studies reveal that subscription boxes with a Customer Acquisition Cost (CAC) below $30 and a Lifetime Value (LTV) exceeding $150 achieve sustainable growth and profitability. Optimizing targeted marketing channels and personalized content has reduced CAC by up to 40% while increasing customer retention rates, boosting LTV in brands like Birchbox and FabFitFun. Data-driven strategies focusing on subscriber engagement and churn reduction are critical for balancing CAC and LTV, maximizing long-term revenue in subscription-based eCommerce models.

CAC vs LTV Infographic

bizdif.com

bizdif.com